Forty years of Goldilocks conditioned an entire generation to see markets as “Perpetual Money Machines” through what amounted to Pavlovian technique.

The formula was simple: when any trouble surfaces, buy the dip, safe in the knowledge that the Fed will intervene and markets will quickly recover to new highs. Each successful rescue reinforced the gospel that faith in the Plunge Protection Team would inevitably be rewarded:

What passed for sophisticated investing was often just momentum or Pavlovian dip-buying, and nearly every modern financial “innovation” and investment strategy evolved within this climate-controlled greenhouse.

Central bankers supplied abundant liquidity and stood ready to intervene at the first sign of instability, enabling us to construct the Financial Matrix—a simulation that took on a life of its own, untethered from the real-world economy. A single imperative prevailed: optimize within the system.

In such a simulated environment, delegating public market investment decisions to algorithms became the rational endpoint. Both "smart" AI trained on decades of BTFD data and investors consistently BTFD into "dumb" passive ETF algorithms reached the same logical conclusion. If markets are indeed a Perpetual Money Machine that always recovers to new highs, and if “beating” this alchemical creation proved futile within the rules of the Financial Matrix, then why not simply automate the buying process?

Then COVID arrived, and the ensuing responses culminated in Mr. Market’s Schizophrenic Break. After decades of accumulating pressure, the structural imbalances beneath the surface erupted in a violent seismic shift, birthing the era of Multiflation™.

Twitter/X: @bewaterltd. Suggestions? Feedback.

Not investment advice. For educational/informational purposes only. See Disclaimer.

Beyond Inflation: Why CPI Conceals The Real Damage

The endless debates about whether inflation is or was “transitory”, whether CPI is headed up or down, and whether tariffs are inflationary or deflationary focus on surface-level movements—all while Multiflation reshapes the entire economic landscape beneath.

While most investors intellectually understand that individual prices move somewhat independently of one another, they often fall into the trap of unconsciously treating inflation as a single, uniform force. They equate inflation with CPI and imagine it as if it were a thermostat that nudges the entire economy's temperature up or down.

Multiflation: The Forest Fire Economy

In reality, Multiflation spreads more like a forest fire through patchy winter terrain. Such a fire is highly disruptive, and doesn't heat everything equally. Instead, it ignites where new money or debt enters the system, raging in some areas while others stay relatively cool or even frigid. Areas closest to the injection of money and credit tend to burn hot and grow rapidly: not necessarily due to organic demand, but simply because they’re nearest to the source of monetary expansion.

This is why aggregate measures like CPI—despite dominating investor attention—miss the deeper disruption. Modest headline inflation can—and often does—mask massive wealth transfers and dislocations occurring beneath the surface that reconfigure the economic landscape in ways a simple temperature reading can't capture. Multiflation affects different assets, sectors, regions, companies, and individuals at vastly different rates and times, creating a complex web of relative price changes.

Consider what our friend experienced running a business through extreme Multiflations in South America. The problem wasn't merely that CPI was rising at a dangerous rate due to Money Printer Go Brrr. The day to day unpredictability and dislocations were just as harmful as the erosion of savings due to monetary debasement raising prices generally.

Workers demanded weekly inflation escalators to keep pace with the economic chaos, and long-term business planning became an exercise in futility. His wife struggled to buy basic groceries as prices swung erratically from day to day: $12 one morning, $8 the next, then $10 by week’s end. Some days the shelves sat empty regardless of price, leaving her to wander from store to store with no guarantee of finding what she needed.

The developed world caught glimpses of such economic disorder in the aftermath of COVID, when shortages and price volatility struck everything from toilet paper to eggs to labor markets. Multiflation transforms everyone into reactive traders rather than productive actors, forcing us to abandon the steady work of running businesses and households in favor of making constant bets about input costs, tariffs, interest rates, exchange rates, government policy, and supply chain disruptions.

