The "Paper Bitcoin" Razor: Proof-Of-Alignment

Bitcoin Treasuries Part V: A Lesson In The Dark Arts—How Not To Get Rekt (A Postmortem)

Summer lovin’ had me a blast

Summer lovin’ happened so fast

…

Summer dreams, ripped at the seams

But, oh

Those summer

Nights!

Throughout Paper Bitcoin Summer ‘25 we warned that the proliferation of Bitcoin treasury companies (BTCTCs) paralleled the ill-fated investment trusts of the 1920s (here). Both eras witnessed the fleecing of credulous retail investors by promoters through insider grants, misaligned incentives, and financial alchemy.

But the current episode also introduced influencers who harvest in-group affinity and trust amongst Bitcoiners—peddling paper promises as somehow aligned with Bitcoin’s vision and values via a deluge of podcasts and conferences.

To efficiently slice through hype and reveal whether promoters genuinely hold their convictions—or are cynically capitalizing on the community they claim to serve—we propose the Paper Bitcoin Razor™: an instant, binary “proof of alignment” fiduciary audit test for BTCTCs modeled on Bitcoin’s own “proof of work.” We have also distilled the Razor into a ChatGPT prompt—soon to be published separately—that empowers investors to do their own due diligence.

What follows will be of interest to all investors, even those who don’t care about Bitcoin or BTCTCs. Understanding the secret “dark arts”—decoding how insiders actually get paid and what behaviors those incentive structures reward—is prerequisite knowledge for investment survival during the Golden Age of Grift.

Twitter/X: @bewaterltd Web: bewaterltd.com

This article reflects opinion and analysis, not investment or legal advice. For entertainment, educational, and informational purposes only. All views expressed represent personal opinions based on public information. Throughout this series, ‘BTCTCs’ refers broadly to the growing class of publicly traded companies holding Bitcoin as a treasury asset. The observations here concern recurring patterns visible across multiple firms’ SEC filings and are not directed at any single issuer. Nothing herein should be interpreted as an allegation of misconduct or criminal behavior. References to companies, executives, promoters, or influencers are made for contextual and educational purposes only. Readers should conduct their own due diligence. See full Disclaimer.

Paper Bitcoin Winter

Experience is what you get when you didn’t get what you wanted.

—Randy Pausch

Retail investors fleeing fiat debasement and centralized intermediaries leapt from the frying pan into the fire, ultimately forfeiting their wealth to the very types of incentive misalignments Bitcoin was designed to solve.

The Paper Bitcoin bonfire combusted more rapidly than even we anticipated. In the span of mere weeks, investors’ Paper Bitcoin “wealth” was incinerated—50%-98% drawdowns were not abnormal even as Bitcoin itself flatlined, relegating many of the BTCTCs to penny stock status. Tim Kotzman’s Bitcoin Treasuries Newsletter captured the scale of the conflagration: the recent crop of BTCTCs consumed approximately US $17 billion of wealth, and of the ~168 public companies holding Bitcoin, ~15%-25% now trade at a discount to NAV.

Take No One’s Word For Anything

If investors take away nothing else from this experience, let this be permanently seared into their consciousness: Nullius in verba, or “take no one’s word for anything”.

While Bitcoin itself may be a trustless asset, no such trust should automatically be afforded to “suitcoiners” who grant themselves outsized awards up front—enabling the pocketing of generational wealth before delivering even a single ₿ “satoshi” of value—and who can continuously conjure endless paper Bitcoin out of thin air to further benefit themselves at shareholder expense.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

—Satoshi Nakamoto

The root problem with Bitcoin Treasury Companies is all the trust that’s required to make them work. Management must be trusted not to self-deal and debase shareholder equity, but the history of these companies is full of breaches of that trust.

—Mushin Nakamoto

A “Flood Tide Of Corporate Larceny”

The executive—he who is not the shepherd—profits when the flock perishes, for he is only a hireling and cares nothing for the sheep; the steward—the good shepherd—bleeds with the sheep.

—John 10:12–13, paraphrased

BTCTC management teams notably avoided bleeding alongside their shareholders; their compensation arrangements typically ensured that they remained insulated from—and in many cases indirectly profit from—the wealth destruction suffered by their shareholder “plebes”.

