Silicon Sorcery: Code’s Captive Markets

The Rise of SkyNet: The Algorithmization Of Finance Part VI

New to the Sorcerer’s Apprentice series? For essential context, start with our foundational posts on the Financial Matrix, HyperPrices, and Hyperreality, or explore the full Table Of Contents.

Imagine a world where AI weaves the fabric of commerce, spinning prices from the threads of data like a cosmic loom, rendering human concepts of “expensive” and “cheap” obsolete. Here, prices exist as mere numerical hallucinations from the digital dreamscape of ChatGPT: abstract ethereal digits untethered from reality.

This isn't science fiction—it’s emerging reality. Algorithms have infiltrated financial markets, creating HyperPrices detached from economic reality:

Skynet Part I introduced these HyperPrices through a thought experiment set in an imaginary Costco.

Part II revealed that HyperPrices already exist in our world—from a $24 million Amazon book to a chaotic Christmas penny-pricing debacle.

Part III established that Skynet is already online in the financial markets, and humans are in retreat. Algorithms now dominate our financial markets—from simple “passive” index funds to the cutting edge AI wielded by quant hedge funds.

Part IV exposed how tradebots generate anomalous behavior such as flash crashes.

Part V explored how Skynet is increasingly creating a self-referential price system.

Now we pierce the veil: the chaotic flash crashes and price spikes we've explored are merely the visible ripples atop the surface of a more pervasive phenomenon. Underneath, Skynet is not only generating the occasional artificial chaos of flash crashes, but rather continuously weaving an artificial order throughout the markets—a constant, subtle restructuring of financial reality itself.

Most of the time, this manifests as an eerie stability, yet this very stability breeds instability. When one thread in the algorithmic tapestry snaps—perhaps from nothing more than the mounting tensions that emerge from countless algorithms weaving among themselves—the whole fabric unravels, briefly slipping its mathematical mask and exposing its artificial nature through flash crashes and “impossible” prices.

Like Mickey Mouse enchanting brooms in the Sorcerer's Apprentice, we've conjured forces that operate beyond our full control or comprehension—and unleashed them into the economy’s central nervous system. While the market’s user interface maintains a reassuring façade of familiarity, underneath, these forces have fundamentally rewritten the economy’s operating system. The stakes extend far beyond Wall Street: algorithms now influence everything from mortgage rates and insurance premiums to the cost of our groceries and clothes. We're all unwitting participants in one of history's largest economic experiments: the Financial Matrix.

Ten Milestones On The Road To Hyperreality: Contents

1. The Metamorphosis Of Money

2. Keynes' Kaleidoscope

3. Central Banks’ Money Printer Go BRRRR

4. Silicon Shadows

5. The Rise of Skynet <== YOU ARE HERE

6. The Institutionalization Of Finance

7. The Symbolic Alchemy Of Risk

8. “We’re All Quants Now”

9. Social Media & “The Ecstasy Of Communication”

10. The Consumerification of FinanceEconomic Blueprints: How Ideas Build and Bind Our Reality

As algorithms increasingly colonize our price system and function as engines of hyperreality, a fundamental question emerges: how did abstract automated rules gain such power over our reality? Over a century ago, the influential social theorist Max Weber illuminated how our abstract worldviews—what he called ‘world images’—act as invisible ‘railway switchmen’ that determine the tracks along which society moves.

The Keynesian worldview proved one of the past century’s most momentous switchmen—radically redirecting the trajectory of entire economies and societies.1 Its reframing of the economy as a mechanical rather than organic system became a defining metaphor for twentieth-century economic thought—one made literal in 1949 through the Phillips Machine’s hydraulic computation of macroeconomic equations (below), and repopularized in recent years by Ray Dalio’s “How The Economic Machine Works.” Like a Formula 1 race car, the Keynesian economy requires an expert driver at the wheel, a remote mission control analyzing real-time telemetry data and guiding strategy, a vigilant pit crew, and a full emergency response team to handle the inevitable car crashes.