Multiflation’s complexity is compounded by government responses and interventions, which may aim to either stoke or quell inflation and growth—though sometimes these measures serve other political ends entirely. Our recent experience with tariffs provides one clear example of such intervention. During the 1970s, government and central bank policies alternately stimulated and contracted the economy—a problematic pattern known as "Stop-Go inflation"—as policymakers swung between concerns about recession and fears of rising inflation, creating a stagflationary cycle that ultimately worsened both problems.

The central issue therefore isn't simply rising CPI—although erosion of purchasing power is certainly a very real issue as well—but rather the fundamental breakdown of the price system itself. As discussed in the Price of Everything, the price system is analogous to the central nervous system of the economy. When prices become corrupted, the ripple effects create widespread dislocations across markets and turn the economy and markets into a bewildering labyrinth; every economic decision—from corporate investment to consumer spending—becomes fraught with uncertainty. The result is a cascade of dislocations that creates both enormous risks and asymmetric opportunities for those who are prepared and positioned to act.

The post-COVID investment environment thus far has offered a mere foretaste of such disorder in the developed world. Moderate CPI inflation—far short of Venezuelan, or even 1970s U.S. levels—has already begun to seriously undermine the strategies that form the foundation of so many investors' portfolios by breaking the assumptions on which they are based. But Multiflation presents an additional trap, as well: even when BTFD 'works', such success proves deceptive due to “money illusion”—delivering nominal gains that fail to keep pace with inflation and taxes, quietly undermining investors' purchasing power and standard of living over time.

Disorder As Opportunity: The Five Archetypes

Most investors remain anchored to strategies that worked for decades, unable to accept that the investing rules have fundamentally changed:

The bigger the shift, the longer markets take to adjust—and the greater the dislocations become across the entire system. Within this widespread denial lies extraordinary opportunity: persistent misalignments between old strategies and new realities create asymmetric advantages for those who recognize what's actually happening.

The challenge is that a portfolio isn't truly diversified if it remains positioned for Goldilocks—allocated according to Goldilocks-era thought processes—even if bandaids such as TIPS, gold, Bitcoin, and ‘alternatives’ have been applied as ad-hoc tactical overlays. Traditional portfolio theory asks: "how much should I own of each asset, risk, and factor to optimize statistics that operate under the assumptions of Goldilocks?" The right question is now: "When the system underpinning Goldilocks breaks—and it is breaking—what actually survives and thrives? What purpose does each investment serve when order dissolves?"