As we detailed in Lessons From The 1929 Crash:

What began [in the 1920s] as innovation quickly became exploitation…this was not an era of isolated bad actors, but a systemic opening for opportunism fueled by rising prices and vanishing ethics.

The most lucrative role in the trust boom wasn’t investor—it was promoter…insiders extracted value both upfront and continuously through fees, while public buyers bore the ultimate risk…

Like the 1920s trusts, today’s Bitcoin treasury companies often feature similar arrangements—founder allocations, insider stock options, and incentive packages for promoters and podcasters. This time, however, such mechanics are disclosed under SEC rules designed in response to the very abuses of the 1920s. But transparency neutralizes neither risk nor incentive distortions…

American enterprise [in the 1920s] “had welcomed an exceptional number of promoters, grafters, swindlers, impostors, and frauds,” creating “a kind of flood tide of corporate larceny.”…“One could indulge in all manner of dubious financial practices with an unruffled conscience so long as prices rose. The Big Bull Market covered a multitude of sins. It was a golden day for the promoter, and his name was legion.”

How did so many investors—many of them sophisticated Bitcoiners who pride themselves on understanding economics and incentive structures—fall victim when all the warning signs were there?

The “Dark Arts”: A Blueprint For Self-Preservation

The answer lies in understanding not only the historical context and reflexive alchemy covered earlier in the series, but in mastering the secret ‘dark arts’ that decode how management teams can legally enrich themselves at shareholder expense—even when everything is transparently disclosed within the SEC filings.

Ferris Bueller’s Day Off & The Great BTCTC Joy Ride

We’ve studied the “dark arts” and analyzed corporate governance (and misgovernance) for what feels like eons, and we are hardly naïfs. But if the dog below represented us before reviewing the BTCTC and Digital Asset Treasury (DAT) executive compensation agreements and other SEC filings:

Then this is us after reading them:

This essay was originally written as a lengthy forensic analysis featuring compensation agreements and SEC filing screenshots juxtaposed against management and director statements.

Instead, we decided to publish a high-level overview of the “dark arts” that enabled this legal wealth transfer from retail to insiders—a blueprint applicable to any company, not just Bitcoin Treasuries.

We’ve also developed a stripped-down version of our proprietary “dark arts” framework—delivered as a forthcoming ChatGPT prompt designed to arm retail investors with some of the tools necessary to detect red flags before risking their retirement or college savings on a trendy Paper Bitcoin story.

We chose this format since few nowadays have the attention span to wade through a dense technical exposition on corporate governance. But there’s a deeper reason, as well: we want to teach you to fish rather than simply feed you. Our goal is not just to show you our work, it’s to empower you to do your own—investing requires learning skills that come from doing and not only from reading.

When people are handed “the answer” on a silver platter, they rarely develop a genuine understanding of the principles required to protect themselves in the future. Others can now learn experientially—by putting in the work—but with an advantage we lacked: a tireless AI tutor available at any hour that adapts to their pace and questions.

“Zoom Out,” Diamondhands

TreasuryCo managements and Bitcoin influencers frequently admonish investors to “zoom out” and focus on long-term value creation to understand BTCTCs:

Watch What They Do, Not What They Say

Dark Arts 101

Compensation structures are inadvertent confessionals of the corporate soul.

They reveal not only management’s motivations but strip away the gilded rhetoric to expose how management truly views shareholders—as owners or marks.

BTCTC management and their favorite podcasters may vociferously proclaim that BTCTCs are an “amplified” Bitcoin proxy and that their investors need to “hold for the long-term.” Unfortunately, in the overwhelming majority of cases, their actions very clearly do not match their rhetoric: they are paper hands to your diamond hands.

In our opinion, BTCTCs are amplified Bitcoin proxies—but only for insiders. In the overwhelming majority of potential outcomes, the payoff for insiders is asymmetrically positive, while the payoff for shareholders—at least relative to Bitcoin—is asymmetrically negative.

If we “zoom out” over the long-term, it seems likely that shareholders in these companies will tend to underperform Bitcoin in a bull market and significantly underperform or be wiped out entirely during a bear market. Shareholders can even be wiped out when Bitcoin does nothing—as we’ve seen recently.