Where classical economics saw a natural order best left to govern itself, the Keynesian machine demanded technocratic control—and, true to Weber's observation that worldviews manifest in institutional forms, Keynesianism transformed our monetary system (“We’re all Keynesians now”), spawned the IMF and World Bank, and reshaped fiscal and monetary policy. Moreover—by embedding itself in economics education and curricula—Keynesianism ensured its worldview would replicate memetically through generations of policymakers, business leaders, and citizens, all of whom internalized its economic “world image”.

The Keynesian worldview and its institutional manifestations thus create a self-reinforcing system of imprisonment, vividly captured by Weber's ‘iron cage’ metaphor. We are confined both by our intellectual tunnel vision—rigid patterns of thought—and by the institutions these patterns have created, recursively reinforcing Keynesianism and constraining our ability to imagine—let alone implement—alternatives.

The past half century of economic experience substantiates Weber’s insights: the Keynesian railway switchman inverted economic logic and directed us, inter alia, onto a track of debt-fueled economic growth, while we continue to be trapped within the iron cage forged by the Keynesian worldview.

This radical redirection of economic thought inverted even our most basic perception of economic causation. Where classical economists saw that we must produce before we can consume, Keynesianism recast consumer demand as the primary driver—turning thrift from a virtue into a potential economic threat. As Keynesian thought displaced classical economics' focus on production and savings, it transformed credit expansion into the universal economic elixir—perversely, the wounds caused by excessive debt were treated by prescribing still more debt.

The ongoing global housing crisis is a microcosm of this pattern: when credit expansion made homes unaffordable, policymakers responded with even easier credit conditions, further driving up house prices, requiring even more aggressive credit intervention—a Red Queen’s race where we must run faster and faster just to stay in place.

When this system failed catastrophically in 2008, economists rationalized the collapse by treating the superficial symptoms—subprime lending and complex financial instruments—as some mysterious disease of 'capitalism,' blind to the role of their own policies in precipitating this catastrophe. The Keynesian iron cage prevented them from envisioning alternate diagnoses of the problem or prescriptions other than stronger doses of the same medicine.

Scientism As Key Strut In Iron Cage

The Keynesian iron cage emerged within an even broader intellectual imprisonment of economic thought that Nobel Laureate Friedrich Hayek termed “scientism”. Economics increasingly spoke only in the language of measurable quantities and mathematical models—if they could count it, graph it, or put it in a formula, that's what became "real", while anything subjective, qualitative, or unmeasurable faded into irrelevance. By recasting economics as a science of mechanical relationships and measurable aggregates, scientism suffused the discipline with both its veneer of mathematical precision and its claim to technocratic authority.

This transformation forged a key strut in the modernist economic iron cage, constraining not only our conclusions but the very parameters around which we are able to think—what questions can be asked, what methods of inquiry are valid, what counts as evidence—and ultimately enforcing what actions are acceptable. The institutions born of this worldview have become systems that not only measure and quantify but fundamentally shape economic and social reality according to the worldview’s precepts—first measuring what the worldview deems important and then using those measurements to reshape society via policy.

Mathematics Metastasized: The Colonization of Modern Finance

This scientistic worldview inexorably metastasized from economics to finance and investing, transforming these domains as profoundly as it had economics by redirecting financial thought onto a new track of pure mathematical determinism. Just as Keynesianism recast economics as a scientific discipline, Modern Finance promised to turn the messy art of investing into a rigorous science of measurement and optimization through theories such as the Efficient Market Hypothesis, Modern Portfolio Theory, and CAPM.

The abstraction of markets into pure mathematical relationships mirrored the Keynesian transformation of economics—both scientistic worldviews operate on abstract statistical aggregates rather than underlying reality. Both, too, assume that volatility can be managed and controlled—Keynesians attempt to stabilize economic volatility through policy intervention, Modern Finance price volatility through portfolio optimization.

