The Forgotten Man

The 2008 Crisis Never Ended

Do you wish to know [when] that day is coming? Watch money. Money is the barometer of a society’s virtue. When you see that [commerce is conducted], not by consent, but by compulsion—when you see that in order to produce, you need to obtain permission from men who produce nothing—when you see that money is flowing to those who deal, not in goods, but in favors—when you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you–when you see corruption being rewarded and honesty becoming a self-sacrifice—[then] you may know [that day has arrived]…

—Francisco d’Anconia

No Country For Young Men

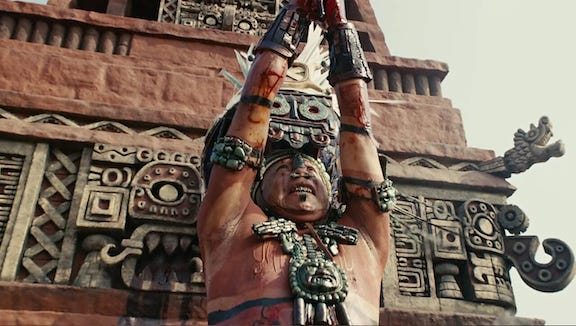

For most of America, the headlines trumpeting a “strong economy” and “stocks at record highs” land like a cruel joke. Michael W. Green’s recent series My Life Is A Lie attempted to quantify the economic devastation felt by the majority of the country these many years. This carnage has been sanctified by our technocrats—an Aztec priesthood invoking sacred economic statistics as celestial omens to justify the ritual sacrifice of society on the altars of GDP and the S&P 500.

Green, an investment industry insider, gave voice to the Forgotten Man:

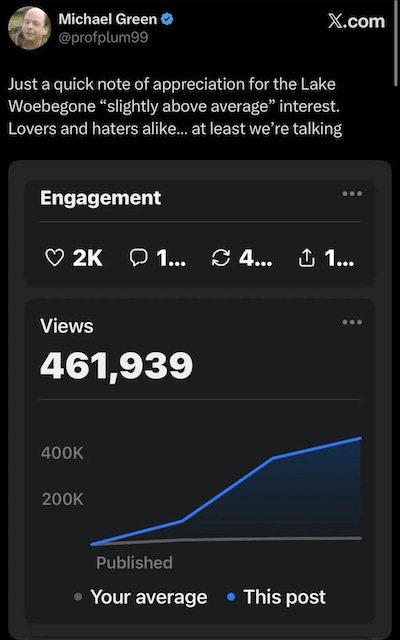

Predictably, the priesthood declared heresy. Economists, journalists, thought leaders, think tanks, and other fellow travelers circled the wagons, tearing apart Green’s numbers, splitting hairs, and nitpicking his methodology.

That is a grave mistake.

Fiddling While Rome Burns

How can you expect a man who’s warm to understand a man who’s cold?

—One Day in the Life of Ivan Denisovich, Alexander Solzhenitsyn

This sort of wonkish debate—whether the poverty line is $30k or $140k, whether CPI is 2% or 4%—exemplifies the scientism enabling our national dissolution: the religious belief that the statistical map is more real than the economic territory. Perhaps such effete technocratic sophistry could be tolerated—even indulged—were the body politic unified. But it is a fatal conceit in such a Balkanized powder keg of a nation.

Into this highly combustible environment, Green’s essays landed like an errant spark. If nothing else, Green forced a long-overdue reckoning with a reality that the credentialed class has steadfastly refused to acknowledge: that they themselves have spent decades drowning the American Dream in a flood of ruinous policy, even as they now insist that the water level is perfectly fine and that Americans are simply bad swimmers.

Such an acknowledgment, however, would be tantamount to confessing that their entire worldview—the long Postwar Consensus—rests on a meticulously constructed lie. That the intellectual facade of modern finance and economics, the modern monetary system and central banking, fiscal and monetary policy, financialization, globalism—all of it—has strip-mined the nation and fracked the American bedrock, leaving behind a slag heap of poverty, misery, and rage in place of the prosperity it promised.

That their own lives have been a lie.

From Picket Fences To Shoebox Micro-Apartments

The party told you to reject the evidence of your eyes and ears. It was their final, most essential command.