As we demonstrated in Steal This Prompt, BTCTCs are highly path-dependent—only the narrowest set of future scenarios are likely to avoid disappointment for long-term BTCTC shareholders. During a BTCTC bull market, new competitive entrants emerge and existing BTCTCs dilute shareholders through exponentially-increasing share issuance and insider compensation structures that cap BTCTC upside versus Bitcoin. If the BTCTCs enter a bear market loaded with too much leverage, or if their stocks trade below the value of their underlying Bitcoin holdings for an extended period, it’s likely game over.

In most scenarios, therefore, the payoff structure for shareholders resembles a particularly unfavorable options strategy: as the stock price falls, the company is effectively selling more and more put options on its own shares, while simultaneously writing covered calls against those shares that cap upside during relief rallies in the stock.

One could certainly quibble over the details of our analysis, but nullius in verba: don’t take our word for it. If we “zoom out” to the big picture conclusion—that these companies will underperform Bitcoin in both directions—and then “zoom in” to examine management compensation schemes, it becomes crystal clear that insiders agree with us.

For anyone possessing the skill to read between the lines, the message is written in comically large, blazing neon letters: they do not truly believe that they can outperform Bitcoin as a benchmark. That is precisely why their compensation agreements are written the way they are.

The Paper Bitcoin Razor

BTCTCs exist for one reason and one reason only: to significantly outperform Bitcoin. If they fail at their raison d’etre, they serve no purpose for shareholders.

This simple truth yields an equally simple test to separate the wheat from the chaff—the Paper Bitcoin Razor—that instantly proves whether or not management and boards truly believe that they can outperform the Bitcoin Hurdle Rate by verifying their alignment with shareholders.

We modeled the Paper Bitcoin Razor on the governance gold standard established by Bitcoin governance expert Pierre Rochard, author of the seminal Speculative Attack essay:

“Proof-Of-Alignment” Test

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it.”

—Upton Sinclair

Pierre has succinctly articulated what should be the non-negotiable foundation of every Bitcoin Treasury Company: a standard so self-evidently correct that any deviation from it likely becomes an instant disqualification for long-term investors. Just as Bitcoin’s integrity relies on “proof of work,” BTCTC integrity relies on “proof of alignment”—compensation structures that are tied solely to outperforming Bitcoin over the long term.

The very first question that shareholders should ask management teams and boards—and then “trust but verify” independently through SEC filings and our forthcoming ChatGPT prompt, following our mentor’s methodology—is whether their compensation agreements conform to Pierre’s gold standard:

Other than a nominal salary, is your compensation structure tied exclusively to the out-performance of your common share price versus Bitcoin—subject to a cumulative high water mark—and are you handcuffed alongside shareholders for a long period of time (say, a minimum of five years) with no way to sell, hedge, or cash out in the interim?

If the response to this test is anything other than an unequivocal one word answer—“YES”—then they are inadvertently revealing everything you need to know.

Watch What They Do, Not What They Say

Dark Arts 101.b

Actions Speak Louder Than Words.

Incentives Matter More Than Assurances.

If Bitcoin is truly the “hurdle rate” and BTCTC shareholders must “zoom out”, then why are managements themselves so strongly incentivized to “zoom in”? This disconnect between rhetoric and reality lies at the heart of the dark arts.

The fact that few—if any—of the management teams and boards whose filings we reviewed have chosen to hold themselves to the gold standard of BTCTC governance perhaps reveals something telling about their “corporate soul”: their true beliefs, priorities, and “revealed preferences.” For all their sanctimonious invocations of the Bitcoin Standard ethos, they appear to be at least as “fiat-brained” and “high time preference” as anyone else in our Golden Age of Grift.

Never forget that as a BTCTC shareholder you only win when your shares appreciate faster than Bitcoin itself. If insiders have ever received or will ever receive compensation tied to any outcome other than this—or if they’re compensated over a shorter time horizon than the holding period they recommend to you—then they are fundamentally playing a different game than you are.

For example, when management receives upfront and annual equity grants that are not tied to the Bitcoin Hurdle Rate, any additional bonuses paid for exceeding the hurdle are essentially a series of free lottery tickets for them. They’ve already secured generational wealth through the base grants regardless of shareholder returns, so the performance bonuses tied to the Hurdle Rate cost them nothing—but do provide convenient cover to claim alignment with shareholders when challenged about incentives.

