New to the series? Start with our foundational posts on Hyperreality and the Financial Matrix for essential context, or explore the full Table Of Contents.

Part of the Sorcerer’s Apprentice series, originally published privately on January 13, 2021. Updated, revised and expanded for public release on September 12, 2024.

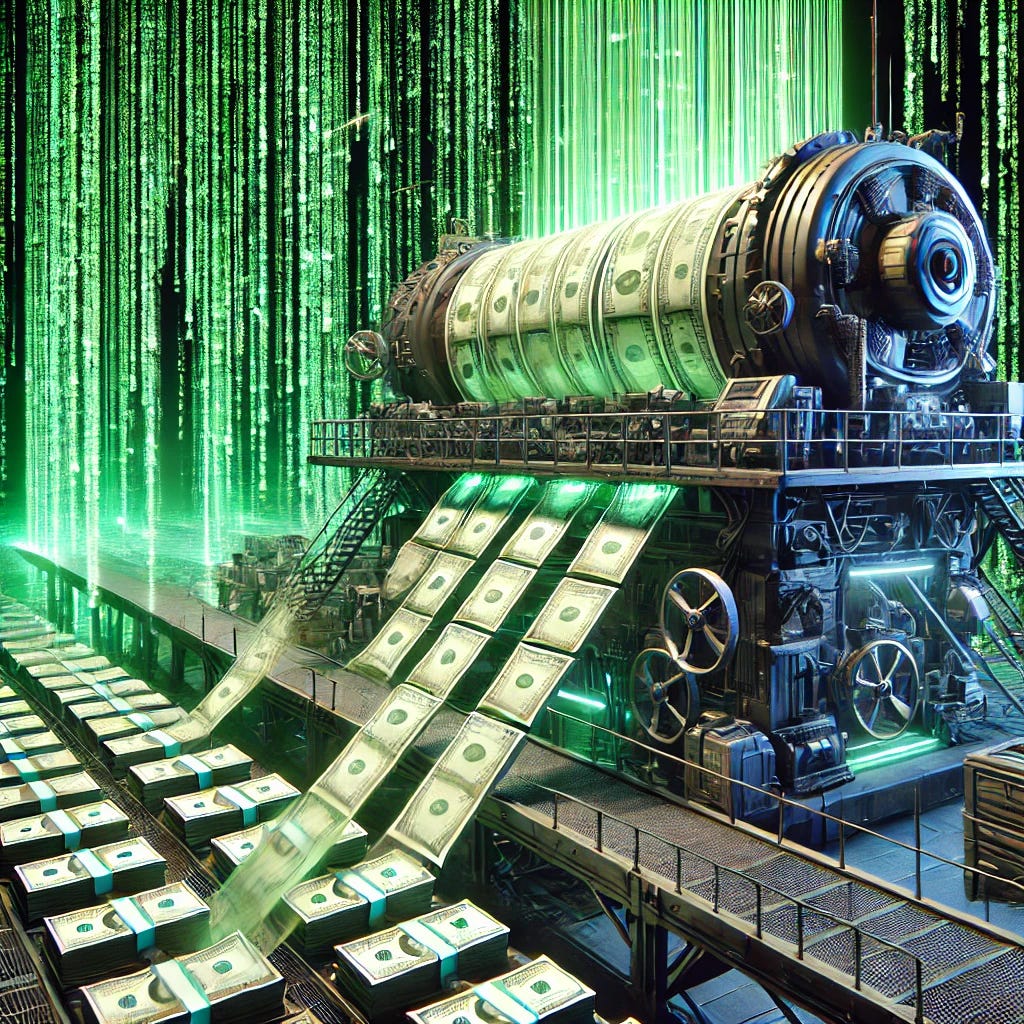

Consecrated by the unholy covenant between money’s metamorphosis and Keynesian doctrine, central banks have emerged as the diabolus ex machina of our global economy— seemingly omnipotent entities that descend upon the financial stage, wielding malefic power to conjure trillions from the ether and “save the world” at crucial junctures. Since the 2008 crisis, these leviathans have established themselves as architects of a new reality—a Financial Matrix—in which they continuously rewrite the economy’s code, warping the fabric of society and propelling us deeper into hyperreality.

