The investing rules have changed: the frameworks and strategies that succeeded for four decades are now failing amidst a structural collapse of the old socioeconomic order. Last month, we identified this new reality—Multiflation (explained here).

Multiflation™ isn’t a passing shock or transient theme. It’s the new medium—the tempestuous ocean in which investors and entrepreneurs must now sail: volatile, contradictory, and unavoidable. Above these waters churn perpetual storm systems, while beneath the surface swirl chaotic cross-currents and treacherous undertows—inflation and deflation, scarcity and glut, booms and busts, monetary disorder, financial repression, geopolitical shocks, and rolling dislocations.

This maelstrom is reshaping every layer of civilization—money, markets, geopolitics, and even society itself. It poses the single greatest threat to our accumulated wealth—years or even lifetimes of labor and sacrifice, stored and crystallized. Yet while Multiflation upends the investment frameworks that succeeded for decades, it simultaneously creates new opportunities for those prepared to navigate the storm.

Charting The Course—And The Journey Ahead

Here, we introduce the method required to steward wealth amidst this new reality. This piece proceeds through three stages—first, diagnosing the insufficiency of traditional investing frameworks; second, establishing the Be Water philosophy; and finally, presenting our systematic method for applying these principles to investment decisions.

This lays the foundation for everything that follows in the coming weeks and months: assessing and curating a collection of holdings that survives and thrives amidst disorder. Future installments will translate principles into practice.

But before we can begin to navigate Multiflation and chart a new course, we must first understand our current position, clarify our destination, and confront the treacherous waters that lie between. Our journey begins with the recognition that the maps which once served us can no longer guide us through these uncharted waters.

Receive our latest insights on X/Twitter here

Not investment advice. For educational/informational purposes only. See Disclaimer.

Multiflation’s Maelstrom

Just as the ocean corrodes, floods, fractures, and drowns—indifferent to anything unprepared for its force—so too does Multiflation erode, overwhelm, and rupture the investment architecture that investors painstakingly optimized over the past four decades. The investing systems—and behavioral reflexes—honed during calmer economic seas are even now revealing themselves as liabilities.

The true captain isn’t defined by calm seas and following winds. His mettle is revealed only when the seas turn violent: amid the heart of the maelstrom, navigational bearings vanish, charts and instruments prove useless, visibility collapses, and every choice carries consequence. What matters now is what was prepared before: gear selected and secured, contingencies rehearsed until reflexive, decision protocols drilled into muscle memory. And—most critically—the captain’s hard-won ability to adapt when all certainties dissolve, while maintaining the discipline required to avoid errors that sink ships.

Stasis Is Not Safety

Despite clear warning signs looming on the horizon, most investment captains stay the course, guided by beliefs formed in yesterday’s fair weather—sails fully unfurled, instruments calibrated for calmer seas, vulnerable to the tempest already gathering strength.

Others sense the shift, yet even these captains often delay trimming sail and taking decisive action, hoping the storm will pass or their current course will somehow carry them through safely.

Such hesitation, however understandable, proves dangerous in Multiflation's waters. Here, stasis isn't safety—it's maximum exposure.

Modern Portfolios Unprepared For Multiflation

Most modern portfolios follow a common blueprint: optimize risk-adjusted returns through diversification across asset classes and investment factors, guided by data on returns and correlations.

These approaches—asset allocation, the endowment model, factor investing, risk parity, 60/40—are fundamentally backward-looking. Worse still, they were born of and optimized for the “Goldilocks” era of our modern fiat monetary system—a historically unique period of declining interest rates, growth without inflation, “coordinated monetary policy” that repeatedly rescued markets from major dislocation, and geopolitical stability.

This four-decade super-cycle for stocks, bonds, and real estate lulled investors into a false sense of security and punished efforts to think outside the established financial orthodoxy. Their conditioning leaves investors trapped, solving backwards-looking statistical equations for an era that no longer exists: Multiflation renders the past four decades of financial history and statistics largely irrelevant.

Investors—And The Financial System—Are Short Multiflation

Investors believe they own diversified baskets of "assets," "factors," and "risks." But rather than spreading risk, their portfolios remain dangerously concentrated in one existential bet dressed in a thousand different disguises: that the world of tomorrow will resemble the world of yesterday; that the socioeconomic order of the past four decades will continue functioning as it has.

Such positioning leaves investors unknowingly short Multiflation—they face a relentless short squeeze that erodes their real wealth as the disintegration of the old order intensifies and accelerates. Indeed, the entire global financial system is short Multiflation, too. The further conditions drift from Goldilocks’ ahistoric "normal," the more intense the short squeeze becomes, triggering glitches in the Financial Matrix—as we witnessed in 2022 and again this year.

