In the heart of the scorching Sonoran Desert, a new frontier of innovation is emerging — one that promises to redefine the Southwest United States economic landscape.

Receive our latest insights on X/Twitter here and visit our website bewaterltd.com

Not investment advice. For educational/informational purposes only. See Disclaimer.

The boundary of Arizona's Salt River Valley marks the threshold between ancient earth and silicon future. Stand at its edge and the scene feels surreal: the saguaro cacti still cast long shadows across a timeless landscape—but just beyond, a new geometry juts from the desert earth. Gleaming semiconductor fabs—$65 billion worth—stretch toward the horizon. This is no mirage; it’s a tectonic shift reshaping the global semiconductor order as Taiwan Semiconductor Manufacturing Company (TSMC) builds the future of American technology in this unlikely desert setting.

For decades, the world's most advanced chips flowed from East Asia. Now—as the AI 'Manhattan Project' heats up and Multiflation's geopolitical tensions expose supply chain vulnerabilities, critical technology is reshoring to the US Southwest.

The transformation builds on deep roots. Since Motorola first established operations in Phoenix in 1949, Arizona has cultivated a tech ecosystem in the shadow of Silicon Valley. Intel, Microchip Technology, and dozens of other companies found advantages in the desert's wide-open spaces, business-friendly climate, and lower costs.

The Arizona Advantage

But today's semiconductor boom represents something entirely different in both scale and ambition. TSMC's historic investment catalyzed a wave of federal CHIPS Act funding, positioning the Silicon Desert as America's answer to Taiwan's chip dominance. This is about more than semi fabs, however: Arizona is being positioned as a pillar of America's broader technological resurgence.

As one industry observer notes, "Given the benefits of land prices, stable infrastructure, generous state and city incentives…a skilled workforce, and a lack of natural disasters, it's easy to see why many companies are choosing Arizona for expansion, relocation, or a startup."

One commodity is in short supply, however: water. Arizona pumps more groundwater than nature replenishes, and the Colorado River—which supplies 40% of the state's water—faces historic shortages. Water is likely the most important constraint on expansion.

The Quiet Power Play Beneath The Fabs

While headlines obsess over fabs, hyperscalers, and the CHIPS act, someone else arrived here first—quietly and deliberately securing strategic control over something even more fundamental. They’ve been methodically buying up residential land, locking up water rights, establishing entitlements, and constructing the connective tissue that makes much of this expansion viable.

It's not who you'd expect: it’s D.R. Horton (DHI)— America’s largest homebuilder by volume. DHI has quietly become the dominant force controlling residential land, water, and zoning across the very corridors in which the AI hardware stack is physically anchoring—Phoenix’s East Valley, North Austin, Reno, and beyond.

DHI isn’t building anything nearly as sexy as Artificial General Intelligence. But Horton controls something more foundational around the fabs that do—positioning itself as a gatekeeper to the next-gen tech corridor buildout.

The Demographics of Disruption

The scale of this buildout demands an army. Phoenix expects 80,000 new positions across the broader semiconductor ecosystem alone within five years—a demographic surge that will reshape the entire valley.

These aren't remote workers who can live anywhere. Semiconductor manufacturing requires specialized workers within commuting distance. As tens of thousands of new permanent residents flood into specific corridors, someone has to build the neighborhoods, secure the water rights, and control the entitled land.

From Builder to Bottleneck: Scarcity As Strategy

DHI has been consolidating a vertically integrated monopoly on the very resources required to support America’s AI supply chain buildout. Its control of housing entitlements and aquifers undergirding America’s semiconductor future positions it as the most underestimated player in the U.S. would-be industrial renaissance.

Yes, as Steve Eisman and Ivy Zelman astutely noted last month, DHI remains exposed to the vicissitudes of the housing market, including its cyclicality and interest rate sensitivity. Current headwinds include a “frozen” housing market, record nationwide housing unaffordability, deteriorating consumer credit, weak housing demand after the initial post-COVID surge and spike in interest rates, elevated inventory levels, increased competition, and industry-wide margin pressures. Even Arizona is not immune.