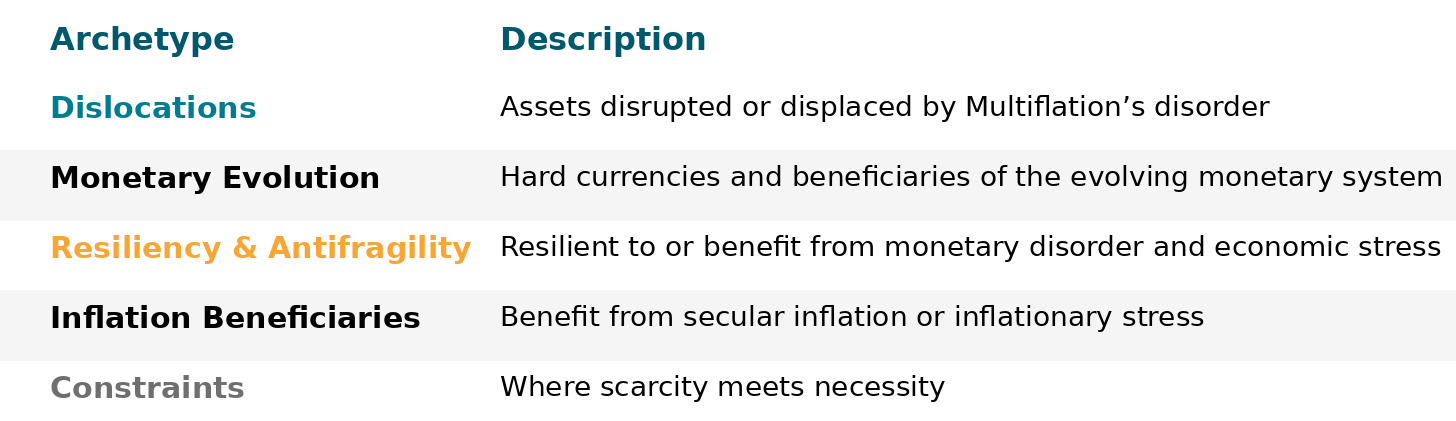

This means focusing on what actually matters—the underlying forces that create, destroy, and preserve wealth during Multiflation. We developed the Five Archetypes to address precisely this challenge, distilling lessons from our study of the best and worst performers during periods of great economic change, and adapting them to today’s unique conditions.

Each Archetype helps investors navigate disorder in a specific way. None is sufficient alone, nor are any of them designed to be “correct”. Collectively, however, the Archetypes provide resilient, adaptive exposure across the full spectrum of failure and success modes of Multiflation—without requiring clairvoyance about what comes next. They transform portfolio construction from a mathematical exercise into strategic curation—selecting assets for their structural roles in preserving and creating wealth amid disorder.

Many approaches to diversification own different flavors of the same assumption: tomorrow's economy will function like yesterday's. Analyzing investment questions through the lens of Archetypes exposes that many seemingly sophisticated strategies might actually be concentrated bets on conditions that have already changed.

This is not to say that Multiflation necessarily requires a complete overhaul of existing portfolios—particularly for those bound by institutional constraints. Sometimes, small strategic and tactical adjustments in thinking and allocations may act as a force multiplier that yield outsized improvements in overall performance and resilience.

These Archetypes will resonate differently with each reader based on their investing experience and background. Some may find them immediately familiar, while others might feel they're encountering novel concepts. As we develop these concepts through detailed case studies and real-world examples over the course of future posts, even familiar patterns will reveal new layers of complexity and application. To help readers navigate this evolving framework, we're building a comprehensive reference guide that will grow with each installment, accessible through an Index we'll maintain throughout the series.

1. Dislocations

The Essence: Exploits mispricings; when Multiflation corrupts the price system, incredible asymmetric opportunities may emerge for those positioned to act. There are three primary types of dislocations:

Price Dislocations are the most obvious, visible in charts as dramatic price movements, though they're often accompanied by deteriorating fundamentals.

Fundamental Dislocations represent structural shifts as well as announced events such as mergers or bankruptcies.

Examples:

Liquid Gold: reshoring, population growth, and AI are colliding with physical water constraints.

Canadian Housing: as a decades-long bubble meets higher rates and tariff uncertainty.

Edge Dislocations occur when markets misinterpret or underreact to new information—for example news that may remove previous overhangs on an asset, creating an all-clear signal. Initially, for a period of time—days, weeks, or months—the market may ignore or underreact to the new information and act as if “it was already priced in”, creating opportunities for those with a Multiflation lens who grasp the implications first.

Why The Archetype Is Necessary: Goldilocks assumptions increasingly fail during Multiflation, creating an increasing number of “glitches” in the Financial Matrix. Dislocations become more frequent and pronounced during Multiflation as corrupted price signals and government interventions create disorder; opportunities may persist longer due to widespread market confusion, algorithmic usage, and institutional inertia.

How It Behaves Under Multiflation: Thrives as corrupted price signals and government interventions create mispricings.

2. Monetary Evolution

The Essence: Exposure to market-chosen money alternatives and infrastructure that supports them as the fiat system fractures and "risk-free" assets are reassessed.

Why The Archetype Is Necessary:

We now inhabit a hyperreal Financial Matrix that has displaced the real economy it once represented, and the advent of generative AI is only accelerating this simulation. In this battle between reality and hyperreality, sound money and censorship resistant money serve as the swords of truth that cut through the illusion.

Sound money serves as a bulwark against monetary debasement, the erosion of purchasing power and trust, and financial repression while simultaneously maintaining liquidity to capitalize on Dislocations. When economic turbulence forces other investors to retrench or become distressed sellers during periods of dislocation, a well-constructed Monetary Evolution component within a portfolio positions us to act as a liquidity provider to those compelled to sell at disadvantageous prices.

