The Metamorphosis Of Money

Inverse Alchemy: From Real To Hyperreal

“So you think that money is the root of all evil. Have you ever asked what is the root of money?”

New to the series? Start with our foundational posts on Hyperreality and the Financial Matrix for essential context, or explore the full Table Of Contents.

Part of the Sorcerer’s Apprentice series. Originally published privately on January 13, 2021. Updated, revised and expanded for public release on June 26, 2024, with previously omitted content restored for completeness, edits to improve readability, and enhanced graphics.

Money serves as the operating system for society—it stores and transmits value across space and time. This invisible architecture acts as a foundational source of stability, ensuring continuity, cohesion, and coherence within communities. However, the monetary OS has undergone a radical transformation—devolving from its origins as a real, tangible object into a purely hyperreal symbolic system detached from any underlying economic reality.

Like fish unaware of the water in which they swim, we’ve become inured to the monetary system that has silently shaped our economic reality—the only one this generation has ever known. Yet this vast sea of abstract symbols is nonetheless unprecedented in human history.

For the first time, all of civilization is enmeshed in a kaleidoscopic, self-referential global monetary system wherein currencies are valued solely in relation to one another, entirely unmoored from any tangible anchor in the physical world. This monetary abstraction has reached its apotheosis in the digital age—our economic interactions now transpire primarily in a virtual ether, echoing the cyberpunk vision of Snow Crash.

The metamorphosis of money threatens to erode far more than our wealth—it insidiously warps our relationship with the world around us. It upends our perceptions of work, wealth, and worth, dissolves all sense of value, and corrodes our collective grasp on reality. As money loses its meaning and value, so too does everything else: society itself becomes increasingly hyperreal, a shimmering mirage of its former substance. The corruption of society’s operating system has birthed an overarching Financial Matrix—a construct so pervasive and encompassing that it feels as though we are participants in a vast social simulation, the very nature of our existence called into question.

Ten Milestones On The Road To Hyperreality

1. The Metamorphosis Of Money <== YOU ARE HERE

2. Keynes' Kaleidoscope: “We’re All Keynesians Now”

3. Central Banks’ Money Printer Go BRRRR

4. Silicon Shadows: The Digital Detachment Of Economics & Finance 5. The Institutionalization Of Finance

6. The Rise of Skynet: The Algorithmization Of Finance

7. The Symbolic Alchemy Of Risk

8. “We’re All Quants Now”

9. Social Media: Memes, Machines, Man, and Manufactured Reality

10. The Consumerification of FinanceThe nature and history of money is well-trodden territory—a subject that has gained fresh impetus with the advent of cryptocurrencies and been explored with renewed zeal in recent years. However, even for those well-versed in monetary theory and history, the following discourse aims to illuminate the topic through a novel lens, unveiling a fresh perspective: the devolution of money and its role in molding our pervasive hyperreality.

Monetary Metamorphosis Through Baudrillard’s Lens

Stage 1: Tangible Money

Money, at its core, is a tool that individuals acquire as a means of obtaining something else; it enables them to avoid the inconvenience of barter and catalyzes the development of complex economies. It’s a social institution that arose freely and organically—an emergent outcome of countless individual actions within a society.

In its early forms, money manifested as tangible objects—gold being a prime example—coveted for their scarcity, durability, and aesthetic appeal. These inherent attributes naturally elevated such items to the status of most sought-after and easily tradable commodities. Individuals across society voluntarily came to accept them as universal tokens of value—as money.

Stage 2: Symbolic Money

The physical nature of gold presented challenges, however—namely in transportation and storage. To address these issues, people began exchanging pieces of paper that acted as claims on gold rather than the actual gold itself. The paper symbol derived its value solely from two factors: its faithful representation of the underlying object of value (gold), and the public’s trust that those issuing these symbolic claims wouldn’t debase them by creating more claims than their gold holdings could support.

These paper claims were understood at the time to be merely convenient symbols or markers for the “real thing” (gold)—they were accepted purely by virtue of their convertibility into physical gold money. As a result, transactions no longer required the exchange of the actual thing of value: the symbol itself now acted as money. This shift to symbolic currency fundamentally altered the nature of money, laying the groundwork for increasingly abstract representations of value—and setting us on the path towards monetary hyperreality.

