The Symbolic Alchemy Of Risk

The Great Mirror Of Folly

The tectonic plates are shifting. Geopolitics…the global economy itself... All of that is in flux….Then there’s our national debt. I think this time is different…we have to get our act together and we have to do it very quickly. [If not] we will no longer be the world’s reserve currency. That’s a fact—just look at history."

Jamie Dimon discussing Multiflation, CNBC, May 30, 2025

The spell is breaking; after decades of illusion, financial reality is beginning to reassert itself and the shifting ground beneath our civilization is now impossible to ignore. Multiflation is here—a historic reordering of the global socioeconomic system that will define the coming decade.

Despite the “Mandate of Heaven”—Trump's presidential victory, Republican control of both the House and Senate, and bipartisan support for fiscal responsibility—the government has failed to reduce its deficit by even a single dollar, prompting another US Treasury downgrade:

The much-heralded fiscal strategy—tariffs to drive revenue and growth, AI-driven efficiency through DOGE for expense cuts—appears to have collapsed at first contact with political reality. Such fiscal recklessness—not only in the US, but amongst nearly all developed nations—sets the stage for the dénouement of the greatest monetary experiment in the history of mankind—the final act of an economic drama whose prologue played out in Versailles three centuries ago.

The following was originally published privately on January 13, 2021. Updated, revised, and expanded for public release on June 8, 2025. New to the Sorcerer’s Apprentice series? For essential context, start with our foundational chapters on the Financial Matrix, Hyperreality, and The Flight Into Fake Values, or explore the full Table Of Contents.

Receive our latest insights on X/Twitter here.

Not investment advice. For educational/informational purposes only. See Disclaimer.

Ten Milestones On The Road To Hyperreality

1. The Metamorphosis Of Money

2. Keynes' Kaleidoscope

3. Money Printer Go BRRRR

4. Silicon Shadows

5. The Rise of Skynet: The Algorithmization Of Finance

6. The Institutionalization Of Finance

7. The Symbolic Alchemy Of Risk <== YOU ARE HERE

8. “We’re All Quants Now”

9. Social Media, Memes, & Machines

10. The Consumerification of FinanceThe Philosopher’s Stone

Is it reality? Is it a chimera? Has half the nation found the Philosophers Stone in paper mills?

—Voltaire, writing about John Law’s Mississippi Bubble

Alchemists of old sought the Philosopher's Stone—a mythical substance capable of turning base metals into gold. But John Law—the audacious Scottish exile who first caught the eye of French nobility in an 18th-century Parisian gambling den—would later show the royal court something far more powerful, and stake the entire kingdom on his grand bet.

Through his Mississippi Company, Law was granted control of the kingdom's fiscal and monetary apparatus. Some consider Law to be the world's first proto-Keynesian, because he argued that metallic money was unreliable, and—like modern economists who compare the economy to a car—that credit issued and managed by a proto-central bank would remove the “brakes” on the economy.

Law’s ‘System’ issued state-backed paper money, monetized government debt, exerted control over minting, influenced taxation, and attempted rudimentary monetary policy—making it the first fusion of central banking, fiscal authority, and financial alchemy in European history; in the process he created a collective fever dream that held the nation spellbound.

The delirium transcended national boundaries: the years 1719-1720 witnessed intertwined financial bubbles across France, England, and the Dutch Republic. The fever finally broke in arguably the world's first international stock market crash—one whose economic shockwaves reverberated across Europe for decades to come.

In England, a ballad captured the fervor surrounding the South Sea Company:

In London stands a famous pile, And near that pile an Alley,

Where merry crowds for riches toil, And wisdom stoops to folly.

’Tis said that alchemists of old Could turn a brazen kettle,

Or leaden cistern into gold; That noble tempting metal.

Our cunning South Sea like a god, Turns nothing into all things…

Few Men, who follow Reason’s Rules, Grow fat with South Sea Diet,

Young Rattles and unthinking Fools Are those that flourish’d by it.

Five hundred Millions, Notes and Bonds, Our Stocks are worth in Value,

But neither lie in Goods or Lands, Or Money let me tell ye.

Yet tho’ our Foreign Trade is lost, Of mighty Wealth we Vapour;

When all the Riches that we boast Consists in Scraps of Paper.

Where Paris’s Rue Quincampoix was engulfed by Law’s Mississippi Bubble frenzy, London’s Exchange Alley—referenced in the ballad above—served as the beating heart of South Sea speculation.