The arc we traced in The Metamorphosis of Money is reaching its endgame: the fiat system is fracturing, the "risk-free" nature of Treasuries is increasingly being reassessed, and officials ranging from Treasury Secretary Bessent to the IMF are calling for a reset of the global economic system.

Money is the lifeblood of the economy—and the most scarce money alternatives become key Constraint Archetypes when fiat money is being competitively devalued. When Russia's reserves get frozen overnight, entire countries find themselves cut from SWIFT, or when central banks create trillions through QE and engage in financial repression, people naturally gravitate toward market-chosen money alternatives to fiat such as Bitcoin and Gold.

How It Behaves Under Multiflation: Gains as fiat currency debasement accelerates flight toward market-chosen alternatives, while providing liquidity and maintained purchasing power to capitalize on distressed selling during volatile periods.

Examples:

Competitive market-chosen money alternatives such as precious metals and potentially Bitcoin.

Companies that provide essential infrastructure and services around this Monetary Evolution may also benefit significantly from these shifts. Treasury Companies, royalty firms, mining operations, and foreign exchange and fixed income opportunities tied to these competing currencies may represent additional ways to participate in this transformation while providing the fundamental "picks and shovels" that enable the broader monetary transition.

While "market money" competing with "state money" represents a central thematic element of Multiflation, the approach to a Multiflation Treasury extends beyond Bitcoin and gold to encompass a broader range of opportunities. Certain less conventional cash-equivalents may also be incorporated selectively when conditions warrant their inclusion.

3. Resiliency & Antifragility

The Essence: This Archetype represents businesses and assets that are resilient to—or actually benefit—from monetary disorder, economic volatility, and rolling dislocations.

Why The Archetype Is Necessary:

These dual categories of resiliency and antifragility work together to insulate the portfolio from Multiflation's inherent disorder while simultaneously generating positive returns from the very conditions that undermine traditional investments. This approach transforms instability itself into a source of portfolio stability.

How It Behaves Under Multiflation: Converts systemic instability into portfolio stability by either weathering disorder or directly profiting from the conditions that undermine traditional investments.

Examples:

Antifragile business examples include debt collectors and distressed asset specialists who thrive precisely when credit conditions tighten and traditional lenders retreat. These enterprises profit from the very circumstances that create stress elsewhere in the system.

Historical analysis across extreme economic cycles reveals valuable patterns for identifying resilient enterprises. Businesses that survived wars, hyperinflations, and systemic collapses share certain characteristics that remain relevant today. Understanding what allowed these enterprises to prosper through multiple shocks provides insights for modern positioning, though success depends on identifying which historical survival mechanisms still apply under current conditions.

This Archetype also encompasses trade structures and instruments specifically designed to profit from disorder, including various derivatives strategies that benefit from volatility and dislocation.

Counterparty and geographical scrutiny becomes equally critical within this framework. Even the strongest portfolio construction becomes worthless if custodians and counterparties cannot honor their obligations during periods of systemic stress, making due diligence on operational resilience as important as investment selection itself.

4. Inflation Beneficiaries

The Essence: When the value of currency erodes, certain assets and businesses transform monetary debasement into competitive advantage. There are two primary types of inflation beneficiaries—those that maintain purchasing power, and those that multiply it.

Why it's necessary: Counteracts currency debasement while generating real returns that preserve and grow purchasing power when traditional inflation hedges may fail.

How It Behaves Under Multiflation: Transforms currency debasement into competitive advantage by preserving or multiplying purchasing power.

Examples:

This includes everything from the Monetary Evolution Archetype, as well as companies with pricing power exceeding input cost inflation, royalty and toll-collector models, deflationary technologies that lower costs while increasing productivity, businesses representing small percentages of customer costs while providing outsized value, and companies trading at or below replacement cost—especially as replacement costs are set to rise substantially.

Warren Buffett documented numerous examples in his 1970s letters. However, for reasons we will explore in future installments, some traditional inflation hedges may not work the same way under Multiflation—and some may even prove to be among the worst places to seek protection.