Ten Milestones On The Road To Hyperreality

1. The Metamorphosis Of Money

2. Keynes' Kaleidoscope

3. Central Banks’ Money Printer Go BRRRR <== YOU ARE HERE

4. Silicon Shadows: The Digital Detachment Of Economics & Finance 5. The Institutionalization Of Finance

6. The Rise of Skynet: The Algorithmization Of Finance

7. The Symbolic Alchemy Of Risk

8. “We’re All Quants Now”

9. Social Media & “The Ecstasy Of Communication”

10. The Consumerification of FinanceHow pale is the art of sorcerers, witches, and conjurors when compared with that of the government’s Treasury Department!

—M. Rothbard

Money’s Metamorphosis

The monetary magic act commenced in 1971 when Nixon abandoned the last vestiges of the gold standard and birthed our kaleidoscopic monetary system. Global currencies now float in a sea of symbolic paper, their value derived solely from a reserve currency itself untethered to anything tangible. The monetary system is entirely self-referential and circularly dependent. Overnight, the world transitioned to a “fiat standard”.

The Keynesian Spell

Keynes—drawing on Knapp’s assertion that money is defined by government decree—provided the intellectual justification for this new monetary system, advocating that governments actively steer the economy as if it were a car.

Freed from the tether of gold and emboldened by Keynesian theory, central banks and governments began to wield their power with increasing abandon. Keynes’ prescribed policy of money and credit expansion became the “foremost tool in their struggle against the market…a magic wand designed to conjure away [scarcity], to lower the rate of interest or to abolish it altogether, to finance lavish government spending, … to contrive everlasting booms, and to make everybody prosperous.”

Economic Vertigo: The Boom-Bust Hyperloop

The world careened from one boom-bust cycle to another ever since. Each crisis spawned increasingly dramatic financial interventions by central banks and governments as they issued progressively larger amounts of money and debt to paper over systemic flaws exposed by prior busts.

The dot-com bubble—inflated partly by measures designed to counteract the 1997-98 financial crises (which themselves were exacerbated by attempts to bail out the Tequila crisis)—gave way to a housing bubble engineered to cushion its burst.

These interventions amplified the very economic instabilities they aimed to resolve—perpetuating a self-reinforcing cycle of crisis and reaction largely of the central banks’ own making.

2008 Crisis & Diabolus Ex Machina

This volatile pattern continued until 2008, when the global financial system’s insolvency was laid bare—the entire system faced catastrophic collapse, buckling under the weight of colossal liabilities and toxic assets.

Rather than allow the market to naturally purge the gangrenous rot, authorities descended as diabolus ex machina, deploying an arsenal of occult machinations—“liquidity injections”, subsidies, guarantees, quasi-nationalizations, and more—to avert disaster.

With a wave of its regulatory wand, the Financial Accounting Standards Board—under pressure from Congress and backed by the SEC and FDIC—effectively suspended mark-to-market accounting in favor of “mark to myth”. This accounting sleight-of-hand empowered financial institutions to transmute toxic assets into gold, valuing them by their own arcane formulas—effectively making up numbers out of thin air—rather than market prices. Critics whisper that this dark magic truly ignited the 2009 recovery by allowing banks to shroud their dire conditions in a veil of illusory health—weaving another layer of irreality into the fabric of society.

Thus, financial system and State were effectively fused into a golem animated by dark financial sorcery; toxic assets were transmuted into illusory gold.

Crossing The Monetary Rubicon

In the aftermath of the crisis, the money printer’s siren song grew to a deafening roar, drowning out the few voices of dissent. Central banks followed the policy prescriptions of Keynes and “the strange, unduly neglected prophet” Gesell. They attempted to “abolish” interest rates by slashing them to unprecedented lows (ZIRP)—and eventually ventured into negative territory (NIRP). Central bank alchemy—often shrouded in hermetic secrecy—conjured trillions of dollars from the ether; their necromancy reanimated toxic assets and failing institutions.

Each incantation in this esoteric ceremony bore cryptic sigils—from ABCPMMFLF to ZIRP—weaving an intricate economic spell over the global economy while obscuring the true nature and impact of their occult manipulations. Central banks armed themselves with an ever-expanding toolkit of unconventional monetary policies, chief among them Quantitative Easing (QE). By purchasing vast quantities of government bonds and other financial assets, central banks “primed the pump” and “stimulated the economy”. Long after the fact, Dick Fisher candidly admitted that the Fed had effectively “injected cocaine and heroin into the system”:

Central bank policy meetings had for decades resembled séances, where bankers attempted to channel and influence the inscrutable will of “animal spirits”. However, in the aftermath of 2008, these rituals took on an even more mystical and consequential air. The slightest alteration in their arcane incanations—even a change in wording or tone—could send shockwaves through global markets and conjure or banish trillions in market value.