Exchange Alley was the proto-physical equivalent of Bloomberg Terminal, Instant Bloomberg chat rooms, r/WallStreetBets, the London Stock Exchange, and Robinhood combined—all rolled into a handful of rowdy coffee houses like Jonathan’s. Equal parts trading floor, rumor mill, and theater, these cafés functioned as unofficial stock exchanges where traders, merchants, and opportunists shared tips, fueled speculation, and chased get-rich-quick schemes.

Broadsheets like Castaing’s tacked to walls listed breaking news and stock prices; rumors, tips, and speculation passed hand to hand or table to table; and deals were struck on the spot amid the din. That included not just shares, but also informal options ("time bargains") and forward contracts—early derivatives used to bet on future movements in stock prices or commodities.

The alley attracted a mix of insiders and eager amateurs, and the action was driven less by fundamentals than by frenzied appetite for risk—the FOMO/YOLO of its day. Merchants, clergymen, and farmers with mud still on their boots piled into the action at these “penny universities” centuries before meme stocks had a name.

There was even a proto-SPAC boom—infamously satirized by “a company for carrying out an undertaking of great advantage, but nobody to know what it is”. Capital flooded into ventures with no clear business—just lofty claims and “vibes”—driven by the same blind faith in promoters and upside that fuels modern “blank-check” manias.

While the Dutch Republic experienced its own speculative fever—a windhandel, literally, “wind trade”, because investors were essentially buying and selling air—it was more restrained than the full-scale national manias that gripped France and England, and less economically damaging than its counterparts.

The Great Mirror Of Folly

Artists and satirists of the era, stunned by the onset of this pan-European collective madness, created The Great Mirror of Folly—a compendium of satirical writings and engravings—as a "warning for posterity". It was their attempt to make sense of the hyperreality of the transnational "share, bubble, and wind trade in France, England, and the Netherlands," and to ensure history would not repeat itself.

The reason we turn to The Great Mirror of Folly—and the reason it remains so compelling—is that it transcends its early eighteenth-century origins to illuminate universal patterns of human behavior. True to its name, it provides a mirror through which to understand our own contemporary folly, revealing the same patterns within our own Financial Matrix.

The Witches’ Sabbath

Today, economic historians typically argue that asset bubbles arise when prices exceed their fundamental value, often driven by “irrational exuberance”. The Great Mirror of Folly, however, offers a more textured, allegorical critique. Rather than focusing solely on what Mackay later called the “madness of crowds”, it satirizes a world enchanted by illusion and chronicles the dissolution of society through financial alchemy.

The Folly collection's genius lies in its recognition of society's descent into hyperreality—where symbols supplant the substance they were supposed to represent, leaving citizens as disoriented as Alice in Wonderland. It echoes Thomas Mann's short story that we explored in The Flight Into Fake Values: just as Mann saw the Weimar hyperinflation as a “a witches’ sabbath that vanished, leaving nothing behind it but headaches and regrets”, Folly drew from a shared vocabulary of the diabolical—invoking witches, Mephistopheles, Baal, and the Devil:

