The Encoded Economy: From Iron Cage To Digital Matrix

Silicon Shadows Part II

New to the Sorcerer’s Apprentice series? Start with our foundational posts on Hyperreality and the Financial Matrix for essential context, or explore the full Table Of Contents. Originally published privately on January 13, 2021. Updated, revised and expanded for public release on September 30, 2024.

In Silicon Shadows Part I, we explored how the digitization of money and markets—coupled with the abstraction created by digital interfaces—severed the connection between our actions in the financial realm and their real-world consequences. Now, we examine two even more profound developments spawned by digitization: the accelerating elimination of human judgment from finance, and our newfound ability to encode our ideas directly into the digital fabric of the Financial Matrix. These twin forces further propel us ever deeper into hyperreality.

Ten Milestones On The Road To Hyperreality: Contents

1. The Metamorphosis Of Money

2. Keynes' Kaleidoscope

3. Central Banks’ Money Printer Go BRRRR

4. Silicon Shadows <== YOU ARE HERE

5. The Rise of Skynet: The Algorithmization Of Finance

6. The Institutionalization Of Finance

7. The Symbolic Alchemy Of Risk

8. “We’re All Quants Now”

9. Social Media & “The Ecstasy Of Communication”

10. The Consumerification of FinanceDigital Deluge: Surreal Sums Dissolve Debt & Debasement Barriers

Previously, we examined how digitization removed a critical physical barrier to monetary debasement and hyperreality: money and debt can now be conjured into existence with a mere mouse click. This obliterated nearly all limits on government spending and debt, allowing States to lay claim to an ever-growing share of wealth and labor—and increasing the likelihood that they resort to debasement and debt monetization to “solve” the debt crisis.

Digitization, however, has eroded not only physical limits, but cognitive ones as well. We evolved to grasp handfuls, not billions; digitization bypassed this evolutionary limitation, enabling financial operations at surreal scales far beyond our innate comprehension.

We casually toss around numbers like “trillion” with a nonchalance that belie their true enormity. Physics Nobel laureate Richard Feynman remarked in the 1980s (!) that: “There are 10^11 stars in the galaxy. That used to be a huge number. But it’s only a hundred billion. It’s less than the national deficit! We used to call them astronomical numbers. Now we should call them economical numbers.” One can only imagine what Feynman would say about the US’ recent budget deficit of nearly a trillion dollars in a single month. A friend quipped that the title of the TV show Billions “doesn’t even make sense any more”.

Enter our silicon saviors. Computers—unencumbered by our human frailties, mental hang-ups, and cognitive constraints—effortlessly create and tally trillions within virtual ledgers, implacably indifferent to the dizzying scale or real-world consequences of our modern financial gymnastics.

Scientism’s Silicon Surge

The advent of powerful computing and digital data made complex mathematical analyses in economics and finance not just possible, but trivially easy. Scientistic and quantitative methods quickly came to dominate both academic research and Wall Street practice.

Computerization seemingly enables the ultimate realization of the scientistic approach—stripping away the qualitative, subjective dimensions of human economic life and replacing them with the clean, quantitative precision of mathematics. Consequently, financial and economic data came to be conceptualized—both subconsciously and sometimes consciously—as purely mathematical phenomena divorced from underlying human action.

