In the era of Multiflation (link here), investors are beginning to rediscover the appeal of hard assets and natural resources after abandoning them during a nearly fifteen-year commodities ice age.

Yet direct ownership of resources remains notoriously challenging: storage and transaction costs, insurance requirements, and—in some cases—outright regulatory prohibition present formidable obstacles for investors. Mining equities may offer explosive upside but introduce additional risks and operational complexities, along with the demanding work of ongoing stock selection and portfolio management. Commodities futures and ETFs have their own drawbacks, including roll risk, tracking error, and tax complexity.

Enter Sprott Inc. (SII.US and SII.CN): the pure-play asset manager positioned at the nexus of this resource renaissance. While many investors are familiar with Eric Sprott—the legendary Canadian investor who founded the firm—and recognize Sprott's flagship closed-end gold and silver trusts, fewer realize that the parent company itself trades publicly.

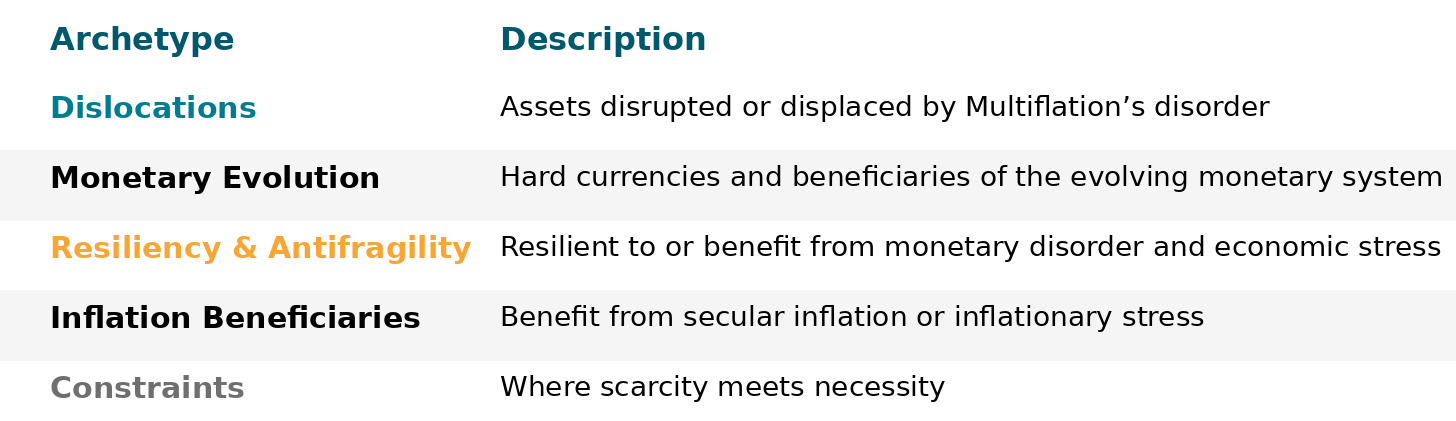

Sprott occupies a rare position among publicly traded assets: it delivers immediate, turnkey exposure to all five Archetypes critical for navigating Multiflation. This distinctive position creates significant opportunity for fundamental revaluation as Multiflation unfolds; while recent stock performance suggests early market recognition of this potential, a broader structural rotation toward hard assets appears to have only just begun.

Traditional portfolio hedges typically impose a performance penalty through negative carry, creating a drag on returns even as they provide protection. Sprott operates differently: it delivers uncorrelated returns that reduce volatility drag and provide dislocation protection—all while paying a dividend. For portfolios seeking multi-Archetype exposure without extensive restructuring, a position in Sprott offers an efficient way to add this dimension alongside other Multiflation holdings.

Twitter/X: @bewaterltd. Suggestions? Feedback.

Not investment advice. For educational/informational purposes only. See Disclaimer.

Note: Be Water’s philosophy and content emphasizes education over prescription—“teaching to fish” rather than simply handing out fish. As with all of our material, this is neither investment advice nor a stock recommendation. Conduct your own due diligence and fundamental analysis to assess the actionability, risks, and trade-offs of any topic we explore together. Consider this analysis a framework for understanding the Multiflation Method as opposed to receiving ready-made investment recommendations.