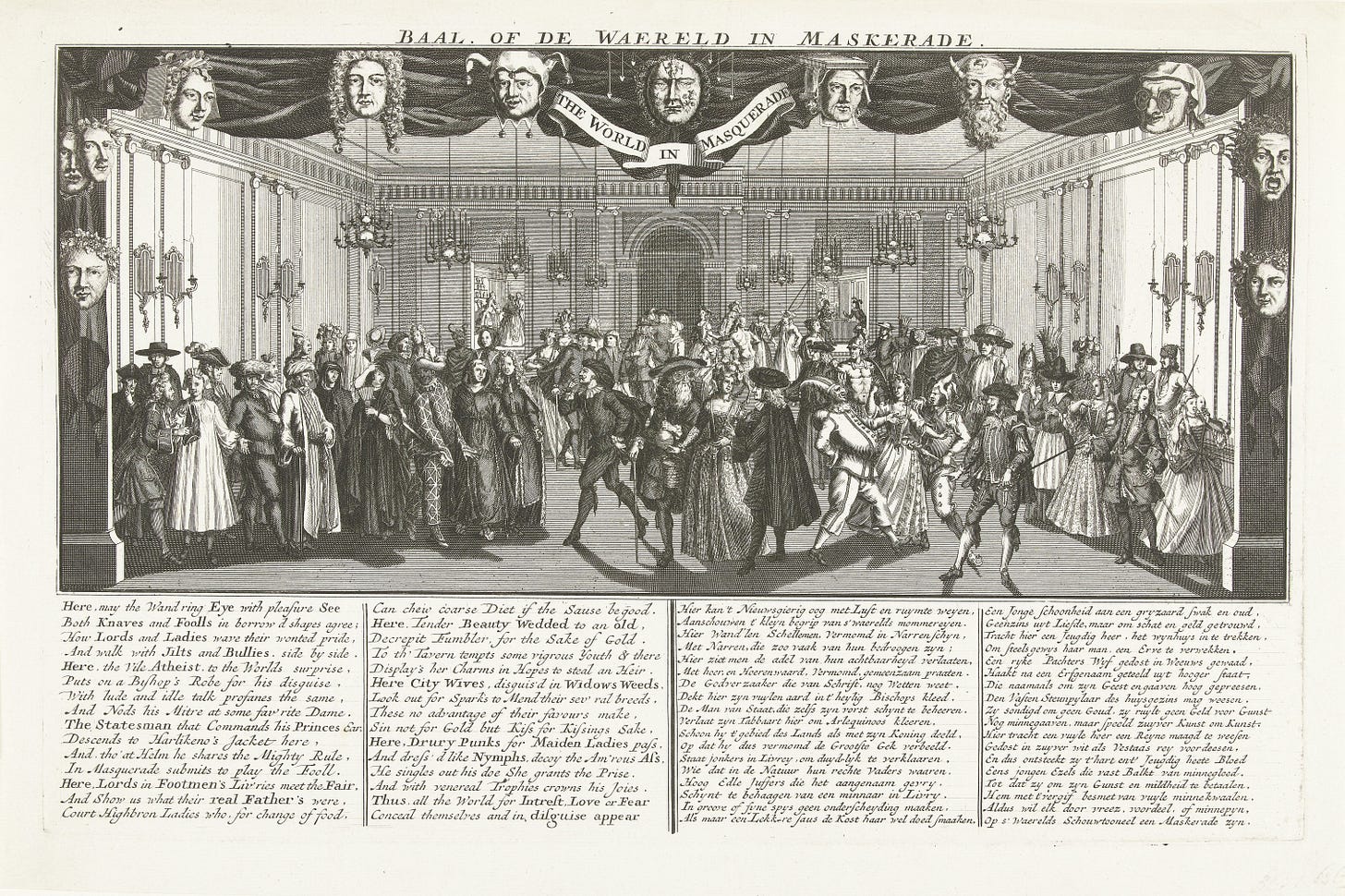

Baal, or The World in Masquerade searingly depicts the original Financial Matrix: a society turned upside down, where folly parades as wisdom, and vice wears the robes of virtue. The image unfolds in a grand ballroom teeming with revelers, each a symbolic archetype of societal inversion and moral collapse. Every station of society is represented, cloaked in illusion and deceit; atheists masquerade as bishops, courtesans don the mourning garb of virtuous widows, swindlers parade as noblemen and sages. Presiding over this corrupted pageant is Baal, the demonic patron of false appearances and moral inversion.

Folly delivered a profound critique of prevailing economic 'reason', revealing how contemporaries understood society’s enchantment not so much as bubbles fueled by “irrational exuberance”, but as fractures in reality itself.

Here one sees with the eye of understanding / Life as a wide hall full of illusions…

But when the masks are off, the game is over, / Then the world, and the turmoil, is mourned.

A witness to the chaos described how under Law’s System—like our current hyperreality, and the one described by Thomas Mann—ideas and words themselves seemed to lose all meaning:

By an all new secret magic, words assembled…that no one comprehended, and the air was filled with obscure ideas and chimeras.

As one contemporary observer noted, constant changes of monetary values and reversals of policy had produced "the desired effect, that of so upsetting all principles, obfuscating all lumieres [i.e., enlightenment, reason], changing all notions [established ideas or shared understandings], that one no longer knew what to hold on to [what beliefs, values, or frameworks remained stable or trustworthy]."

Symbolic Alchemy & Memes

Alchemical imagery saturates these works, alluding to the severing of some essential bond between representation and reality. Folly documents a society lost in delusional reverie—bewitched by enchanted paper, seduced by symbols, signs, and memes. The collection's most penetrating insights emerge from its recognition that financial alchemy operates not just on financial instruments and risk, but on human consciousness itself; what begins as financial alchemy evolves into something far more profound—a rehaping of collective consciousness that alters how whole societies conceptualize themselves and the world around them.