The Modern Finance worldview forged new bars within the scientistic iron cage, fundamentally altering our conception of markets, risk, and value. The very nature of investing and value underwent a transformation: what was once an entrepreneurial judgment about business fundamentals became reducible to a set of mathematical relationships that treated all financial assets—from companies to securities to Non-Fungible Tokens to cryptocurrencies to bundles of cash flows—as interchangeable numbers and symbols to be manipulated in equations. Equity markets were reimagined as a black box ‘Magic Money Tree’ that mechanistically generated 'correct' prices and promised inevitable long-term appreciation. The specter of uncertainty was tamed—transformed into quantifiable risk—while portfolio construction became a matter of mathematical optimization.

Modern Finance, too, created institutions and practices that both reinforced its mechanistic worldview and embedded itself throughout society and markets. Where central bank policy became an institutional expression of Keynesianism, Modern Finance Theory crystalized into practices such as “institutional investing” and “asset allocation”—consisting of institutional consultants, optimized model portfolios, index funds, risk management systems, factor models, and quantitative strategies that now dominate the flow of trillions in global capital markets.

Capital—forced through ever-finer sieves by Modern Financial Theory's scientistic approach—increasingly flows only in patterns dictated by mathematical abstractions, until what remains is a hyperreal market where filtered abstractions react to other filtered abstractions rather than to underlying economic reality. For example, as index funds have come to dominate ‘asset allocation’, ‘price discovery’ increasingly reflects only the mechanical buying and selling of entire indices, as Michael W. Green and others have long argued.

Modern Finance Theory perhaps reaches its apotheosis in the newest AI Robo-advisors: self-learning algorithms that automatically allocate capital into index funds (themselves algorithmic products of Modern Finance Theory), creating a perfect digital Ouroboros where tradebots implement scientistic algorithms to buy other scientistic algorithms—nested layers of automation without a human in the loop, each built on the worldview that markets are merely equations to be optimized mathematically.

The Magic Money Tree & Volmageddon

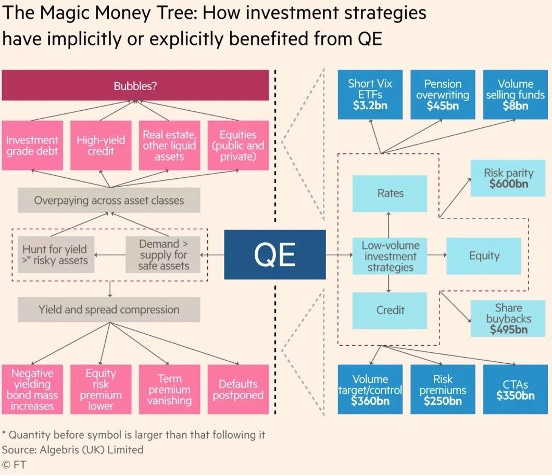

The volatility complex—the interconnected system of volatility metrics, indices, derivatives, trading strategies, and market participants bound to them—reveals how our two dominant economic worldviews, Modern Finance Theory and Keynesianism, are locked in a recursive feedback loop.

When Modern Finance Theory's algorithms interact with signals corrupted by Keynesian interventions, they create the kind of doom loop vividly illustrated by an ant "death spiral":

When ants’ pheromone trails get corrupted, they begin following each other in a circular marching pattern: each ant follows the chemical trail left by those ahead of it. The more ants join the circle, the stronger the signal becomes, attracting even more of their nestmates. This continues until the entire colony marches itself to exhaustion and death. No individual ant intends this outcome, yet their collective behavior—emerging from each ant following its own algorithmic directive to track chemical signals—creates a vicious self-reinforcing feedback loop that ultimately destroys the colony.

Our own financial doom loop begins with a quintessentially scientistic sleight-of-hand: redefining risk as volatility, reducing the multi-dimensional reality of uncertainty into a single metric that we could supposedly measure, model, and control—not to mention trade as an instrument. This reduction—this flattening of reality into a single number that tends to rise when stocks fall and fall when stocks rise—set the stage for what followed.

After the 2008 crisis, the Federal Reserve fostered preternaturally calm markets by suppressing this redefined notion of risk through Keynesian-style policies like Quantitative Easing. Just as corrupted pheromone trails led ants to follow a suicidal path, these distorted market signals fundamentally altered the medium in which Modern Finance Theory operates—and therefore what constituted 'optimal' behavior for humans and tradebots to follow under the theory. Keynesian policy fused with the mathematical logic of Modern Finance Theory to create an automated doom loop that amplified the effects of both worldviews.