Glitches In The Financial Matrix

Economist George Shackle captured our predicament with his concept of "kaleidics". Markets rest on "agreed formulas about the future" that everyone accepts—until they don't. Like a kaleidoscope, these shared assumptions can "change as swiftly, as completely, and on as slight a provocation" as a “twist of the hand or a piece of news.” One moment everyone believes bonds and stocks move in opposite directions; the next, they crater together.

What makes this particularly dangerous now is that these “assumptions”—modern investment theories and strategies—have become hard-coded into the financial system itself over the past several decades through algorithms, policies, regulations, and institutional structures governing trillions in capital.

In Silicon Sorcery (found here) and our ongoing series The Sorcerer's Apprentice & The Man Who Broke The Market (found here), we demonstrated that algorithms do far more than passively execute investment strategies—they fundamentally rewrite the economy’s operating system in their own image, creating the Financial Matrix: a video game-like simulation of financial markets (explained here and here). The Financial Matrix is governed by reflexive, self-reinforcing feedback loops that amplify both these assumptions’ apparent “predictive” power during stable periods—and their catastrophic failure when conditions sufficiently shift beyond a critical threshold.

The Diversification Delusion

The kaleidoscopic instability of the Financial Matrix explains why "diversified" portfolios prove anything but diversified during Multiflation. When outsized kaleidic shifts occur today, they shatter the hard-coded foundations of the Financial Matrix itself. Yesterday's consensus correlation becomes today's catastrophe without warning. The very algorithms designed to spread risk instead concentrate it.

When crisis hits, correlations converge on 1 and promised protection fails exactly when it is most needed—exposing that these foundational “assumptions” were artifacts of an extraordinary period in economic history, not timeless investment truths.

The past several years offered a mere foretaste of this breakdown, as moderate inflation—far short of 1970s levels—already began to seriously undermine the strategies that form the foundation of so many investors' portfolios by breaking the assumptions on which they are based. Even prestigious endowments now find themselves trapped in the Multiflation labyrinth—see recent examples here and here.

Yet Multiflation's most pernicious damage occurs between acute crises—through rolling dislocations, “stop-and-go” inflation, and financial repression that collectively wage a chronic war of attrition on wealth. Different assets and strategies fail in unpredictable rotation, creating a relentless erosion of capital that traditional risk models and orthodox inflation theories are fundamentally incapable of addressing. These failures don't cancel each other out through diversification—they compound because the dislocations all flow from Multiflation’s disorder, hitting different assets through interconnected yet unpredictable transmission mechanisms.

Even those whose portfolios are rising or “outperforming” fall victim to money illusion—feeling wealthier because their statements show higher dollar values even as their real purchasing power steadily erodes beneath the surface. The destruction unfolds invisibly, concealed by the very portfolio gains investors celebrate.

Navigating Disorder: The Be Water Approach

The coherence of the old order is even now collapsing. Conditions have changed irreversibly. The navigator's mindset and methods must evolve accordingly—becoming as fluid, adaptable, and responsive as the waters themselves.

We offer not another rigid investment formula, style, or doctrine, but a lens through which to continually refine your existing investment process for Multiflation's complexity. For those bound by institutional constraints or existing frameworks, this lens enhances how you think about and implement even traditional portfolios and allocations; “adapt what is useful, reject what is useless, and add what is uniquely your own.”

Rather than asking "How much should I own of each asset, risk, and factor to optimize statistics?" the Be Water approach transforms the question: "When this system breaks—and it is breaking—what actually survives and thrives? What purpose does each investment serve when order dissolves?"

The objective is to build a seaworthy vessel—one that can flex, float, and endure Multiflation's turbulence—and to develop the Captain: not just to steer, but to read the weather, trim the sails, and make sound decisions amid fog, storm, and broken instruments. This means focusing on what actually matters—the underlying forces that create, destroy, and preserve wealth when familiar frameworks fail and dislocations become the norm. It means learning to flow like water—with change rather than fighting against it.

Water and Wealth

Nothing in the world is as soft and yielding as water.

Yet for dissolving the hard and inflexible, nothing can surpass it.

The soft overcomes the hard; the gentle overcomes the rigid.

—Lao Tzu, Tao Te Ching

Water is the most enduring, essential, and paradoxical substance known to man. It yields without surrender, and persists without resistance. It carves canyons, yet sustains all life. It dissolves more substances than any other liquid, yet retains its identity. It erodes mountains not by force, but by patience. From liquid to gas to crystallized solid, it changes form but never nature. Water obeys no master, yet flows with perfect coherence.