The Mirror's creators implicitly understood that this was an epidemic outbreak of what we would now call "memes"—speculative viral ideas that found their ideal growth medium in a financial system creating claims to wealth out of thin air. The core insight remains constant across centuries: when societies believe they can conjure wealth through symbolic alchemy—whether Mississippi Company shares, houses, mortgages, ETFs, private equity, private credit, or memecoins—when they sell vibes and memes to one another in ever more elaborate circular exchanges, the consequences extend far beyond financial markets to upend society itself.

Symptoms of this epidemic abounded. Securities and financial jargon transformed into mystic talismans; exchanges became fairgrounds of fraud (or, as Le Shrub so eloquently puts it, the “Golden Age Of Grift”) and carnivals of deception; the masses, spellbound—like the cartographers in Borges’ story—traded reality for theater, substance for spectacle in a grand “Masquerade” of illusion.

Arlequin Actionist

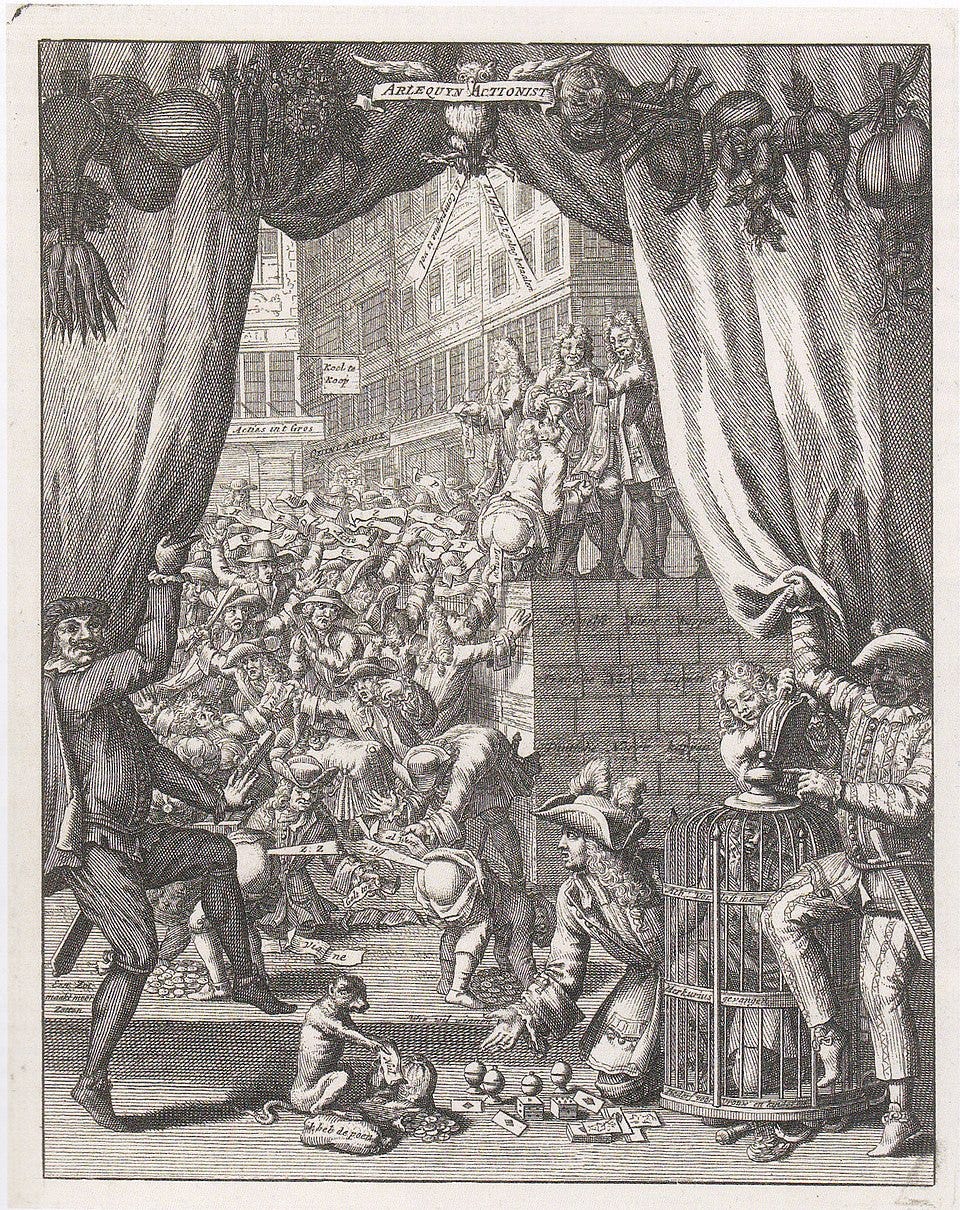

Central to this theme of illusion in Folly was the idea of creating value from "nothing." Law's banknotes and company shares seemed to conjure "unfathomable riches" from the transmutation of air into treasure:

Behind theater curtains that underscore the hyperreality of the scene, John Law and stock promoters are feeding gold coins to a man through a funnel. In an inverted alchemical process, the squatting man then expels excrement—papers representing “wind” or speculative schemes into the eager hands of the crowd below.

This scatological act is a crude but powerful way to show their utter worthlessness and the deceptive, fraudulent nature of the entire enterprise, transforming real money into literal waste. The print also features other figures explicitly "breaking wind" labeled “South Sea” and “Mississippi”. An owl—traditionally a symbol of wisdom—perches solemnly between curtains, but subverts expectations by passing gas in the form of a banner declaring "Actie zonder Waarde" ("Shares without value").

Over three centuries later, the mechanics remain intact—only now the expelled wind has a ticker symbol and is listed on major crypto exchanges:

Monopoly Of Winds

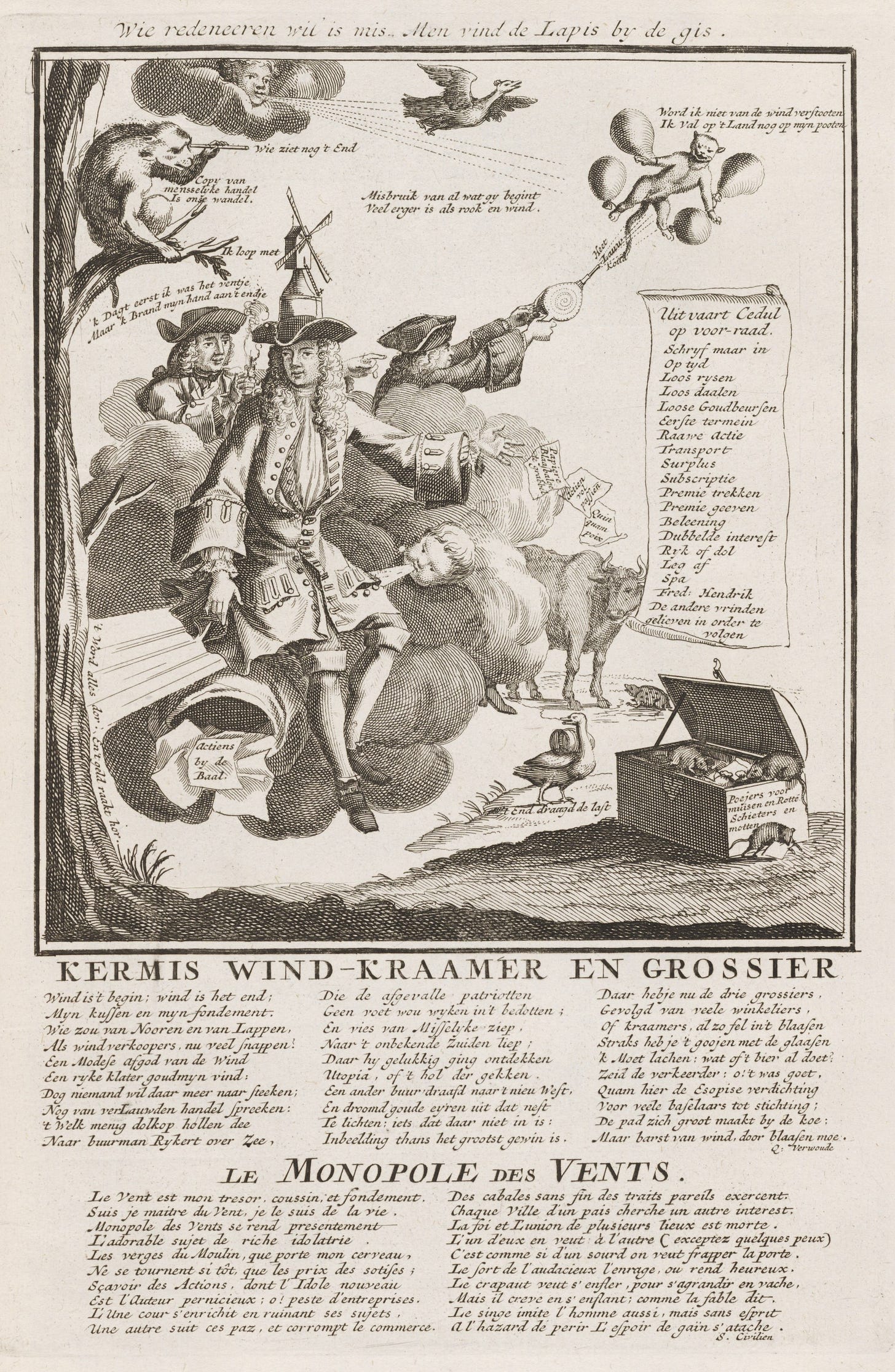

“The Monopoly Of Winds”, too, bitingly satirizes the wind trade:

At the heart of this scene stands the central figure, a lavishly dressed “wind-merchant”: an allegorical personification of both John Law himself and the grand illusion he so skillfully wove. The windmill crowning Law's head marks him as a "project maker"—someone akin to “Helicopter Ben” and “JPOW” who could conjure apparent wealth from nothing but "wind, a promise, a plan.”

The windmill, used to manufacture paper at the time, visually represented the entire "wind trade"—the creation of paper financial instruments from nothing, which were then inflated into a speculative bubble by its spinning blades blowing hot air.

Much like modern memes featuring The Bernank showering paper dollars from helicopters, or anime girls gleefully dancing before Powell/Kashkari’s roaring money printers—satirizing modern monetary excess with the phrase “Money Printer Go Brrr”—Folly used humor as a scalpel, cutting through the alchemical abstractions of finance to reveal their underlying absurdity.

In Monopoly of Winds, Law is perched precariously on a swirl of ethereal clouds blown by an angel, quite literally trafficking in air as he dispenses worthless share certificates and prospectuses. Speculators cry "Grab it, I have it!" and recite the proto-YOLO gambler's motto "Who dares nothing, wins nothing." "Shares by Baal" condemns the speculative frenzy as both financial idolatry and a total inversion of moral and economic order. Behind Law, a man holds a candle that burns his fingers, representing the consequences of the risky speculation.