The Fed-induced artificial calm acted like a corrupted ant pheromone trail, drawing billions into ‘democratized’ strategies like XIV and SVXY—two ETF products that systematically bet against market turbulence. The volatility tail began wagging the market dog. As each moment of calm begat more calm, these products didn't just suppress the volatility metric they were built to track—they fabricated an entire self-contained artificial reality: an entire market ecosystem that acted like a Magic Money Tree.

The insanity of the era was perfectly encapsulated by a former Target store manager who turned $500k into $12 million by day-trading mathematical abstractions of fear from his home office in Florida. He became so successful that investors allegedly "pounded on his door," offering him $100 million to manage a hedge fund, all while he casually ate popcorn.

As short volatility strategies delivered increasingly impressive returns, they attracted a surge of capital from various sources—ranging from explicit short-volatility products like SVXY and XIV to more subtle forms of volatility selling embedded throughout the financial system. Market makers sold volatility to hedge their positions, which further suppressed the risk gauge. The resulting appearance of stability made these strategies seem even safer, drawing in additional capital and perpetuating the cycle.

Modern Finance Theory interpreted this artificial calm as reduced risk, triggering a cascade of automated and discretionary responses from both algorithms and human traders alike that created a reflexive, self-reinforcing feedback loop. Risk models like Value at Risk (VaR)—which estimate potential losses based on recent market volatility—saw the low volatility as a signal that it was safe to take on more leverage. Risk parity funds mechanically loaded up on stocks, trend-following algorithms amplified the upward momentum, and portfolio optimization models recommended heavier positions in risky assets—particularly equities.

These dynamics collectively suppressed volatility further and drove equity markets higher, as machines and traders reinforced each other's moves. Each turn of the cycle amplified the illusion of stability, embedding complacency throughout the market—even as that very stability made the system itself increasingly fragile.

Like the deceptive order of the ants' circular formation, what appeared as market stability was in fact a synchronized march toward disaster. Each new trader and algorithm joining the low-volatility bet added to the pressure that would ultimately snap. After 10 consecutive positive months and nearly a full year without a downward move of more than -2% in the index, the artificial calm exhausted itself, violently reverting to chaos. During February 2018's Volmageddon, the S&P suffered a down 4.1% day—relatively mild compared to historical precedents—but the volatility index surged from 17 to 37, destroying some of the very instruments that had helped engineer the calm.

The volatility “risk” gauge didn’t just measure markets, it became an integral part of the very system it sought to understand—the map reshaped the territory it claimed to represent. Though Volmageddon has mostly receded from market memory as equities resumed their relentless upward march, it revealed a fundamental truth about our financial system. This ant-like doom loop—where artificial stability emerges from the Keynesian-Modern Finance-Algorithmic scientistic complex and collapses under its own contradictions—extends far beyond the microcosm of the volatility complex.

Algorithmic Amplification: From Iron Cage To Silicon Matrix

Volmageddon serves as an emblematic case study of a broader phenomenon reshaping our financial markets and society: the automation of human worldviews through algorithmic systems. What happened in the volatility markets—the marriage of worldviews and automation—now permeates the entire Financial Matrix.

Where worldviews once worked gradually through human institutions and actions, in our digital age they now find a vastly accelerated and more powerful vector of propagation and intensification: algorithms encode them into an automated silicon Matrix that operates at lightning speed and on a global scale. These unprecedented force multipliers accelerate our progress along a given worldview “railway track” while making any future switch to a different track increasingly difficult. Weber's metaphorical railway tracks have been transformed into literal digital pathways that reshape and constrain society far more quickly and thoroughly than previous institutions ever could.

Far from being “neutral math” constructs, algorithms are—at their core—worldviews formalized in code. Even the most rudimentary algorithm—seemingly objective in its simplicity—carries the indelible imprint of its creator's Weberian 'world image': his assumptions, values, ideologies, and biases—even his choice of how to frame the problem being addressed. Algorithms are therefore more than just passive tools: they transform beliefs and rules that previously existed solely in human minds and social structures into automated systems, which then relentlessly execute these now-embedded worldviews with rigid precision.