Stage 3: The Corruption Of Symbolic Money

The system of gold-backed paper money persisted until governments abandoned it out of expedience, primarily to remove restraints on their ability to finance guns and butter. European nations left the gold standard to finance World War I, and the United States followed suit during the Great Depression.

The War’s devastation extended far beyond the immense human toll—it eviscerated the entire international economic, legal, and monetary order. The major powers suspended convertibility of their currencies into gold shortly after hostilities commenced, enabling the protraction of an otherwise financially untenable conflict. Had they remained “crucified upon the cross of the gold standard”—and been forced to finance the war solely through tax receipts—the conflict would likely have been constrained to a much smaller scale and forcibly concluded in a fraction of the time.

When peace was finally restored four years later, the Pandora’s box of symbolic monetary abstraction had been irrevocably opened. The gold standard was now just another malleable institution that could easily be discarded to suit political ends. The logic was seductive: if it could be set aside for war, why not for peacetime prosperity? Faced with the choice between painful liquidation of uneconomic investments that had mushroomed to feed the war effort and the allure of inflation, politicians predictably chose the latter.

Rather than return to the gold standard, the leading nations adopted an inflationary compromise—a so-called “gold exchange standard” that preserved the old form but gutted its substance and wore its carcass as a skin suit. The gold exchange standard represented the second fundamental shift in the nature of money, effectively dissociating the symbol (paper) from the underlying thing of value (gold).

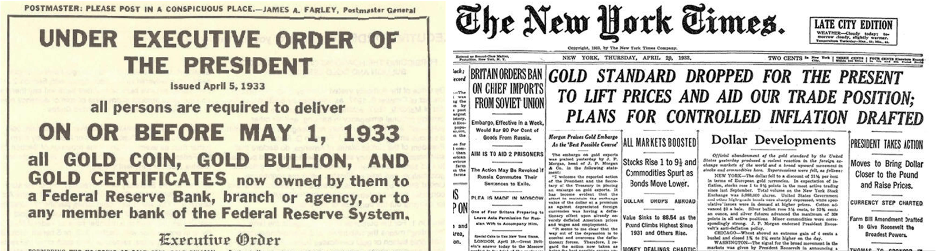

President Franklin D. Roosevelt’s (FDR’s) unprecedented actions during the Great Depression entrenched and advanced this monetary transmutation. In 1933, FDR issued an executive order confiscating citizens’ physical gold, and Congress abrogated the gold clauses in public and private contracts that had previously allowed creditors to demand payment in gold—effectively removing protections against currency devaluation.

The following year, FDR enacted the Gold Reserve Act of 1934, triggering the 20th century’s first technical US sovereign default by breaching contractual obligations, even though the government continued to make interest payments. The Gold Reserve Act officially ended the domestic gold standard—the government reneged on its promise to allow citizens to redeem paper currency for gold. Foreign governments, however, still retained the ability to redeem paper for gold.

By forcibly confiscating citizens’ gold and unilaterally rewriting the contractual underpinnings of the monetary system, FDR had eliminated public protections against currency devaluation. Now free to act, he significantly devalued the dollar against gold, and launched a special executive program through which he would personally steer the gold price—bizarrely, from his bed while eating breakfast, and as his advisers looked on. Even more absurdly, he set the price using numerology as his guide:

One morning, FDR told his group [of advisers] he was thinking of raising the gold price by twenty-one cents. Why that figure? his entourage asked. ‘It’s a lucky number,’ Roosevelt said, ‘because it’s three times seven.’” As [Treasury Secretary] Morgenthau later wrote, ‘If anybody knew how we really set the gold price through a combination of lucky numbers, etc. I think they would be frightened.’”

FDR’s arbitrary approach to monetary policy was so ludicrous that South Park’s later satire of the 2008 bailouts seems almost tame by comparison. In the episode, critical financial decisions are made by a decapitated chicken running on a game show-style board at the U.S. Treasury, while officials play kazoo music. The chicken’s random movements determine whether to bail out failing companies, and billions of dollars are allocated based on where the headless bird collapses.