Symbols & Shadows

The accompanying sardonic inscription, "He who tries to reason is led astray. One finds the Philosopher’s Stone only by speculation and chance," equates the pursuit of wealth through speculation with the alchemist's elusive dream and—like the South Sea Ballad—highlights the futility of any rational approach in such a hyperreal environment. The chaotic, irrational scene depicted is, paradoxically, the "correct" way to understand and navigate this new financial world, a lesson that resonates across centuries, as evidenced by this infamous tweet:

Beneath the Monopoly engraving, a poetic indictment unfolds:

The wind is my treasure, cushion, and foundation.

Master of the wind, I am master of life,

And my wind monopoly becomes

Straightway the object of idolatry.

I manipulate symbols and shadows,

Making the foolish see riches in clouds.

I inflate bubbles, so light yet so tall,

And with every gust, the gullible fall.

This is the secret: I sell illusions,

And buyers thank me for their delusions.

The wise man keeps his coin inside—

The fool sees gold in every tide.

The game is chance, the hope is gain,

But all is wind, and loss, and pain.

The Maestro

The Monopoly Of Winds can be understood as a mock-apotheosis. Whereas traditional apotheosis scenes depict heroes or rulers ascending to godhood, often amidst clouds and divine attributes, here Law's elevation is not to a divine realm but to a kingdom of air and illusion. The "[stock] shares full of calamities" are a perversion of divine blessings or royal largesse.