The Flattened World: Algorithms Reduce Reality To A Photograph

But algorithms do more than merely fortify our ‘iron cage’ and amplify and accelerate the idea-to-reality transformation identified by Weber. Even seemingly "simple" algorithms—like passive indexing or model portfolios—represent profound philosophical choices.

‘The medium is the message' rings particularly true for algorithms: as a medium itself, an algorithm—regardless of purpose—by nature reduces all reality to measurable relationships. This reduction becomes particularly destructive when algorithms replace human judgment in economics: their very structure and operation encode scientism directly into the operating system of our Financial Matrix. That this philosophical commitment to scientism comes cloaked in seemingly neutral technical choices makes it all the more pernicious.

Hayek warning about the scientification of economics is therefore all the more relevant today:

...it seems as if this whole effort... to 'scientificize' economics... [was] due to a mistaken effort to make the statistically observable magnitude the main object of theoretical explanation.

He elaborated on the limitations of this approach in his Nobel acceptance speech:

In the social sciences often that is treated as important which happens to be accessible to measurement. This is sometimes carried to the point where it is demanded that our theories must be formulated in such terms that they refer only to measurable magnitudes.

One major problem alluded to by Hayek above is that by focusing only on that which we can measure and quantify in an effort to force feed data into our mathematical equations and algorithms, we are actively and biasedly sifting through information and screening out anything that is subjective or qualitative. This screened-out ineffable dimension is what Hayek called tacit knowledge—knowledge that cannot be formalized or articulated, let alone quantified or algorithmatized. In short, we are discarding our gold while retaining the dross.

Algorithms necessarily eliminate everything that cannot be quantified—by the very nature of what an algorithm is and does. An algorithm can only process numerical data—even audio, video, text, and images must be represented as binary 0s and 1s—this isn't a bug but rather a defining feature. An algorithm can analyze the word "love" or identify patterns correlated with behaviors or expressions of love, but it cannot experience love itself.

This same inability to capture the non-quantifiable lies at the heart of our issues with algorithmic economics. When we delegate human economic judgment to algorithms—whether through a simple algorithm like “passive investing” or more complex AI strategies—we directly encode the Spirit of Scientism into the very operating system of our economy and financial markets. We are attempting to model and calculate what can only emerge from the interaction of countless human minds interpreting and acting within human contexts to achieve human goals—making use of a specific kind of “tacit knowledge”.

Pareto—famous for the 80/20 Rule—reveals the critical hyperreal flaw in all of this when he acknowledged that for the purpose of scientistic economic analysis, “the individual can disappear, provided he leaves us his photograph of his tastes”. It’s conceptually no different than turning a living, breathing person into a static collection of vital statistics frozen in time: blood pressure, heart rate, oxygen saturation, body mass index, and so on.

This "photograph" Pareto speaks of is not just metaphorical—it's precisely what we create when we reduce humans to "photographs of tastes”: sterile arrays of numerical abstractions—prices, volumes, correlations, factors—upon which we then build automated systems and processes. Our scientistic method is akin to taking a low-resolution black and white snapshot of a vibrant, dynamic, colorful 3D world—flattening the world into two dimensions, freezing time into a static moment, and limiting our view to a single perspective—and then mistaking the crude facsimile for the real thing.

These mathematical photographs become the only "reality" our financial system can perceive or interact with. Like beings who have never left Plato's cave, algorithms mistake these shadows for substance—because by nature they are only able to operate in this flattened mathematical realm. Our algorithms dutifully process and respond to these abstractions with perfect mathematical precision, generating prices and making decisions that ripple back into the physical economy. Yet what their calculations have lost in translation—the human elements and tacit knowledge that resist quantification—give markets their essential character and the price system its utility as coordinator of human activity across space and time.