Birth Of The Financial Matrix

It became clear that a monetary Rubicon had been crossed: once detached from tangible constraints on money creation, the system inevitably progressed toward its logical conclusion—unlimited money creation. As the dust settled, Americans found themselves unwitting subjects of an entirely new social and economic order—the Financial Matrix—that preserved much of the façade of a market while gutting what had remained of its substance.

Financial stocks—save for a handful of fallen giants such as Lehman—continued to trade on exchanges. But the financial system—and by extension much of the “real economy”—was de facto quasi-nationalized. While the shift towards a more centrally controlled economy had begun much earlier, this bloodless coup d’état propelled us from the illusion of free markets to outright financial authoritarianism with breathtaking velocity.

“Temporary Measures”

We’ve long since become inured to this state of affairs, which makes it easy to overlook that central banks’ primary communications strategy to legitimize their actions hinged on presenting them as temporary emergency tools. Federal Reserve transcripts from QE2 planning discussions reveal the deliberate nature of this public relations campaign. Dallas Fed President Richard Fisher expressed concerns about potential accusations of debt monetization —a policy outright prohibited in many countries due to its association with loss of faith in the currency and hyperinflation—warning that it could “[raise] its ugly head”.

In response, New York Fed President William Dudley proposed emphasizing the temporary nature of QE measures, thereby distinguishing them from permanent debt monetization in the public eye. Bernanke, too, rationalized this legitimization strategy, asserting that “we are not monetizing the debt because we will be returning our balance sheet to a more normal level ultimately”. Alchemical transmutations were downplayed as mere “asset swaps”—a sleight of hand obscuring the true nature of the exchange: the transformation of no-money into money.

QE Infinity: Permanent Emergency As The New Normal

But as an FT article noted over a decade later, these “temporary interventions” have become permanent and ever-larger fixtures of our society: “The Federal Reserve has gone well past emergency measures and crossed the threshold of ‘QE infinity’”. In Europe, the ECB's Mario “Bazooka” Draghi’s “whatever it takes” authorized even more blatant monetization of government deficits.

The Bank Of England was right to question whether this “medicinal” cocaine had escalated into a “dangerous addiction”. Like an addict, the global economy now relies on regular injections of monetary stimulus merely to prevent withdrawal symptoms and maintain a semblance of basic functionality; each crisis is met by a renewed flood of stimulus—heroin and cocaine. Since the 2008 Crisis, “markets” have effectively remained on economic life support—as Fisher noted, they are being “maintained on Ritalin” in between doses of harder drugs.

Mr. Market’s Schizophrenic Break

As hits of the Quantitative Easing (QE) drug failed to provide the necessary “high”, authorities have been forced to move beyond QE and to create an ever-broadening array of programs—effectively a permanent debasement policy—to support the façade of the Financial Matrix and prevent reality from reasserting itself.

The sheer scale of monetary debasement—particularly during the COVID pandemic—has become so incomprehensible to the human mind that it resulted in a schizophrenic market break that Charlie Munger characterized as “the most dramatic thing that’s almost ever happened in the entire world history of finance”.

Money Printer Go BRRR

The absurdity of this situation has not been lost on the public, leading to a memetic cultural phenomenon that encapsulates the surreal nature of “modern” monetary policy. After fifteen years, virtually all market participants and even ordinary citizens have come to understand this state of play, to the point that it has become an infamous meme:

The modern meme echoes earlier forms, such as those from John Law’s own alchemical experiment and the Weimar era:

Laymen now openly discuss central bank monetary debasement and chase cryptocurrencies in an attempt to outrun its corrosive effects on their wealth. This awareness in the mainstream consciousness signals that the curtain concealing the monetary magic show is starting to lift, revealing the mechanisms behind the illusion to an ever-growing audience.

Hyperreality & The Financial Matrix

While the magic wand of money printing has conjured the illusion of prosperity, this grand deception has eroded the very foundations of our economic and social order. Money is society's operating system; when it loses touch with reality, everything else follows suit. As money has become increasingly untethered from reality since the Crisis, we’ve found ourselves inhabiting a hyperreal Financial Matrix, where “meme magic”, “vibes”, and digital incantations shape our economic landscape and society.

‘Money is society's operating system; when it loses touch with reality, everything else follows suit.’

The money quote

but I don't understand isn't he right when he says money shouldn't be tethered to anything tangible and faith can do the trick??