In the age of Multiflation, water transcends metaphor to emerge as archetype. Where our era worships the ephemeral, water embodies permanence. Amidst chaos, water demonstrates coherence. Water’s authentic scarcity rebukes our age of illusion and hyperreality. Where entangling dependencies weave fragility throughout the global order, water flows sovereign and self-contained.

The substance that shapes continents and nurtures life offers wisdom for those who steward wealth: amidst sweeping and accelerating change, we must ourselves “Be Water.”

Curation, Not Construction: Be Water Holdings

This philosophical foundation transforms how we approach wealth preservation: the very notion of a "portfolio" must dissolve and reshape. We can no longer merely “construct portfolios" or build around “asset classes” and “allocations” to appease a mathematical model; positions can no longer be chosen for statistical neatness or academic diversification qualities. What once passed for prudent architecture now fractures under Multiflation’s forces.

Instead, we must curate our collection of holdings with the intention and discernment of a navigator selecting the right tools, crew, and provisions for an uncertain voyage. We assemble components whose endurance and character enhance our vessel's capacity to withstand, adapt, and persist through every storm. Each holding serves its purpose—contributing to a whole that is built for permanence, designed for survival, and readied for whatever the next swell may bring.

In this, we honor the true nature of wealth: not as numbers in a spreadsheet, but as stored effort and sacrifice, entrusted to our care and protection through every season and storm. Our objective now, therefore, is less to “outperform” than to outlast; to arrive at our destination safely by curating a collection of holdings that survives and thrives.

The Multiflation Method

As Jim Grant once observed, “the future is always unlit”—but Multiflation has made navigating that darkness profoundly more treacherous. In such an environment, a guiding methodology is now essential:

When you have a [method] to work from, you avoid the problem that comes with stumbling around in the dark over chairs and night stands. At least you can begin to visualize in the dark, which is where we all work. The future is always unlit. But with [method], you can anticipate where the [furniture] might lie.

—Jim Grant, Grant’s Interest Rate Observer

The Multiflation Method provides a structural framework for decision-making in the darkness of disorder. We developed this approach not as an intellectual exercise, but out of necessity: the cost of misreading reality—even briefly—has never been higher. In the remaining sections and future installments that follow, we'll move through the process systematically—from principle to practice, from concepts and orientation to execution—fully developing and applying each in turn.

Following the Method ensures that we are prepared for all potential failure—and success—modes of Multiflation itself. Water teaches us to flow; sailing teaches us to harness that flow toward our destination. Just as every competent sailor must master chart-reading, weather interpretation, and sail handling, every Multiflation navigator must develop complementary capabilities:

Elements provide timeless principles for protecting and building wealth amidst disorder.

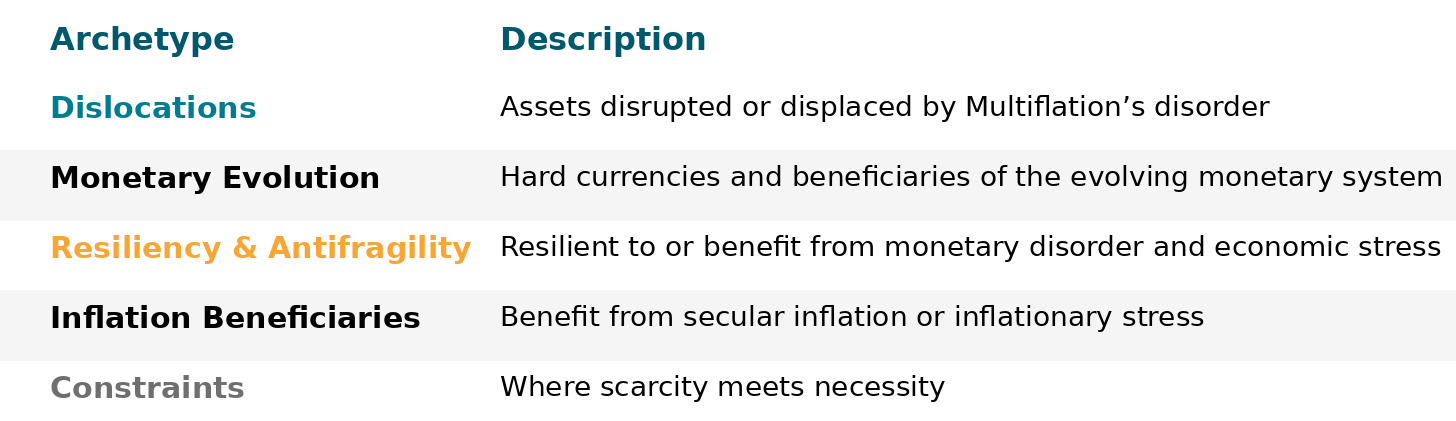

Archetypes translate these principles into actionable investment categories, providing comprehensive exposure to the attributes that survive and thrive through Multiflation's disorder.