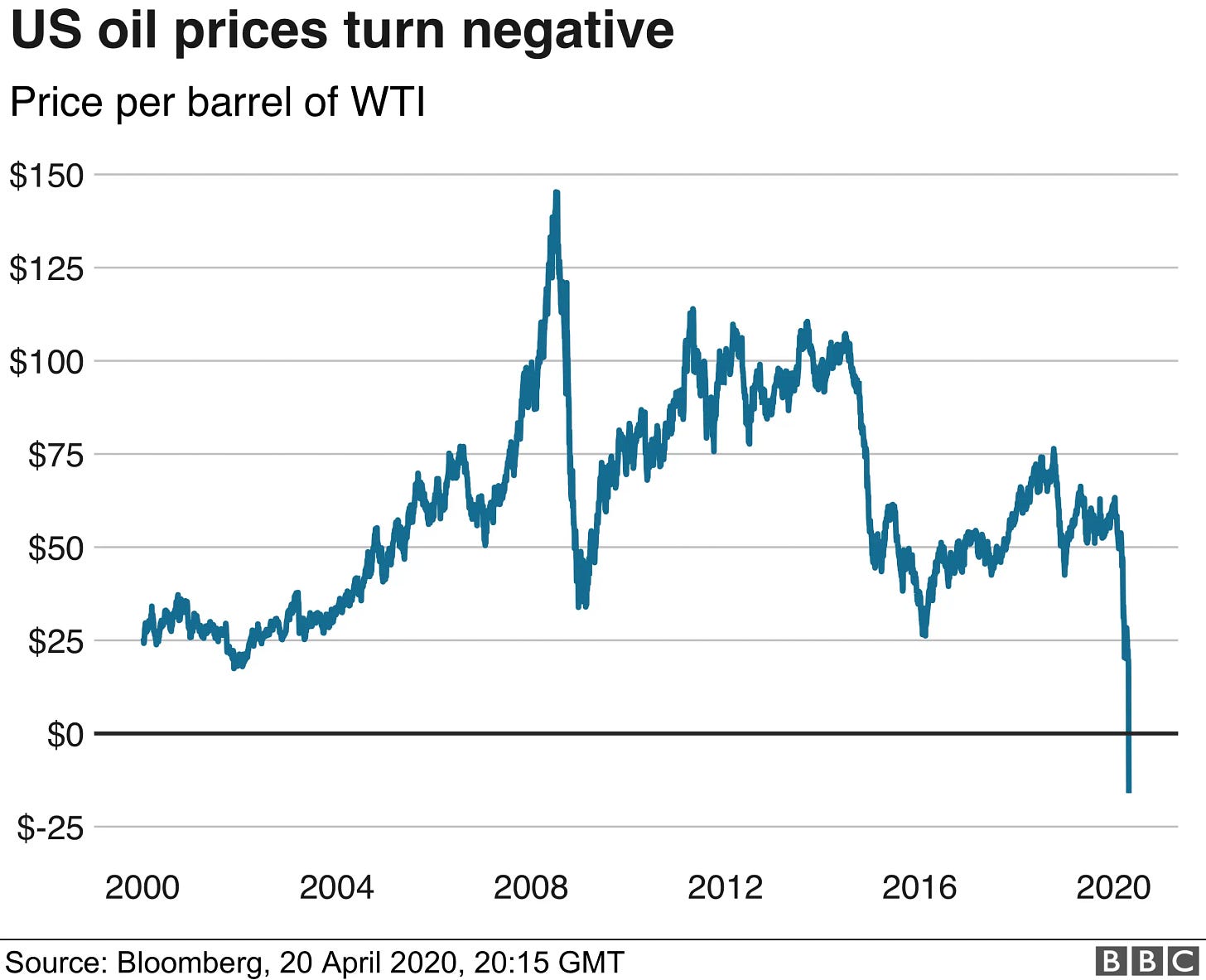

Indeed, to our digital demigods, all numerical inputs are equally valid and susceptible to precise mathematical manipulation. Computers don't distinguish between data that correspond to anything in the real world outside their digital domain, or whether the numbers they crunch are even economically possible. (Yet even our algo overlords required a hasty reprogramming during the 2020 oil price plunge to take into account the mind-bending concept of negative crude prices.)

To A Digital Hammer, Everything Looks Like A Virtual Nail

Scientism’s ascendancy is more a reflection of our newfound ability to collect and crunch vast amounts of data effortlessly than proof of its ultimate correctness or analytical superiority—as evidenced by the LTCM, 1987, and 2008 crises. While physics boasts fundamental laws that accurately predict the speed with which an apple falls due to gravity, our computational finance tools have failed to uncover comparable immutable truths.

The prevalence of scientism exemplifies the adage that, ‘to a hammer, everything looks like a nail’—our analytical tools have come to define our perspective on the nature of economic reality. Armed with powerful computers and sophisticated mathematical techniques that excel in the hard sciences, we now tend to reframe every economic question as if it were a quantitative puzzle awaiting a numerical solution.