—Winston Smith

Whether Green’s numbers withstand academic scrutiny is altogether beside the point. His essays struck such a visceral nerve because Green—as someone with institutional investment credentials—put numbers to what millions have experienced firsthand for decades. And he did so at precisely the moment when their long-simmering rage is boiling over.

And then the Minnesota headlines broke.

If Green’s essays were a stray spark drifting toward the powder keg, these revelations of fraud represented a blazing torch hurled straight at it. Billions have been bled from the American middle class—those who can barely afford their own children—to bankroll the imaginary children of fraudsters.

But the scale of the plunder extends far beyond one state:

The populace’s rage, therefore, springs from a well far deeper than Green’s economic statistics—or any one else’s, for that matter—could ever fully plumb. Understanding this fury—and its implications for both our civilization and our portfolios—requires returning to an existential question we posed five years ago: how did we devolve from the society depicted in the New Yorker’s 1957 Christmas cover (left) to that depicted in its 2020 Christmas cover (right)?

These two contrasting images—set six decades apart—bear witness to a birthright betrayal so absolute that it defies measurement. The transformation seems inconceivable: in the course of a single lifetime, how did the most prosperous civilization in history come to cannibalize its children's futures?

Asked differently, how could prior generations buy houses, raise families, and afford healthcare on a single income—and then retire—while younger generations drown in debt, face bleak job prospects, are cursed to rent forever, risk financial ruin from hospital visits, and accumulate pets rather than rear children?

Why do so many feel worse off than even a decade ago, despite record asset prices and strong GDP growth? And why has this malignancy metastasized simultaneously throughout the Western world—the US, Europe, Canada, Australia?

The answers won’t be found in economic textbooks, models, and policy papers that led us here in the first place. Nor will they emerge from the clerisy who authored them:

But answer these questions, and the chaos of our age suddenly resolves into clarity: not only the financial stress, but the seething rage erupting across Western nations worldwide. The collapse not merely of institutional trust, but of societal trust writ large. The rise of populism and politically motivated violence. The pervasive sense that the very fabric of civilization—if not reality itself—is being torn apart at the seams. The gnawing feeling shared by ordinary people that they are struggling to survive a precarious interlude before some major cataclysm strikes.

Mr. Market’s Schizophrenic Break Of 2020

The madness of the 2020-2021 COVID era was apocalyptic—literally a lifting of the veil: governments induced a global economic coma yet asset prices—the economy’s vital signs—registered euphoric highs. It was as if a comatose patient's monitors indicated an Olympic athlete in peak condition—the clearest illustration of what Green is now attempting to quantify.

Meme stocks, fake currencies, and bankrupt companies—indeed all assets—went parabolic even as the economy flatlined.

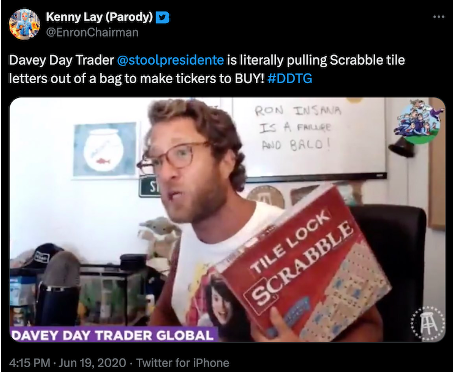

We call this period Mr. Market’s Schizophrenic Break, the absurdity of which was perhaps best encapsulated by David Portnoy (aka “Davey Day Trader”) picking stocks out of a scrabble bag on Twitter and CNBC—a strategy that consistently worked!

The Financial Matrix

Portnoy himself saw through this surreal facade during the height of the COVID market mania:

The good news is I know it’s rigged. The government is [saying] don’t worry we’re just gonna create a trillion-billion-zillion dollars. It’s fantasy land. It’s Schrute Bucks [fake money from a popular TV show]. It’s the worst coronavirus day in a while and the government is saying don’t worry about it cause we’re gonna print a quadrillion dollars and the market sky rockets. The stock market is disconnected from reality. The whole thing is a pyramid scheme. We’re living in the Matrix.

Portnoy wasn’t merely ranting, however—he had unwittingly laid bare the central economic mystery of our age, one that somehow eluded our credentialed classes: that the numbers and charts streaming across Bloomberg terminals had become utterly divorced from the reality of everyday life.