DHI clearly faces near-term headwinds that could pressure the stock. However, many of these headwinds can be hedged, and once they abate DHI could emerge as a bedrock holding in any Multiflation portfolio.

The Inevitability of Infrastructure

Whether America's semiconductor reshoring effort ultimately succeeds or fails is less relevant to DHI's positioning than Washington’s determination to try. Geopolitical tensions with China, the AI “Manhattan Project”, and supply chain vulnerabilities exposed during COVID have made domestic chip production a matter of national security.

The attempt will likely happen regardless of the economics. Even if Arizona's fabs prove less competitive than Taiwan's, even if yield rates disappoint, even if the whole project struggles—it seems likely that workers, capital, and resources will be driven into these corridors.

The federal government is pouring billions into Arizona's semiconductor buildout, but every new fab, every new neighborhood, every relocated engineer requires a home—and water rights—that are becoming increasingly difficult to secure; DHI is uniquely positioned to capture this demand. The CHIPS Act can fund factories, but it can't conjure water from the desert floor.

DHI: Through The Multiflation Lens

DHI occupies the nexus between tech and AI buildout, reshoring, and water scarcity—positioning the company at the epicenter of one of America's most resource-constrained, fastest-growing markets.

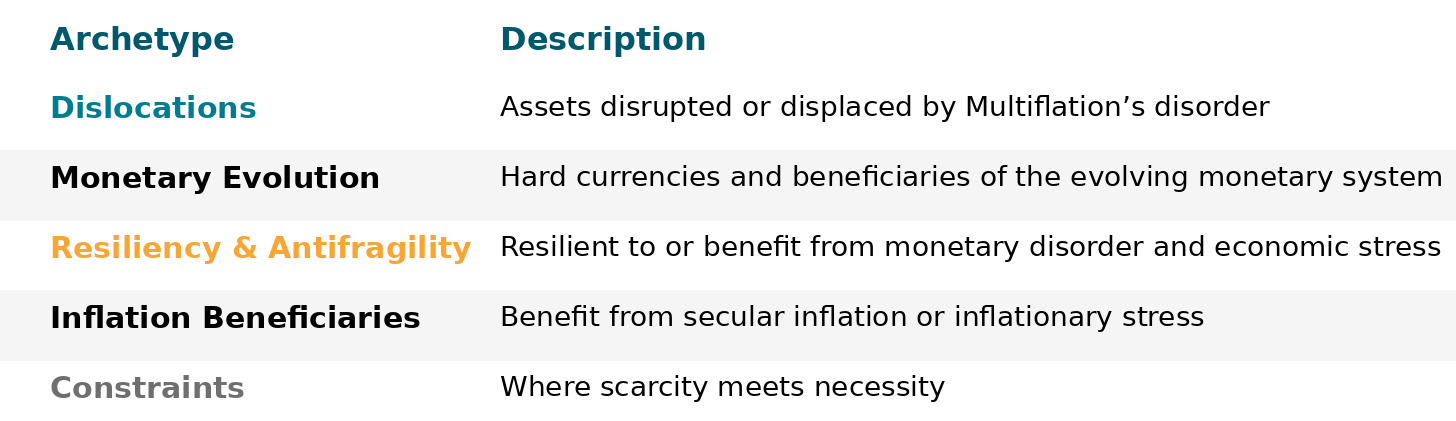

In the forthcoming series, we'll use DHI as our laboratory to demonstrate parts of the Multiflation Method in action. We'll examine how DHI fits into four of the five Archetypes for navigating the Multiflation regime:

By the series' end, we’ll have both a better understanding of DHI's unique position and a replicable process for analyzing other investments through Multiflation's lens.

Next: Part II - The Water Play That Cornered the Market

Yes dude! I’ll be following this series with unquenchable interest.