The Commodity Tollbooth

Sprott manages a comprehensive suite of precious metals and commodity ETFs, funds, and physical trusts, alongside other strategic resources businesses. Their business model transforms commodity investing's inherent costs and complexity into profit—effectively operating as a tollbooth on a likely soon-to-be-crowded commodity highway. While direct commodity ownership typically involves negative carrying costs—for example paying to store and insure gold in a vault—Sprott inverts this dynamic by paying shareholders a 1.5% dividend yield.

Rather than paying fees to access commodities exposure, Sprott shareholders receive their proportional share of the fees that other investors pay for commodity exposure. Instead of merely capturing price appreciation on the underlying commodity, Sprott shareholders capture both the commodity direction and the economics of fund ownership itself. As Multiflation and inflation drive investors toward hard assets, Sprott benefits twice: first from rising commodity prices that increase the value of underlying assets, and second from the management fees generated by swelling inflows from other investors seeking the same protection.

Conceptually, Sprott shareholders become a General Partner in the Sprott funds without a seat at the management table, collecting a proportional share of the diversified fee streams that flow from commodity demand. The company’s historical reluctance to reinvest heavily in business expansion means these growing cash flows likely return to shareholders rather than being consumed by costly growth initiatives—albeit operating leverage is notably diluted by an expense base, tax obligations, and compensation structure that collectively consume a not-insubstantial portion of revenues before they reach equity holders.

During the prolonged resources bear market, Sprott endured as an underearning cyclical business that nevertheless continued generating cash flow even as competitors either failed outright or abandoned the sector entirely.

The company now stands at an inflection point, transitioning toward a less cyclical business model capable of sustainable profitable growth. Sprott offers investors scarcity value as the premier publicly traded company in the space—boasting dominant brand equity and franchise value within natural resources, a profitable and loyal AUM base anchored by recurring revenues, a dividend yield, and a pristine balance sheet.

Sprott is therefore uniquely positioned for the coming decade defined by Multiflation—including resource nationalism, the urgent need to address over a decade of underinvestment in commodities, and the return of real-asset investing. The trillions currently allocated to stocks and bonds represent an enormous pool of capital; even a modest shift toward commodities would create substantial tailwinds for Sprott.

The company carries tremendous embedded upside optionality through its portfolio of Multiflation beneficiaries: natural resources chokepoints, chaos hedges that activate during monetary, economic, and geopolitical disorder, exposure to surging energy demands from AI and other industries, and the ability to consolidate and grow during dislocations.

Ownership in Sprott may therefore offer a compelling alternative or supplement to other commodity exposures within a broader Multiflation strategy; in short, it’s the commodities and resources “easy button”:

We view our Multiflation holdings as a curated collection wherein each position contributes specific characteristics that enhance the whole’s resilience and adaptability. Sprott exemplifies this approach by offering exposure that is related to—yet fundamentally different from—direct commodity ownership. While physical commodities and ETFs provide pure price exposure to underlying assets, Sprott delivers a more sophisticated exposure profile that combines commodity sensitivity with the stabilizing characteristics of a fee-generating business and the ability to capitalize on dislocations.

Archetypes Analysis

Monetary Evolution

The global financial system stands at a historic inflection point as mounting fiscal imbalances, competitive currency debasement, and eroding confidence in fiat monetary systems converge to challenge the established order. While the precise contours of Monetary Evolution remain uncertain, the leading market alternatives to the current fiat-centric system have crystallized around two primary camps: precious metals, and the digital native alternative embodied by Bitcoin.

Sprott stands to benefit significantly from this Monetary Evolution, as investors seeking refuge from fiat instability may naturally gravitate toward the firm's physically-backed precious metal trusts, funds, and ETFs. The company's positioning ensures participation in the broader flight from fiat currencies, though the magnitude of its benefits would naturally depend on gold's relative share of the monetary transition as well as Sprott’s own market share within the gold market.

Inflation Beneficiary

Sprott’s business model makes it an inherent inflation beneficiary, deriving its power from a reflexive flywheel dynamic. As Multiflation drives demand for its products, Sprott's assets under management and profitability expand through both underlying asset price appreciation and heightened investor inflows, which should generate higher revenues with minimal incremental costs.