This satirical enthronement highlights the illusory nature of Law’s financial "System" and critiques the "mass idolatry" that had, for a time, elevated him to a position of immense power and perceived financial wizardry. The satire thus targets not only Law's schemes but also the public credulity that enabled them—a credulity we see repeated today in the mythologizing of modern central bankers like Greenspan, Bernanke, Powell, Lagarde, and Draghi, whose financial alchemy is similarly sanctified by contemporary media:

Bestiary Of Folly

Surrounding Law is a bestiary of allegorical animals and figures, each embodying a particular human folly or corrupting influence within the chaotic carnival of illusion. Perched in a withered tree, a monkey observes a flying cat through a telescope—a parody of human analysts futilely tracking speculative assets. The rhetorical question “Who can see the end?” hovering above the monkey's head emphasizes the folly involved.

The cat floating on balloons is the avatar of Fartcoin-like inflated assets, while the man blowing air through bellows symbolizes the forces that artificially inflate them. The duck bearing a barrel approaching the chest of speculative papers is a Dutch pun symbolizing the public left carrying the financial burden after the collapse of the bubble; the phrase beneath it, “Eend draagt de last” (“the duck bears the burden”), marks an early visual metaphor equating the duck with the bagholder of the bursting bubble economy.

Mice crawl over the papers, signifying the presence of deceit, fraud, decay, corruption, and the insidious undermining of value—suggesting that the paper assets are not only worthless but also tainted by fraud.

Behind the chest, a toad confronts an ox—a nod to Aesop's fable where a toad puffs itself up to match an ox's size—symbolizing overambitious speculators who inflate themselves with false promises and empty assets, vainly attempting to rival genuine wealth.

Proto Meme Ledger

To the right of Law in Monopoly floats a scroll that operates as a proto-meme ledger, mocking the inventory of financial jargon—such as options trading and promises of outsized yield—that fueled the speculative delirium. Markets had been reduced to carnival barking—where fortunes were made not by selling substance, but by hawking abstract financial symbols and manipulating memes and jargon.

The Monopoly of Winds feels startlingly contemporary. Replace Law's floating papers with modern financial jargon, and the result would be an equally apt satire of today's financial theater. Much like today's memes and financial buzzwords—ETFs, 0DTEs, the “bankruptcy bubble”, memecoins, Apes, SPACs, yield farming, Quantum Computing, CLOs—often sell “hot air” by wrapping it in convincing language and memes to create the illusion of sophisticated investment opportunities. The set pieces may have evolved—from windmills to “Money Printer Go Brrr”, “Number Go Up”, and 🚀 rocket ship emojis—but the underlying dynamics remain remarkably consistent.

Money Magician

The ideas that financially destroyed France would metastasize. Refined and reimagined over time, they eventually became the foundation of modern money and finance. Writing in the 1940s—long before Quantitative Easing made “Money Printer Go Brrrr” a meme—John T. Flynn had even then recognized in Men Of Wealth: Money Magician how thoroughly our own society had absorbed Law’s alchemical teachings:

John Law exploited the eagerness of men to grow rich by making their profit, not in producing goods or creating utilities, but gambling on the changes in the price of investment certificates. He perceived also the uses of the bank as an instrument for creating an immense reservoir of savings funds as well as an instrument for actually manufacturing money—bank credit.

It would be a long time before the full possibilities of these weapons would be realized by the acquisitive man. Indeed it would not be until our own time that this would be done. But it has been done…

Oddly, two hundred years after John Law, the gambler-philosopher, wrought upon society, one may see everywhere the…fruits of his brief adventure permeating our whole economic edifice…If you would see his monument, look about you.

But even Flynn and Law could not have imagined how far beyond those primitive French monetary conjurations the world would venture. Today's central bankers and financiers have truly perfected Law's dark arts, weaving transmutations that would have left even that master alchemist speechless.

Where Law wielded crude paper instruments, our modern Sorcerer’s Apprentices conjure digital money from the ether with a keystroke; ETFs, trading algos, and derivatives then spawn like self-replicating incantations, cascading endlessly through markets with the relentless determination of Mickey's enchanted brooms—automatically amplifying and channeling this conjured "wealth" until it weaves itself into a vast Financial Matrix that pulses beyond Mickey’s control.

What medieval mystics sought in their Philosopher's Stone pales before this achievement: we stand witness to the most brazen monetary experiment in human history, one that reduces John Law's Mississippi Bubble to a quaint provincial sideshow.

Next: The Symbolic Alchemy Of Risk Part II: Metastasizing Monetary Mirage

From Versailles to the Eccles Building—how Law's symbolic alchemy became the foundation of modern finance.

Damn, I should’ve bought Fartcoin back in ‘21. 1721

Brilliant thank you for sharing your thoughts