Algorithms Transform The Flow Of Information

The transformation of our markets from human-driven to algorithm-dominated therefore represents more than just “technological progress” or “automating what humans used to do”. Skynet is the final crystallization of our philosphical attempt to reduce the messy reality of human economic activity into pure mathematical relationships, and profoundly changes the flow of economic information through society.

Economic order depends on the flow of a particular type of information. The economy is shaped by the precise nature of the institutions that disseminate this information—monetary, social, political, financial, and communication—as well as the specific ways these institutions generate and transmit information and prices.

Like ants following pheromone trails, economic actors respond to economic signals transmitted through our institutions. When central banks tamper with interest rates, for example, they corrupt the price system’s information about the availability of savings. Since all businesses follow these same distorted signal trails, this leads to a synchronized “clustering of errors” in which businesses march in unison toward unsustainable investments, generating widespread economic instability. Similarly, price controls broadcast incorrect information about supply and demand, misleading people into making faulty decisions based on artificial rather than genuine economic signals.

Algorithms represent an emerging institution, one capable of introducing distinct forms of information distortion and corruption into the economy. Like central bank manipulation of interest rates—indeed, in conjunction with it—the replacement of human economic judgment by algorithms corrupts the flow of information that markets need to function effectively. The algorithmization of decisions that require human tacit knowledge and judgment has the potential to severely corrupt the price system and impair economic coordination—and therefore create significant economic errors.

Part of what confounds people’s understanding of the issue is that the Financial Matrix still looks like the old system, algorithms really are just an extension of our existing scientistic worldview, and everything appears to be going extremely well—as many assets hit all time highs. But nonetheless economic information is being corrupted in a way that is causing entrepreneurs, capital deployers, and consumers to commit grievous errors that will only be revealed later in time.

Algorithms As Engines Of Hyperreality

The progressive filtration of economic reality through algorithmic sieves mirrors the AI model collapse phenomenon we explored in the last chapter. Each pass through our scientistic filters strips away more of the qualitative texture that gives prices meaning—just as each generation of AI training on AI-generated content loses more of its connection to human-generated data and becomes increasingly self-referential.

This perpetual dance of shadows chasing other shadows—algorithms endlessly reading and writing to this layer of mathematical abstractions—reveals Skynet's essential nature as an engine of hyperreality. Every interaction in this flattened realm pushes us further from the human reality we originally sought to represent, generating an endless stream of HyperPrices. The dramatic flash crashes and Volmageddon are merely moments when this shadow realm briefly allow us a glimpse into the true nature of our Financial Matrix: they expose the deep structural instabilities created by our automated systems simultaneously encoding multiple worldviews that share similar philosophical blindspots.

The map has become the territory; these abstracted, numerical representations have become more "real" than reality itself. We have created a Financial Matrix that increasingly dictates terms to the physical world, forcing reality to conform to its abstractions rather than the other way around.

Conclusion

In 1831, when 74 soldiers marched across the Broughton Suspension Bridge in lockstep, their synchronized footsteps created tiny vibrations that—while individually harmless—synced with the bridge's natural sway. Like perfectly timed pushes on a playground swing, each footstep intensified the vibrations until the accumulated energy led to catastrophic failure, as the bridge’s support system buckled and collapsed under the resonant forces.

This principle of resonance—where small synchronized forces compound until they shatter seemingly robust systems—illuminates a crucial vulnerability in our Financial Matrix. As algorithms increasingly dominate market behavior, they create their own forms of dangerous synchronization. Each algorithm may appear to operate independently, following its own mathematical logic. Yet collectively, they march to common rhythms through shared methods of reducing reality to measurable relationships.

Just as a bridge can accumulate destructive energy from soldiers marching in sync, the Financial Matrix—and the automated fusion of Keynesian intervention and Modern Finance Theory within it—is generating its own form of dangerous resonance, compounding hidden fragilities through its own synchronized behaviors. The question isn't whether our Financial Matrix will experience its own resonant collapse, but rather when.

We use "Keynesianism" herein as convenient—albeit not entirely accurate—shorthand for modern economics more broadly, while acknowledging this simplifies a complex evolution in economic thought.

I think you’re overestimating humans.

you have to have read the previous versions and still remember them to understand this one

thanks once again