Rising commodity prices create their own marketing, attracting investors seeking inflation protection. These inflows enhance Sprott's capacity for new product launches and strategic acquisitions, reinforcing the company’s growth. Valuation aside, this structure potentially makes Sprott equity both a safer and more asymmetric expression of a Multiflationary thesis than direct commodity or mine ownership. The company profits from the very inflationary pressures that erode the value of traditional financial assets, positioning it to benefit regardless of whether price inflation manifests through currency debasement, supply chain disruptions, or resource scarcity meeting demand from AI and geopolitical uncertainty.

Resiliency & Antifragility

Both Sprott the company and its products are by nature resilient and anti-fragile. The firm's most durable economic moat is not any single fund or product, but rather the trusted, scalable, and operationally efficient platform and brand itself, backed by a pristine balance sheet.

For example, the closed-end fund structure underlying Sprott’s trusts creates an inherently stable capital foundation that insulates the firm from the redemption cascades that can devastate open-ended funds and ETFs during periods of investor pessimism. This generates more predictable, recurring fee streams that provide management with revenue visibility and operational flexibility during volatile periods and bear markets.

Sprott’s countercyclical business lines in commodity-focused private credit can help buffer earnings during commodities bear markets. When commodity prices collapse and equity markets close to miners, distressed mining companies still need capital and expertise, allowing Sprott to generate fee income when its other commodity funds face headwinds.

While investors often view commodities as a monolithic asset class, Sprott's specialized expertise allows it to recognize and capitalize on the idiosyncratic fundamentals that drive individual resource markets. This granular understanding creates strategic optionality for a manager equipped with both domain expertise and balance sheet strength. During broad commodity bear markets, Sprott can selectively redeploy capital and launch new products geared toward specific resources exhibiting superior fundamentals, potentially generating strong returns even within a challenging macro environment.

The firm's zero-debt capital structure and robust free cash flow generation transform market dislocations from threats into opportunities. While overleveraged competitors retreat into defensive postures during credit crunches or commodity selloffs, Sprott can deploy capital when assets trade at compelling valuations. This financial fortress enables the firm to act as a consolidator and liquidity provider within its specialized niche, acquiring distressed funds and mandates from forced sellers at attractive prices. Indeed, Sprott has a track record of acquiring "dislocated" funds and asset management mandates—such as Uranium Participation Corporation, Central Fund of Canada, and Tocqueville's gold strategies—at highly attractive valuations.

Finally, Sprott's focused market position and modest size create an embedded takeover option that provides downside protection during severe bear markets. Large asset managers seeking instant market leadership in precious metals or critical materials could readily absorb Sprott, likely at valuations that significantly exceed the firm's current market price. This strategic value should represent a natural floor beneath the equity, ensuring that patient investors benefit regardless of short-term market conditions.

Constraints

After more than a decade of chronic underinvestment in resource development, the world now faces Multiflation—including mounting shortages in essential commodities—just as AI, aging infrastructure, geopolitical tensions and other factors drive demand for the fundamental building blocks of civilization. As we wrote in January 2021, when the Sorcerer’s Apprentice was first published privately:

The world cannot continue indefinitely running on the hyperreal services provided by the Tech giants and financial alchemists, but rather must pay attention to the material things that supply our real, more basic needs; things without which Amazon would have nothing to deliver us and Facebook no means to talk or listen to us. It is time to stop obsessing about electrons and to start concentrating on neutrons and protons, too.

This observation has only grown more urgent since publication; Sprott operates at the intersection of necessity and scarcity—a strategic position that will become increasingly valuable as structural supply deficits collide with surging demand across critical materials. Through its product offerings, Sprott positions itself as a primary conduit for capital seeking to capitalize on these Constraints.

The Sprott Physical Uranium Trust exemplifies this strategy's power. Launched in 2021, it has rapidly ascended to become the world's largest vehicle for direct uranium investment, protected by formidable competitive moats that render replication at scale extraordinarily difficult. The operational complexity, regulatory hurdles, and specialized expertise required to source, purchase, transport, and store physical uranium create exceptionally high barriers to entry.

The firm's copper expansion strategy targets the massive tsunami of long-term demand emerging from grid infrastructure modernization, renewable energy deployment, data center proliferation, and the voracious power requirements of artificial intelligence systems. This surging demand confronts a supply landscape scarred by decades of underinvestment in new mines, steadily declining ore grades, and development timelines that stretch across multiple economic cycles.

