Mr. Market’s Schizophrenic Break Of 2020

A Prelude to the Market Madness of 2024

Part of the Sorcerer’s Apprentice series. Originally published privately on January 13, 2021. Updated and revised for public release on May 28, 2024, with minor edits and enhanced graphics.

In mid-2024, as financial markets once again show alarming signs of froth and speculative excess—from the resurgence of meme stocks to the frenzy surrounding AI—the unprecedented financial spectacles of 2020 cast an increasingly ominous shadow. It was a time when central bank liquidity reigned supreme, traditional fundamentals ceased to matter, and speculative manias reached a fever pitch. To grasp the forces driving the present market zeitgeist, one must first revisit the surreal events that defined the pandemic years. Stay tuned for future installments that will explore these deeper forces, analyzing how they have intensified and evolved over the intervening years.

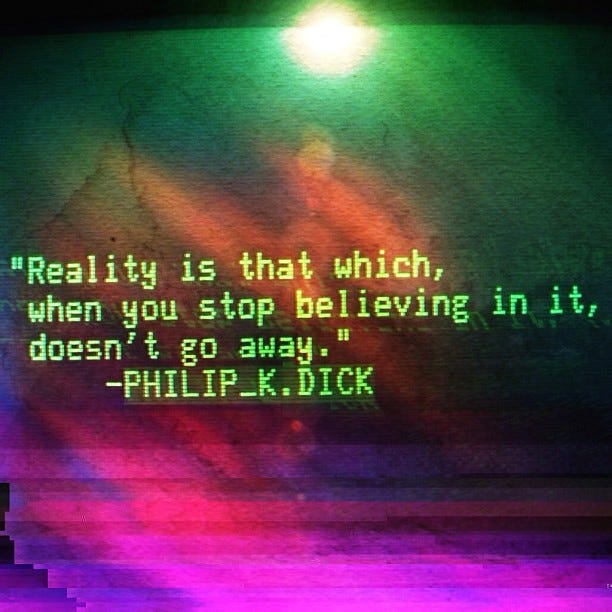

Monetary Malware: Corrupted Currency Corrodes Reality

The speculative frenzies and market distortions of recent years are but symptoms of a deeper malaise: the corrosive effect of monetary debasement on our collective grasp of reality itself.

Monetary debasement disintegrates more than people’s pocketbooks; it fundamentally alters the way in which they relate to society and the world around them—ultimately corroding their sense of reality itself. Money is the “operating system” for society, and therefore corrupt money will corrupt society itself: everything in society threatens to become unreal once money itself ceases to be real. As money has lost its meaning, so too has our collective grasp on what is real.

This disturbing dynamic lies at the heart of the speculative manias and market dislocations of recent years. What began as isolated pockets of excess has metastasized into a systemic distortion—a cancer eating away at the very notion of objective reality. It has become the defining challenge of our era—not just for investors—but for society at large.

The Twilight Zone Of 2020: Markets Detach From Economic Reality

This past year witnessed possibly the most surreal financial spectacles in world history; the S&P hitting new all-time highs amidst a global pandemic and one of the most severe economic contractions in history—while unemployment skyrocketed and many citizens relied on food banks to provide sustenance—was by far the least surprising thing that occurred.

Monetary Debasement On An Unprecedented Scale

The sheer scale of monetary debasement has become so incomprehensible to the human mind that it has resulted in a schizophrenic market break, leading Warren Buffett’s partner Charlie Munger to characterize it as “the most dramatic thing that’s almost ever happened in the entire world history of finance”.

As Dan Morehead observed, in 2020 we took on two centuries of debt in one month! The US budget deficit in June 2020 was larger than the total debt incurred from 1776 through the end of 1979; “with that first trillion we defeated British imperialists, bought Alaska and the Louisiana Purchase, defeated fascism, ended the Great Depression, built the Interstate Highway System, and went to the Moon.” According to Bank of America, the big four central banks in aggregate have been injecting liquidity at a rate of $1.4 billion per hour!