Silicon Supplants Carbon

The digitally-enabled trend towards abstraction and virtualization in finance is accelerating at warp speed; increasingly, human decision-making is being supplanted by algorithms and artificial intelligence. “Passive” investing—a dominant force in the markets that steers trillions and “owns” vast swaths of corporate America—is, at its core, an algorithmic approach to capital allocation.

In active management, too, algorithms are rapidly replacing humans. Machine learning models analyze vast troves of data to make investment decisions, execute trades, and manage risk. High-frequency trading algorithms operate at speeds and scales incomprehensible to human traders, while AI-driven robo-advisors are replacing human financial planners for many retail investors.

Smart contracts—self-executing agreements that automate complex financial transactions without direct human oversight—likely mark the next stage in this evolution. In insurance, these crypto-clauses could automatically process claims and payouts based on predefined conditions. For supply chain management, AI-enhanced smart contracts could optimize inventory and trigger payments by tracking shipments in real-time and forecasting demand.

The infamous 2016 DAO hack—which exploited a smart contract vulnerability to siphon $50 million worth of Ether—starkly illustrates the risks inherent in code-as-contract and financial automation. Nonetheless, the march towards autonomous financial systems continues unabated.

This evolution marks a new frontier in financial abstraction, where not just the interface, but the very process of financial decision-making detaches from human judgment and underlying reality. As algorithms increasingly direct capital—rather than discerning human entrepreneurs with feet on the ground and biological brains in their head—the tenuous link between markets and economic reality fades and hyperreality intensifies.

These days, our beach-lounging hedge fund manager needn’t even tap on his iPad—his army of automated bot traders do all the work back at HQ. Once he’s programmed the bots, they operate autonomously—executing complex strategies and moving vast sums. He can remain blissfully unaware of the minute-by-minute market fluctuations, the cascade of trades, or even the amounts being moved around. The abstraction is complete; the manager now floats in a detached bubble of ignorance and the algos—by embedding themselves into the fabric of financial practice—help encode our Financial Matrix.

From Iron Cage To Digital Matrix: The Map Becomes The Territory

The digitization of finance—and society more broadly—heralds a seismic shift in our construction and perception of reality. Max Weber likened our memetic “world images” to invisible “railway switchmen” that determine the tracks along which society is molded—and ultimately steer the course of history. In our digital age, Weber's concept has taken on new dimensions. Like the Architect in the Matrix, we now possess the unprecedented ability to instantaneously hard code our memetic “world images” into the fabric of reality through apps, algorithms, social media platforms, and search engines.

Once we infuse our digital Sorcerer’s Brooms with a particular ideology—our “railway switchmen” digitally encode a “track” in the Matrix—we reify these memetic worldviews. At the same time, competing alternative memetic tracks are inherently excluded— effectively erased or rendered invisible—not merely from discourse, but from our digitally mediated reality itself. This unprecedented ability to implement ideological worldviews in real time at the societal level—while eliminating alternative worldviews—contributes to a collapsing distinction between ideology, projections based on that ideology, and observed reality.

Computerization has thus allowed us to not only convert our faulty, self-referential analog economic and financial ideologies—such as Keynesian economics and the Efficient Market Hypothesis (EMH)—into the digital world, but to implement them. For example, we can now more easily collect and analyze statistics with the goal of implementing “quantitative investing” or Keynesian-style policies. Digitization has increased market liquidity and reduced transaction costs, aiding and abetting the proliferation of passive and quantitative investing strategies. As a result, memetic ideologies such as Keynesianism and the EMH are now hard coded directly into the Financial Matrix.

Self-Fulfilling Prophecies: When Models Make Reality

The result is a self-referential, self-reinforcing, hyperreal loop: our ideological models generate outputs that influence markets and economies, which in turn appear to validate these models. This creates a system where economic indicators and model predictions don’t just describe reality—they actively manifest it. Our economy and markets appear to operate on Keynesian and EMH principles not because these theories are inherently correct, but because society's economic “operating system” has been rewritten in their image. We’ve created a self-fulfilling prophecy that effectively forces reality to conform to our models. As in the Borges fable, our digital map increasingly supplants the economic territory it purports to represent.