Dislocations

Sprott's strategy is deeply aligned with the "Dislocations" Archetype, positioning the firm to capitalize on market stress, contrarian viewpoints, and the mispricing of "unloved" assets. The entire Sprott brand is built upon a contrarian ethos, a willingness to venture beyond conventional investment strategies and challenge consensus thinking. Its core products are, by their very nature, expressions of a view that runs counter to the prevailing narrative of perpetual low inflation, central bank omnipotence, and the unassailable stability of the fiat currency system.

Other than its focus on gold and natural resources, the firm's alignment with this archetype is most tangibly expressed through its corporate acquisition strategy, which can be accurately described as a form of dislocation arbitrage. Sprott's M&A playbook deliberately targets niche, fragmented, or "unloved" commodity-focused funds and managers. While volatility in these markets deters many investors, Sprott's expertise, institutional infrastructure, and balance sheet allow it to deploy capital as others retreat and position the firm to capitalize on fundamental supply-demand imbalances that could persist for years.

Multiflation Scenarios

Reflationary Boom +/- Mixed or Uncertain Performance

While a "risk-on" environment might draw some capital away from commodities and defensive assets like gold, Sprott benefits from general asset price inflation. The key vulnerability is commodities dramatically underperforming broad equity markets, potentially leading to modest outflows or slower growth.

Stagflationary Grind ++ Very Strong Performance.

This is likely Sprott's ideal environment. High inflation and low growth destroy the appeal of both traditional equities (margin compression) and bonds (negative real yields), forcing capital into monetary alternatives. Gold and silver thrive, driving Sprott's AUM and fee revenue higher in a period of widespread economic discoordination.

Hyperinflationary Blow-off ++ Very Strong Performance

In a terminal phase of competitive monetary debasement, there would likely be a panicked flight to Sprott's physically-backed products and their commodities funds and expertise. Its role as a trusted custodian and manager of real assets would be paramount. The value of its AUM would likely soar in both nominal and real terms, leading to exponential growth in fee revenue and profits.

Severe Deflationary/Credit Shock - Negative Performance

A sharp credit seizure where fiat cash becomes king could be challenging. Gold and commodity prices would likely fall in the short-term. The "safe haven" narrative would potentially be temporarily eclipsed by a desperate need for liquidity. Sprott's debt-free balance sheet ensures survival, but its earnings would suffer.

Geopolitical Fracture & Supply Seizure + Positive Performance

Major conflict would trigger a flight to non-sovereign, politically neutral assets outside the traditional banking system. This directly benefits gold. Furthermore, a focus on energy security would highlight the strategic importance of uranium, boosting its Uranium Trust. An environment of protectionism, resource nationalism, geopolitical conflicts, and supply chain vulnerability enhances the appeal of Sprott offerings.

Policy Whiplash & Price Controls + Positive Performance

Erratic central bank policy and government interventions like price controls create profound uncertainty and undermine faith in fiat currency, driving capital towards Sprott's offerings. One risk is that the commodities and funds could be targets of windfall taxes or confiscation.

Technological Dislocation +/- Mixed or Negative Performance

Technological dislocation presents structural risks, for example as gold-backed stablecoins and tokenized commodity products offer potentially superior alternatives to traditional closed-end funds. These solutions could capture flows that would otherwise benefit Sprott or trigger outflows from existing products. Meanwhile, breakthrough technologies in extraction, substitution, or energy production could undermine the scarcity dynamics that underpin commodity valuations themselves.

HyperBitcoinization -/- Mixed or Negative Performance

Bitcoin’s ascendance as the dominant monetary alternative would disadvantage gold relative to bitcoin, though Sprott’s gold and commodities exposure should still benefit in real terms as stores of value outside the fiat system.

Untapped Value & The Opportunity Ahead

Yet despite embodying all five Archetypes, Sprott hasn’t fully capitalized on these strategic advantages—held back, for example, by compensation structures that dilute operating leverage and perhaps overly-conservative product development and marketing. We’ll explore these constraints and potential opportunities for enhancement if there is sufficient reader interest—share your thoughts in the comments or reach us by email.

great industry and business pick, but i'm surprised that you don't even mention any valuation metrics. i liked SII more last year and now am wondering if it's close to full value at 31x next year PE?

Thanks again for the great call on SII and the content overall, 10/10!