Speculative Euphoria Reaches A Fever Pitch

It is altogether unsurprising, then, that speculators have been possessed by “animal spirits” and that the ensuing “euphoria” has spiked beyond levels last seen during the Dotcom Bubble:

The Death Of Value

We no longer bother to maintain the pretense that fundamental financial reality or valuations matter. Tesla—the clear ringleader of 2020’s “electric vehicle mania”—was bid up beyond even the most fanciful potential economic fantasy. In January 2021, TSLA’s market value broached $834 billion—making Elon Musk the richest man in the world on paper—after the stock was added to the all-important S&P500 index.

Robinhood: The Rise Of Retail Investors

The online trading community—galvanized by government stimulus checks, central bank monetization, margin debt, and boredom from being cooped up indoors during the pandemic lockdowns—worked itself into a full-fledged speculative orgy:

Robinhood and other retail trading platforms posted unprecedented volume surges as retail “investors” fully embraced the philosophy of “YOLO” (You Only Live Once).This was easy to do as they basked in the comfort of a guaranteed Fed backstop (a.k.a the Fed “put”): their favorite stocks were up 80+%.

Theater Of The Absurd: Mistaken Tickers & Bankruptcy Bubbles

Some of the most conspicuous speculative activity took place in tech stocks; professional investment managers were then forced to chase the performance of these stocks and indices without regard to valuation. To give a small sense of the insanity that took place, the share price of FANGDD Network Group Ltd—a small Chinese real-estate firm—rocketed from $10 to $130 over a period of four hours as Robinhood investors mistook the firm’s shares for some sort of derivative on technology FANG stocks (i.e., Facebook, Amazon, Netflix, and Google).

The mania was not confined to sexy tech stocks, however. Hertz filed for bankruptcy—and then proceeded to gain ~1000% over the next two weeks as it became one of the “bankruptcy bubble” (!) darlings favored by retail day traders. Hertz quickly attempted to pawn off $500mil of equity (warning in its prospectus that its stock was essentially worthless)—and managed to sell ~$30mil before the SEC finally stepped in. Note that Hertz didn’t file fake or misleading reports—most of the insanity is occurring in plain sight (such as an actual bankruptcy filing!)—and it simply doesn’t matter.

Despite a record issuance of corporate bonds, central bank liquidity drove bond yields and spreads to extraordinarily low levels; some $3 trillion in corporate bonds now trade with negative yields! Private equity, M&A, and IPOs feasted on this liquidity glut—U.S. IPOs set a record at $174bil and the average first-day return for IPOs averaged 40% (the highest ever other than 1999/2000).

SPAC Bubble: Laughing All The Way To The Bank

2020 also witnessed a record-setting proliferation of “SPACs” (Special Purpose Acquisition Company)—a “blank check” business model often indicative of financial manias. SPACs accounted for half of all IPOs, raised over $60billion in 2020 (more than the previous decade combined), and are mushrooming at a rate of 1-5 per day.

U. Penn students created a “Penn SPAC Club”, a SPAC chose its stock tickers based on laughing “emoticons” (“LMAO” and “LMFAO”)—presumably to poke fun at the surreal situation and its own gullible investor base, and even SPACs that have yet to announce an acquisition target were up ~20% last year.

Today’s SPAC bubble is all too reminiscent of that classic South Sea Bubble scheme of 300 years ago: “A company for carrying out an undertaking of great advantage, but nobody to know what it is.” Meanwhile, a “SPAC of SPACs” (a SPAC raised to buy other SPACs) was launched, which calls to mind not only the CDO-squared lunacy of 2005-7 but also the investment trust mania of the Jazz Age—especially the notorious Summer ‘29 Shenandoah & Blue Ridge investment trusts by Goldman Sachs that were pilloried by J.K. Galbraith in The Great Crash.