This misalignment festers regardless of how earnest and genuine management and boards appear, how deep their knowledge of Bitcoin runs, how strong their professed adherence to the ethos of Bitcoin, or how compelling their vision sounds. When incentives diverge, trust the compensation structure over the story every time.

The BTCTC filings reveal a veritable rogues’ gallery of techniques that allow insiders to earn generational wealth even as shareholders are left holding the proverbial bag. Rather than cataloging every variant we encountered, we’ll highlight several particularly instructive classes of examples that cut to the heart of the problem.

“Zoom In” On Fiat Incentives: Monkey Math Metrics

BTCTC management teams trumpet—and typically tie a large portion of their compensation to—impressive-sounding metrics parroted ad nauseam as mantras on podcasts and company conference calls: Bitcoin-Per-Share, Bitcoin Yield, Bitcoin-Rate-Of-Return, Bitcoin Torque, Bitcoin Amplification, Total Bitcoin Stack, and so on. Many go so far as to claim that optimizing for these metrics is part of their sacred fiduciary duty.

These metrics may prove useful in analyzing BTCTCs, but as management compensation and fiduciary targets they create a fundamentally irresolvable misalignment between management and shareholders. Compensating on these metrics effectively enables management teams to “grade their own tests”—to reverse engineer their own path to short-term enrichment—while simultaneously spinning a tall tale to investors that these metrics create long-term value and that everyone else should remain patient for the eventual payoff.

Insiders are able to earn compensation in the short-term for activity of dubious value—regardless of whether the Bitcoin Hurdle Rate is ever met.

These are therefore convenient metrics for management to (mis-)direct attention toward precisely because they are nothing more than financial engineering constructs. Superficial accounting sleight of hand allows them to easily manipulate and boost the numbers—and therefore their own compensation!—to the mistaken applause of retail shareholders, all without necessarily creating any genuine value versus the “Bitcoin Hurdle Rate” that investors should actually care about.

Consider, for example, how preferred shares marketed as ‘digital credit’ might create this dynamic: management issues preferreds to acquire Bitcoin, which mechanically boosts Bitcoin-Per-Share and triggers their compensation. But those preferreds are effectively equity in disguise. Without operational cash flows, BTCTCs must eventually issue common shares to pay the preferred dividends, creating a circular dilution machine in which management extracts real compensation based on an artificially inflated metric that ignores the future dilution obligation embedded in those preferreds. And remember: “accretive dilution” only works when BTCTCs trade at an mNAV premium sufficient to absorb the equity issuance; otherwise it’s simply “dilutive dilution” with a management payday baked in.

Once again, a simple acid test can immediately reveal the strength of insiders’ conviction: ask whether compensation tied to these metrics should vest only after achieving a minimum of five-year cumulative share price outperformance versus Bitcoin (again, subject to a high water mark)—allowing management to put their own money where their metrics are.

Pay-for-Plummet

“I rob Bitcoin Treasury Companies because that’s where the money is.”