Undercurrents identify and filter specific themes and opportunities worthy of immediate and longer-term focus.

Each investment we pursue must be legible through all three lenses: Elements, Archetypes, and Undercurrents; this ensures no action is random, reactive, or untethered from the environment we now inhabit.

The Multiflation Map helps us read current economic conditions like a captain studying charts and weather patterns. The Map orients; the Method ensures every decision moves us closer to a collection of holdings that endures and compounds. Our method is not built to react to every wave, but to withstand the storm—embedding adaptability, resilience, and endurance into principle, process, position, and portfolio.

Elements: Philosophy

The Five Elements are timeless investment principles made acutely urgent through the disorder and dislocations of Multiflation. These are not a checklist of attributes; we don’t “implement” them, so much as align with them. They’re conceptual ideals that shape how we think, analyze, and act; together, they translate complexity into clarity, and harness disorder for advantage. They manifest at all scales: from individual positions to themes to entire portfolios and businesses.

Emergence represents the culmination of all principles converge to create a collection of holdings that not only withstands disorder but transforms it into an advantage. Emergence occurs when preparation meets pressure—revealing strength that exceeds the sum of its parts.

Archetypes: Strategy

Archetypes translate the abstract wisdom of the Elements into concrete investment categories, solving a fundamentally different problem than modern portfolios: "What structural mechanisms preserve and create wealth during Multiflation’s disorder?"

We distilled these Archetypes from our study of economic history, focusing on the attributes of the best and worst performers during periods of great change, and adapting them to today’s unique conditions. Four are timeless. One—Monetary Evolution—is uniquely timely because the evolutionary arc we traced in The Metamorphosis of Money is reaching its endgame: the fiat system is fracturing, the "risk-free" nature of Treasuries is increasingly being reassessed, and officials ranging from Treasury Secretary Bessent to the IMF are calling for a reset of the global economic system.

Each Archetype represents a distinct survival and opportunity mechanism. None is sufficient alone, nor are any of them designed to be “correct”. Collectively, however, the Archetypes provide resilient, adaptive exposure across the full spectrum of failure and success modes of Multiflation—without requiring clairvoyance about what comes next.

They transform portfolio construction from a mathematical exercise into strategic curation—selecting assets for their structural roles in preserving and creating wealth amid disorder. This approach to building seaworthy collections of holdings supersedes any individual asset class, sector allocation, security selection, or tactical tool.

Undercurrents: Themes & Tactics

Undercurrents transform abstract Elements and Archetypes into concrete opportunities and ensure that we maintain strategic focus on multi-year themes rather than noise. They answer: "where and how should we focus attention now?"

The Multiflation Map: Orienting Without Predicting

The Multiflation Map tracks how inflation and growth interact to create different economic waters, climates, and storm systems. It's our tool for understanding what type of seas we're navigating—not predicting exactly where we’ll be next month or next year. Think of it as knowing it's hurricane season in the South Pacific versus predicting which Tuesday a particular storm hits.

Each region of the Map has distinct characteristics. Some reward patience, others demand speed. Some expose scarcity, others force liquidation.

Critically, however, we don't need to predict exactly where the winds and currents will push us next. Our Method—Elements, Archetypes, and Undercurrents—allows us to survive or thrive across all weather patterns and regions of the Map. We're preparing for a turbulent voyage, not counting on specific storm patterns.

Multiflation Method In Action

This is the foundation; in subsequent posts, we'll detail each component and demonstrate how they collectively help us chart a safe course through Multiflation's disorder.

What sounds abstract becomes concrete through application. Next week, we begin demonstrating how the Multiflation Method works in practice. Through a real world example, we’ll analyze a company through our lenses—one that embodies four Multiflation Archetypes, including one essential Constraint that markets are overlooking entirely. This isn't about identifying the next winner; it's about mastering a systematic process that works when traditional frameworks fail.

The storm is already here. Those who adapt their methods will not merely survive Multiflation—they will harness its disorder to their advantage.

thanks thanks

am surprised you are giving us all this for free

thanks once again

love this - looking forward to the rest