The Rise Of SkyNet: Ghosts in the Machine

The Rise of SkyNet: The Algorithmization Of Finance Part I

New to the series? Start with our foundational posts on Hyperreality and the Financial Matrix for essential context, or explore the full Table Of Contents.

Part of the Sorcerer’s Apprentice series, originally published privately on January 13, 2021. Updated, revised, and expanded for public release on October 4, 2024.

Note: This piece predated the AI revolution of 2022-2023. From the vantage point of late 2024, our exploration of algorithmic finance might initially appear quaint. However, the emergence of ChatGPT-3.5 and its successors has only amplified the relevance of these ideas in the interim. The questions we grappled with four years ago—probing the nature of modern prices, the autonomy of digital systems, and the future of finance—have only grown more pressing and complex. As AI relentlessly reshapes our world, the challenges to our understanding of markets, money, and reality itself have intensified exponentially.

In Silicon Shadows Part I, we explored how the digitization of money and markets—coupled with the abstraction created by digital interfaces—severed the connection between our actions in the financial realm and their real-world consequences. In Part II, we examined two even more profound developments spawned by digitization: the accelerating elimination of human judgment from finance, and our newfound ability to encode our ideas directly into the digital fabric of the Financial Matrix.

Like Mickey Mouse enchanting brooms in the Sorcerer's Apprentice, we’ve summoned forces that now operate beyond our full control or comprehension. While society’s user interface remains seemingly unchanged, these forces have fundamentally rewritten its operating system and birthed the Financial Matrix—a system in which the prices flashing across our Bloomberg terminals and Robinhood apps represent...what, exactly?

Ten Milestones On The Road To Hyperreality: Contents

1. The Metamorphosis Of Money

2. Keynes' Kaleidoscope

3. Central Banks’ Money Printer Go BRRRR

4. Silicon Shadows

5. The Rise of Skynet <== YOU ARE HERE

6. The Institutionalization Of Finance

7. The Symbolic Alchemy Of Risk

8. “We’re All Quants Now”

9. Social Media & “The Ecstasy Of Communication”

10. The Consumerification of FinanceWhen Prices Become Hyperreal

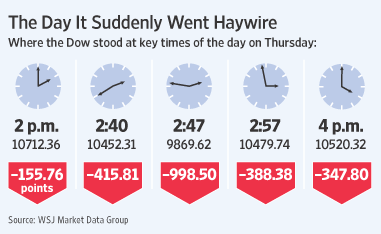

In 2010, financial markets briefly entered the Twilight Zone. Within minutes, the stock market plummeted nearly 10% before rocketing back up—all without human intervention. This “flash crash”—triggered by automated trading algorithms run amok—saw blue-chip stocks like Procter & Gamble whipsaw between a penny and $100,000. Though the resulting trades were soon voided and the insane gyrations halted, the incident revealed how untethered from reality prices could become in our digital age.

HyperPrices At Costco

Now, imagine such madness infiltrating your local Costco. You enter for a routine shopping trip. The familiar warehouse stretches before you, but something’s amiss. Sleek digital price tags flicker on every shelf, their displayed prices in constant flux.

An organic apple: $8,947.23. A wheel of artisanal cheese: $0.75. A 4K TV: $12.01. A case of water: $3,333.33—no, wait, now it’s $1.99, now $500, now negative $3.

Disoriented, you grab the apple and approach a store manager. “Excuse me,” you stammer, “why is this apple nine thousand dollars?”

The manager smiles politely. “That’s the current price” he replies.

“Yes, I can see that. But how are these prices determined?” you press.

“They’re just prices,” the manager responds with a shrug. “You know—numbers assigned to items by corporate HQ. The only difference today is that corporate is pilot testing the newest machine learning system called HyperPrice, which sets prices in real-time using ChatGPT7.”

Heart racing, you grab a few items with seemingly reasonable price tags—bread for $0.99, and that suspiciously cheap TV. At checkout, the display flashes: “$25,156.89.”

“That's impossible!” you exclaim. “A minute ago the bread was under a dollar! The TV was twelve bucks!” The cashier nods sympathetically. “The machines adjust prices up and down in real-time now.”

Dazed, you hand over your credit card. As you exit, clutching your receipt, a chilling realization dawns on you: these aren’t prices anymore—not in any meaningful sense of the word. The problem isn’t that they are high or low, expensive or cheap—those concepts no longer apply. Prices are just...abstract numbers now, floating freely in the ether. Your paper receipt is a snapshot of these digital phantoms—a frozen moment in time capturing arbitrary artifacts of an AI's inscrutable calculations.