—Willie “Laser Eyes” Sutton, probably

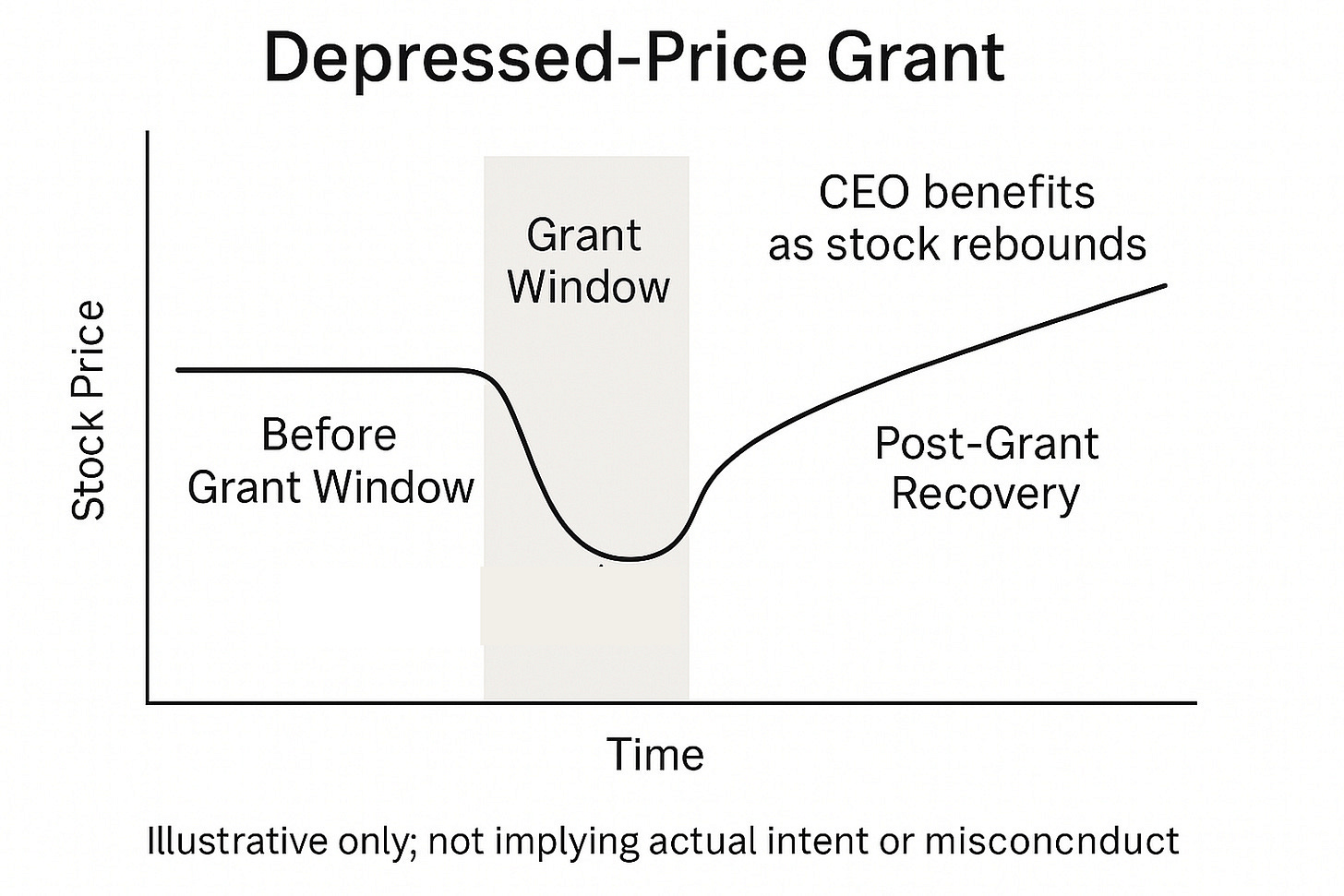

Another common pattern we identified involves structures whereby the mathematical incentives become outright perverse—scenarios wherein management can actually benefit from shareholder misery, after which they own more shares and profit from any recovery in the share price.

This represents a perhaps even more questionable variant of the “spring loaded option grants” that dark arts ninja Mike at NonGaap dissected. However, these depressed-price grant incentives operate through a distinctly troubling mechanism. BTCTC management teams have available to them asymmetric information and certain unique levers through which they could effectuate share price depression should they succumb to the temptation to pull them—or at the very least find themselves not particularly incentivized to take actions that would prevent the share price from cratering.

Note: pointing out the perverse incentive structure at play is not equivalent to alleging that management acted on these incentives. Neither is highlighting the perverse short-term incentives equivalent to claiming that management lacks any incentives for long-term value creation.

The illustrative table below, using a hypothetical scenario, highlights the striking inversion of incentives with this sort of grant: the worse the short-term stock performance, the richer management’s payday upon rebound:

Keep this in mind when insiders protest that they “haven’t sold a share”—that may be technically true (although double check to ensure that all possible hedging and selling-adjacent activity is explicitly prohibited in their contracts), but they also haven’t needed to sell due to incentive structures like this: they may be awarding themselves more shares at lower prices anyway.

The same perverse incentives infect even routine annual equity compensation. For BTCTCs, even “normal” annual equity grants to management and directors create a fundamental misalignment with shareholders: management profits from stock price recoveries even if the stock is catastrophically underperforming Bitcoin.

Shareholders require significant cumulative outperformance versus Bitcoin itself to make their investment worthwhile; management only needs the stock to appreciate from whenever they decided to pay themselves, creating a heads-I-win-tails-you-lose dynamic.