By declaring unbacked paper money “legal tender”—meaning it must be accepted as payment for all debts—and simultaneously banning private gold ownership, FDR fundamentally transformed the nature of US currency for its citizens. His sweeping edict effectively severed the direct link between US dollars and gold domestically, radically redefining the relationship between monetary symbols and the real assets they were intended to represent. No longer was paper currency merely a convenient representation of gold; it had become the thing itself—an entirely self-referential symbol. The dollar now derived its value not from the physical commodity that it represented, but via governmental decree.

FDR removed key constraints on money creation and paved the way for increasingly abstract, symbolic forms of money. The inflationary potential unleashed by this shift would over time propel us into our current hyperreality and set the stage for the Financial Matrix—wherein such symbols could proliferate endlessly, unmoored from any underlying reality.

“Nixon Shock” Ends Gold Standard

In 1971, Nixon completed FDR’s transmutation of money by severing the sole remaining link between the symbolic representation of gold and gold itself. Even after FDR had deprived US citizens of their gold and their ability to use it as money, foreign governments had still retained the ability to redeem their dollars for gold. Nixon’s decision to “close the gold window” eliminated this final anchor—paper currency unbacked by anything tangible became the seemingly valuable entity in and of itself.

The US dollar’s status as the global reserve currency meant that Nixon instantly transmuted not just American money, but the entire international monetary system by extension. While many individual countries throughout history had abandoned gold for paper currency—with disastrous consequences—this was the first time such a transformation occurred simultaneously worldwide.

Overnight, the world transitioned to a “fiat standard”. Nixon’s abandonment of the last vestiges of the gold standard birthed our kaleidoscopic international monetary system—one that is entirely self-referential and circularly dependent. Every nation’s currency—once directly or indirectly anchored to gold—now floats in a sea of symbolic paper currencies deriving value solely from a reserve currency itself untethered to any tangible asset.

Money has become a pure abstraction, supported only by two other abstractions—law and faith—rather than anything tangible. It functions as money not through voluntary adoption, but by legal decree—the law compels its use as money, and we therefore collectively ascribe it utility and value.

Today’s currency thus bears little resemblance to traditional money. What we now call a “dollar” is actually a Federal Reserve Note—a promissory note issued by our central bank. The cryptic language and symbols adorning the notes in our wallets reflect the abstract, self-referential nature of modern currency—the notes don’t promise to pay us in gold or anything tangible, but rather in more notes of the same kind. The US currency is a circular liability that can never be truly liquidated or redeemed, and all other world currencies are, in turn, anchored to this circular construct.

This monetary metamorphosis has created a system in which the map has not just replaced the territory—it has become the territory. Monetary hyperreality laid the foundation for our entire hyperreal edifice—including the Financial Matrix, wherein financial symbols and abstractions increasingly dominate and distort the underlying economic reality they ostensibly represent.

Stage 4: Hyperreal Money

The purely symbolic—yet still tangible—paper currency of yesteryear has reached its apotheosis in the digital age, taking the abstraction of money to its ultimate logical conclusion and completing the inverse alchemical process: from gold, through paper, to virtual 0s and 1s. Money now exists as a pure simulation, as Baudrillard would say—insubstantial tokens floating around in the virtual ether.

The metamorphosis of money finds its most candid expression in Ben Bernanke’s “helicopter money” speech and Modern Monetary Theory (MMT)—frighteningly candid acknowledgments that money has become a pure abstraction with its own self-referential value and reality that can be created in infinite quantity. The idea has so thoroughly permeated popular culture that it has spawned a well-known meme with its own dedicated website:

As Adam Ferguson noted in When Money Dies, the astronomical volume of currency printed during past inflations such as the Weimar hyperinflation was constrained primarily by the physical limitations of printing presses, the availability of materials, and the exhaustion level of workers:

The Reichsbank had proclaimed, and was now carrying out, a programme of unlimited printing of [money] notes. More and more printing presses were employed for the work, and by December the amount issued was limited only by the capacity of the presses and the physical fatigue of the printers… the unissued paper marks then in the hands of the Reichsbank and its branches would have filled 300 ten-ton railway wagons…The running of the..note-printing organisation…is making the most extreme demands on our personnel… The dispatching of cash sums must, for reasons of speed, be made by private transport. Numerous shipments leave Berlin every day for the provinces. The deliveries to several banks can be made...only by aeroplanes.