In this inverted Bizarro World, bankruptcy was bullish, currencies invented as a joke were enormously valuable, and picking stocks from a Scrabble bag was a wise investment strategy.

With a degenerate gambler’s uncanny intuition for detecting rigged games, Portnoy had stumbled onto a profound truth: that financial reality had somehow been replaced with an elaborate, videogame-like simulation—the Financial Matrix. This self-contained universe was governed by its own laws and utterly indifferent to the world it was supposed to represent.

The 2020-2021 COVID madness represented the reductio ad absurdum toward which the entire post-War policy consensus had been hurtling—the culmination of decades of pathology that had metastasized to such absurd extremes that it became impossible to ignore even for laymen like Portnoy and his “degen” followers.

But while Portnoy had correctly identified the symptoms, he had not diagnosed the underlying disease. Five years ago this month—amidst the heights of the COVID market mania—we set out to identify the cancer at the heart of the global financial system, to understand how virtual reality had replaced reality, and to assess the implications for investing.

The result was The Sorcerer’s Apprentice & The Man Who Broke The Markets. In Sorcerer, we traced the vectors of metastasis—monetary, memetic, algorithmic—that had spread through the global financial system, mapping the ways this cancer would ultimately upend markets, economies, and societies worldwide.

We originally published Sorcerer privately in January 2021. However, as the pathologies we diagnosed then have only intensified in the interim, we felt compelled to expand and update the work for a public audience. This growing urgency also explains why Green’s recent series resonates so deeply now. The economic cancer we diagnosed in late 2020—having metastasized invisibly for decades, revealing itself only in occasional paroxysms, as in 2008—finally became impossible to ignore when the COVID policy response devoured economic reality itself in 2020-2021, and then in 2022 ignited the worst inflation in five decades.

The Day Is Come

The COVID years—and beyond—mark the fulfillment of Francisco d’Anconia’s prophecy. He exhorted us to watch the money—to read it as the barometer of a society’s virtue. He warned of the day when ‘money is flowing to those who deal, not in goods, but in favors’ and when ‘men get richer by graft and by pull than by work.’

Look around. That day is not coming; rather it is already here. Green’s essays and recent news headlines merely crystallized the gnawing suspicion that has haunted the American subconscious since at least the 2008 Crisis: that for decades the productive American citizen has been taxed and inflated into serfdom—forced to finance their own dispossession and the demolition of their way of life. Americans have been reduced to human batteries whose life force powers the Financial Matrix.