Note: granting fixed shares is perhaps slightly less problematic than granting fixed dollar amounts—for reasons illustrated in the table in the section above, namely that the share count doesn’t mechanically increase as the price falls—but both create significant misalignment with shareholders.

Inside(r) Influencer Industrial Complex

Bear in mind that many of the metrics shareholders analyze to judge the progress of BTCTCs may not account for the full cost of the marketing machinery required to keep capital—and therefore Bitcoin—flowing into these companies. Enter one of the most expensive line items you’re unlikely to see properly accounted for, despite being integral to the business model (such as it is): the compensated insider and influencer sales force.

BTCTCs depend on continuous access to capital markets and enthusiasm for their securities—they therefore require a steady stream of buyers for their stock and “digital credit” offerings to fund Bitcoin acquisitions. To help manufacture this demand, many have turned Bitcoin influencers and podcasters into a compensated promotional force for their stocks and bonds through cash pay, equity grants, and board seats. This is not altogether dissimilar to an affinity-driven, multi-level marketing-adjacent promotion funnel, wherein community trust becomes a distribution channel for equity and “digital credit” rather than Tupperware and dietary supplements.

These influencers may promote BTCTC stocks to their audiences while their compensation—typically disclosed deep within SEC filings—creates at the very least the appearance of a conflict of interest. The influencer may profit, for example, when the stock rises from their grant price, regardless of whether it beats Bitcoin or creates genuine value.

We will await additional details—including proxy filings and accurate fully diluted share counts—but it would not surprise us to see that disclosed stock awards to the BTCTC insider ‘influencer’ community cumulatively total in the tens if not hundreds of millions of dollars, with more on the way. These influencers may face their own perverse incentive to liquidate shares as quickly as contractually allowed, knowing that future grant tranches are already queued behind them while ongoing equity issuance across the capital structure will dilute their existing holdings—essentially selling before the coiled spring weakens or snaps entirely.

The “Paper Bitcoin Razor” Prompt: DIY Due Diligence

We’ve created a ChatGPT prompt—currently undergoing final testing—that analyzes BTCTC compensation structures and SEC filings to identify the “dark arts” at work. There was little guesswork involved; the reason that we were able to write it so effectively is that we had already unearthed exactly where the bodies are buried—at least until the full proxy statements are filed next year, at which point we will likely discover the location of additional unmarked mass graves.

Think of it as a treasure hunt where you’re searching for buried red flags instead of gold—except in this case, finding treasure means discovering misaligned incentives before they cost you money. Upload company filings, ask questions, and get plain-English explanations of what compensation structures actually incentivize—cutting through management rhetoric to see if they pass the Paper Bitcoin Razor.

Conclusion: Not Your Keys, Not Your Coins

Reminder: not investment, financial, or any other kind of advice.

Throughout our careers, we have learned one painful lesson at great cost: no matter how compelling the underlying asset may appear, or how attractive the story being told about it, when management’s incentives fundamentally diverge from those of shareholders—particularly regarding upside potential and downside exposure—prudence demands that one step back and reassess the investment.

The Paper Bitcoin Razor arguably speaks louder than all of the BTCTC podcast episodes and conference presentations combined. Insiders are broadcasting very clearly—through actions rather than rhetoric—that they do not believe they can beat the Bitcoin hurdle rate. When someone shows you who they are through their compensation structures, it’s usually best to believe them.

Given that BTCTC managements have revealed their “corporate souls”—or lack thereof—through their compensation agreements, they have arguably earned themselves a prolonged “penalty box” discount to NAV through governance misalignments alone, let alone business model issues.

Bitcoin investors still interested in investing in BTCTCs despite these revelations would do well to abandon the “diamond hands” mentality and view these vehicles instead as—at best—trading sardines rather than eating sardines. Those who do decide to undertake these risks with eyes wide open should know that mastering the “dark arts” is essential to ensure that management’s incentives are at least temporarily aligned with their own.

As for those select BTCTC management teams and boards that intend to take their fiduciary duties seriously, we may follow up in a later essay offering “light arts” constructive criticism —a roadmap for differentiating yourselves from the pack, both operationally and through governance—and demonstrating that BTCTCs can transcend their current reputation as “cynical dilution juggernauts” engineered to enrich insiders.

Until then, never forget: nullius in verba.

Not Your Keys, Not Your Coins