At one point during the hyperinflation, the value of the paper money was worth less than the cost to produce it:

…in order to produce low-currency notes far more working time was required by paper-makers, engineers, printers, lithographers, colour experts and packers than was represented by the value of the finished article.

Unlike the Reichsbank’s physical printing presses—which were at least minimally constrained by materials, logistics, and labor—Bernanke’s infamous “printing press” is purely metaphorical, its supply of digital “ink” virtually limitless and costless. Now, a mere keystroke can conjure infinite currency instantaneously by altering a few digits in a virtual ledger—a process so frictionless and abstract it leaves no physical trace.

With this digital power, modern Federal Reserve chairs and financial policymakers can instantly move billions or even trillions of dollars, potentially making decisions as capricious as those guided by FDR’s numerology or South Park's headless chicken—but with far greater reach and speed. The immaterial nature of these transactions also introduces unprecedented opacity: oversight of the true money supply becomes far more challenging than in the era of physical currency, as changes can now occur with minimal tangible evidence.

The ease of digital currency creation has granted central banks hitherto unfathomable power to manipulate markets and economies and obliterated nearly all limits on government spending and debt—laying claim to an ever-growing share of wealth and labor while simultaneously eroding the public’s ability to grasp the true nature and scale of these very interventions.

The degree of debasement surpasses our cognitive limits—we are simply not wired to intuitively grasp or compare the difference between billions and trillions. Nobel Prize-winning physicist Richard Feynman once quaintly remarked in the 1980s that:

There are 10^11 stars in the galaxy. That used to be a huge number. But it’s only a hundred billion. It’s less than the national deficit! We used to call them astronomical numbers. Now we should call them economical numbers.

One can only imagine what Feynman would say about 2020’s deficit and Quantitative Easing (QE). Nowadays, we not only casually throw the term trillion around, but—as Dan Morehead recently observed—in 2020 we took on two centuries of debt in one month! The US budget deficit in June 2020 was larger than the total debt incurred from 1776 through the end of 1979; “with that first trillion we defeated British imperialists, bought Alaska and the Louisiana Purchase, defeated fascism, ended the Great Depression, built the Interstate Highway System, and went to the Moon.”

According to Bank of America, the big four central banks in aggregate have been injecting liquidity at a rate of $1.4 billion per hour! A friend recently quipped that the title of the TV show Billions “doesn’t even make sense anymore”.

“A New Bretton Woods Moment”

Today’s monetary system would be utterly unrecognizable to people living 100 years ago. Government-issued currency—now mostly replaced by digital bits—has been considered money for the adult lifetimes of nearly everyone alive today. This false sense of permanence makes it easy to forget that our monetary order has only existed for a little over a generation—a mere blink of an eye in the context of millenia of monetary history. There are many compelling reasons to believe that a new monetary system is on the horizon; however, there is little reason to believe that a future monetary system will resemble today's in any way.

The digitization of fiat money has enabled the distortion of economic reality to such a hallucinatory degree that the world now resembles a real-life version of Snow Crash. Since the 2008 crisis, central banks have so blurred the line between real and fake money that they inadvertently catalyzed the creation of a new, parallel monetary system beyond their control—a virtual set of digital currencies resembling those previously found only in video games or Snow Crash’s fictional Metaverse.

Even now the IMF is calling for a “New Bretton Woods Moment”—another reshaping of the international monetary system—suggesting that central planners recognize the instability of the current system and are devising strategic solutions. Central Bank Digital Currencies (CBDCs) appear to be their weapon of choice—a Franken-Fiat creation for the digital age that would only amplify the worst aspects of the current hyperreal system and create altogether new problems in the process.

The illusory permanence of today’s financial order is crumbling, and we stand on the cusp of a monetary revolution. The future is unwritten, but battle lines are already being drawn between centralized fiat CBDCs, decentralized cryptocurrencies, and gold in what promises to be the defining monetary conflict of the 21st century—one that will ultimately determine the fate of the hyperreal Financial Matrix and, by extension, our own.

guys, thi s is a great work... i just discovered it... giv em esom etime to go through it...

just seen this and wooow

eating it all up