When Memes Move Markets

Message boards for retail day traders and options traders have proliferated on sites like TikTok, Discord, Reddit, and Slack to such an extent—and are filled with such maniacal behavior—that it makes us quaintly nostalgic for the original Silicon Investor and Raging Bull stock chat rooms of the bygone Dotcom Era:

[The Reddit/WallStreetBets Forum] is best known as a place where users announce their bets on the market, which are often centered on so-called meme stocks—like Tesla—securities that have transcended their role as financial instruments to become a sort of economic inside joke. The biggest and boldest of these bets…are known as “YOLO [You Only Live Once] bets.” Winners brag of spending their newly acquired fortunes on yachts and “tendies”—that’s chicken tenders—seen in jest as making up the ultimate luxury lifestyle.

Source: Money

The system-wide profusion of derivatives trading—particularly amongst the retail day trading community—was a major factor that fueled the speculative melt-up:

Infinite Money Glitch

The self-titled “weaponized autists” of the Reddit/WallStreetBets (WSB) forum—who in late 2019 discovered glitches in Robinhood’s algorithmic code that allowed them to place leveraged trades with an infinite supply of borrowed cash—achieved collective consciousness in 2020 when they realized that they could create an extremely profitable self-fulfilling prophecy by buying enough out-of-the-money call options to force market makers to buy and drive up the underlying stock, which generated a winning lottery ticket for WSB themselves. A top market strategist at a bulge bracket investment bank was sheepishly forced to explain WSB’s ‘weaponized’ options trading and ‘YOLO’ to the firm’s clients:

Equities “Weaponized (short) Gamma” update: yesterday’s short-dated Call volumes in the RobinHood YOLO names were again just absolutely absurd, with TSLA seeing ~950k Calls trade, PLTR ~700k, NIO ~425k...while “lowly” SPX only saw 350k Calls traded—I’m telling you, this is a “real thing,” with the Retail hordes on Reddit/WSB intentionally creating negative convexity events for Dealers in short-dated out-of-the-money upside Calls in these single-name high-flyers

SoftBank—manager of the $100bil Vision Fund, whose stated goal is to invest for the next hundred years—itself turned into a gigantic version of a WallStreetBets trader by buying extremely short-dated out of the money call options using tens of billions of other people’s money:

SoftBank is the “Nasdaq whale” that has bought billions of dollars’ worth of US equity derivatives in a move that stoked the fevered rally in big tech stocks before a sharp pullback on Thursday, according to people familiar with the matter.

The Japanese conglomerate has been snapping up options in tech stocks during the past month in huge amounts, contributing to the largest trading volumes in contracts linked to individual companies in at least 10 years, these people said. One banker described it as a “dangerous” bet.

Social Media Memes Fuels Speculative Frenzy

Social media sites and chatrooms catering to unsophisticated retail traders spread virally via fashion models and “influencers” on sites such as Instagram and Tik Tok:

We’ve culled a handful of the 7000+ self-introductions from one of these options chat rooms; our favorite is undoubtedly “diamondprofessional”, who decided that now is the perfect time to make his triumphant return to day trading options after taking a 20-year sabbatical following the wipeout he suffered in the Dotcom crash:

“We’re Living In The Matrix”

The year was probably best encapsulated, however, by David Portnoy (aka “Davey Day Trader”) picking stocks out of a scrabble bag on Twitter as his horde of many millions of viewers copied his trading strategy—a strategy that consistently worked!

Portnoy perhaps single-handedly accomplished more than anyone else over the past decade to expose the farcical nature of the “market”:

The good news is I know it’s rigged. The government is [saying] don’t worry we’re just gonna create a trillion-billion-zillion dollars. It’s fantasy land. It’s Schrute Bucks [fake money from a popular TV show]. It’s the worst coronavirus day in a while and the government is saying don’t worry about it cause we’re gonna print a quadrillion dollars and the market sky rockets. The stock market is disconnected from reality. The whole thing is a pyramid scheme. We’re living in the Matrix.