The simulacrum [a symbol that no longer refers to anything other than itself] is never that which hides the truth - it is truth that hides the fact that there is none. The simulacrum is true. –Baudrillard, Simulacra and Simulation

HyperPrices In The Financial Matrix

While today’s economic and asset market pricing mechanisms have generally not reached the extremes of our imaginary Costco, they do share many unsettling parallels—and in the next installment we will explore additional real-world examples, such as a glitch with Amazon book prices. Even as we edit this essay in 2024, we’re seeing ongoing instances of algorithmic anomalies in the financial system: Bank Of America customers are experiencing a snafu that sets their bank balances to $0:

On the surface, asset prices retain their familiar form; the flickering numbers on our screens appear the same as always, and the ritual of obtaining stock and bond quotes has remained fundamentally unchanged for decades. However, beneath this veneer of normalcy, a profound transformation has taken place. While these prices masquerade as meaningful, they have steadily devolved into mere facades—shedding their ancestral role as bearers of meaning to become more akin to the phantasmal HyperPrices in our imaginary Costco.

Algorithmic Meme Magic

The digitization of finance has enabled us to create virtual agents (algorithms)—disparagingly nicknamed SkyNet from the Terminator movie series by some—which we set loose in an attempt to automatically execute our wills and ideologies within the purview of our hyperreal Financial Matrix.

Algorithms—sequences of instructions that tell a computer what to do— have become ubiquitous yet often invisible forces shaping our world. These “black boxes” are far from neutral. Each algorithm’s implementation requires its creator to make certain choices that inevitably reflect—consciously or not—his assumptions, values, and ideologies.

By imbuing these digital constructs with our worldviews, we cast them in the role of Max Weber’s “railway switchmen”, subtly determining the tracks along which society is molded. Algorithms are digital spells. Once unleashed, they ripple through our world, bending it to their logic—even as they remain hidden in the shadows. Once we infuse our digital Sorcerer’s Brooms with particular ideology—our “railway switchmen” digitally encode a “track” in the Matrix—we reify these memetic worldviews into the fabric of our reality.

A key point to remember is that algorithms themselves function as memes and wield their own form of “meme magic”—transmuting ideas into tangible reality. We ourselves used algorithmic “meme magic” to create the image on the cover graphic on this report. [Editor’s note: this was published before DALL-E, Stable Diffusion, etc.] Similar “meme magic” can be used to create “Deepfake” videos that extremely convincingly mimic reality—such as the following video of Barack Obama delivering a PSA about fake news:

The capabilities of deepfakes were further showcased in the recent viral video “Sassy Justice” by the creators of South Park, in which a Donald Trump likeness stars as a sassy reporter, and Mark Zuckerberg cameos as a dodgy dialysis center owner.

There are even AI algorithms such as “dank learning” that are designed to artificially create their own memes, as well as an entire field of computer science devoted to “program synthesis” in which algorithms write their own algorithms [Editor’s note: this now seems quaint in light of ChatGPT].

Algorithms enmesh themselves into our world, and shape it in myriad unseen ways. This is metaphorically what Najjar was attempting to capture in his artwork of financial mountains shaped by algorithms—“math we have written but can no longer read…math that is no longer derived from nature, but rather…rewrites nature”. Humans create algorithms, which in turn affect reality for humans, who then create additional algorithms that affect still other algorithms, and so on ad infinitum in a recursive feedback loop that propagates in unpredictable and chaotic ways.

Most recently, we’ve seen the power of Twitter and Facebook algorithms to create reality: they curate news and social media posts—and also altogether censor certain information and users. Even celebrity comedian Rowan Atkinson (Mr. Bean) recently weighed in on this topic: “The problem we have online is that an algorithm decides what we want to see, which ends up creating a simplistic, binary view of society. It becomes a case of either you’re with us or against us.”

Other algorithms determine election results (!), search results on Google, recommendations for what movies to watch on Netflix or songs to listen to on Spotify, pricing information for sites like Amazon and eBay, credit availability (FICO scores), real estate valuations (Zillow Scores), how businesses manage their global inventories and supply chain, and—most importantly for our purposes here—algorithms directly impact financial markets as well.

Up Next:

As we penetrate deeper into the Financial Matrix, we’ll examine the chaos unleashed by our digital brooms at the core of our markets.

This is a great article describing the phony nature of our economy.

For a new perspective on technology, read this:

https://swiftenterprises.substack.com/p/computational-independence