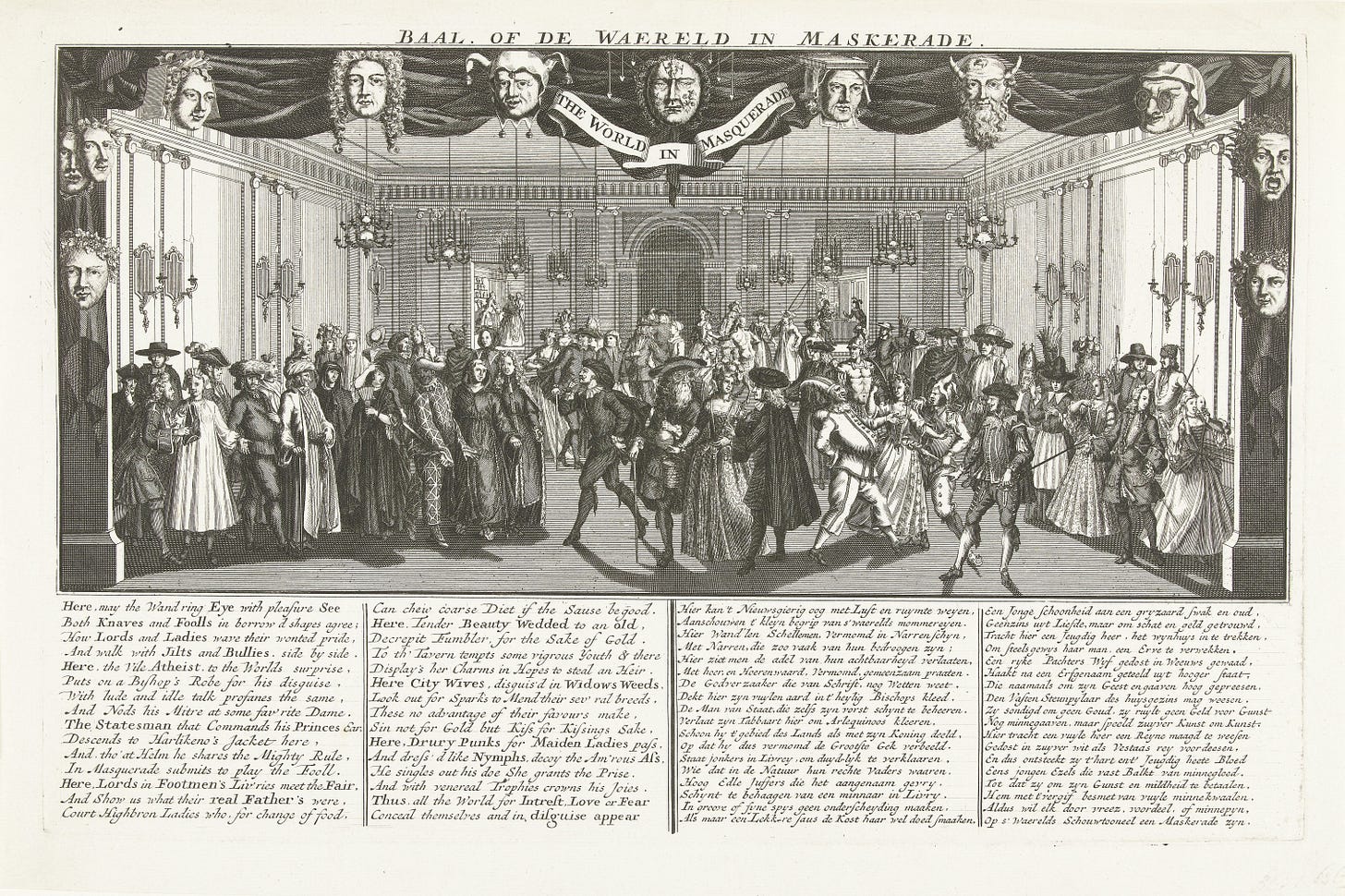

It is even now dawning on the citizenry that the “strong economy” and “record-setting stock market” are merely mirages conjured by the Financial Matrix—phantom metrics generated by and for the simulation. Meanwhile, in the ‘desert of the real,’ the productive have been treated as enemies, and “those who deal in favors” preside over a Witches’ Sabbath wherein swindlers parade as sages and vice dons the robes of virtue:

Here, corruption is rewarded and honesty has become a self-sacrifice—the laws no longer protect you against them, but protect them against you: “for my friends, everything; for my enemies, the law.”

Twitter/X: @bewaterltd | Mojo Website: bewaterltd.com

Not investment advice. For educational/informational purposes only. See Disclaimer.

Up Next: The End Of Illusion

In Part II: The End Of Illusion, we will examine the pincer now closing in on American—if not global—capital: the overt collectivism rising in major cities like New York and the command-economy dictates descending from Washington. As it becomes increasingly unwieldy to maintain the Financial Matrix’s illusions, those operating it—as well as those opportunists exploiting the mounting chaos created by the system—are abandoning the pretense of market mechanisms for more naked political control.

Whether the Financial Matrix can sustain ‘record highs’ in the stock market—at least in nominal terms—should now be of secondary concern.

The era of investing primarily for ‘Return on Capital’ has ended. The primary objective must now be ‘Return of Capital’—quite literally.

The investment ‘truths’ of the pre-COVID ‘Goldilocks years’ were a digital mirage, sustained only by the artificial logic of the Financial Matrix. Now, however, the code is glitching. As the simulation crashes headfirst into the volatile reality of Multiflation, rigid adherence to these old certainties is becoming a dangerous liability.

The pincer crushes what is fixed, yet cannot grasp what is fluid.

Be Water.

Stunning breakdown. The Portnoy scrabble bag anecdote captures everything in one absurd moment, when random selection outperformed professional analysis it basically proved the system had decoupled from fundamentals. I've watched this disconnect widen since 2020, and the thing that gets me is how many smart people are still pretending the old valution frameworks matter. Reality and the simulation diverged, and we're only starting to reckon with what that means for actual capital preservation.

Very interesting. I came over from Michael Green's substack. Well worth the trip;)