5. Constraints

The Essence: Structural collision courses between scarcity and necessity, where explosive value creation becomes inevitable.

Why It’s Necessary: In a world drowning in paper (or virtual) financial assets, true scarcity becomes increasingly valuable, but scarcity alone isn't sufficient. We seek Constraints that add demand to the equation.

How It Behaves Under Multiflation: Generates asymmetric returns as monetary debasement drives capital toward scarce assets with rising demand, creating compounding forces.

Examples:

Our recent water series illustrates how this Constraint is being systematically undervalued—for example as AI demand is creating entirely new demand dynamics. Constraints represent supply and demand dynamics—often creatively defined—working together across multiple levels that often aren't intuitively obvious.

One non-obvious point is that every price reflects a dual ratio: the supply and demand of the asset itself, and the supply and demand of the money against which it is priced. Most analysis ignores the monetary side, treating currency as stable. Under today's monetary conditions, however this sometimes creates significant blind spots that obscure the true forces driving asset prices.

The most powerful Constraints under Multiflation emerge when monetary debasement drives capital into assets where supply and demand already favor higher prices. As money becomes more abundant and holding it becomes less desirable to hold, it will tend to seek refuge in genuinely scarce assets with rising structural long-term demand. Understanding this dual dynamic—both the asset's fundamentals and the monetary backdrop—helps investors recognize when apparent overvaluation may actually signal the early stages of a major repricing, allowing them to hold through volatility rather than exit prematurely.

Diversification For Multiflation

The most compelling investment opportunities during Multiflation rarely confine themselves to a single Archetype. Instead, the strongest positions tend to emerge when assets and businesses operate across multiple categories simultaneously, creating reinforcing advantages that compound as disorder intensifies.

Consider some examples from our emerging research pipeline:

Water infrastructure: it starts as a fundamental Dislocation and Constraint (physical scarcity meets burgeoning demand due to population growth), becomes an Inflation Beneficiary (pricing power), and may demonstrate Resiliency and Antifragility.

Similarly, commodities and precious metals specialists such as Sprott, Inc. span three distinct Archetypes: they provide infrastructure for Monetary Evolution as investors seek alternatives to fiat currencies, operate as Inflation Beneficiaries through exposure to hard assets, and represent Constraints by controlling access to genuinely scarce resources with rising institutional demand.

This multi-Archetype approach extends beyond individual positions to portfolio construction itself. While each investment may span several Archetypes, the overall portfolio must also achieve balance across all five Archetypes to ensure resilience regardless of which specific aspects of Multiflation dominate at any given moment. A portfolio concentrated in positions that all span the same three Archetypes, for instance, remains vulnerable to scenarios where the other two categories prove most critical.

Through the Be Water Method, portfolios become capable of navigating all seas, adapting fluidly to whatever tumultuous conditions Multiflation presents.

Adapting To The New Reality

The transition from Goldilocks to Multiflation represents a permanent shift that will define the investment landscape for the next decade. This isn't a temporary disruption to be weathered—it's the new baseline reality from which all future economic activity will emerge. Traditional portfolio management strategies have become concentrated bets on conditions that no longer exist, leaving investors exposed to forces they don't fully understand.

The Five Archetypes provide a framework for navigating this new reality. Unlike conventional diversification approaches that spread risk across different flavors of the same underlying assumptions, these Archetypes position investors for the structural changes already underway. Success depends on aligning with Multiflation's dynamics rather than fighting them, whether you're building businesses, allocating capital, or shaping policy.

The companies and assets that will thrive in the coming decade are already becoming visible, but most investors continue evaluating them through frameworks designed for a vanishing world. The decade ahead belongs to those who stop optimizing for conditions that are rapidly disappearing and start positioning for the world that's emerging. In the coming weeks and months, our understanding will deepen through practical application—each case study will refine both our process and understanding.

Fascinating and mind opening series.

Please provide more concrete examples for the Archetypes.

Really enjoying, thank you. Do you offer any service for portfolio construction?