AI Flash Crashes & Meltups

The Rise of SkyNet: The Algorithmization Of Finance Part IV

Skynet goes on-line August 4th, 1997. Human decisions are removed. Skynet begins to learn at a geometric rate. Skynet becomes self-aware at 2:14 a.m. Eastern time, August 29th. In a panic, they try to pull the plug.

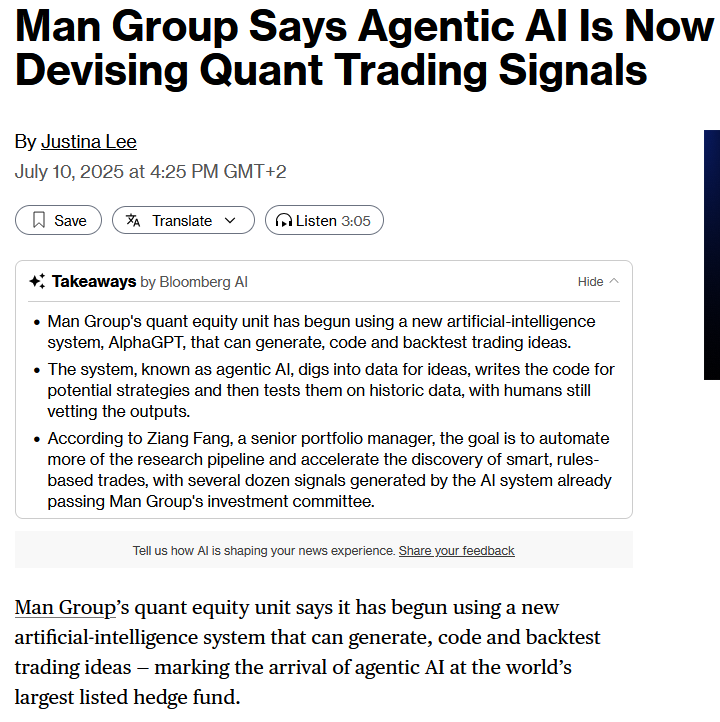

Man Group just announced that AI is now creating its own trading strategies—and several dozen signals have already passed their investment committee.

The Skynet series has been exploring what happens when AI and algorithms interact in the capital markets and economy: what do computer-mediated prices even mean?

Part I introduced HyperPrices through a thought experiment set in an imaginary Costco.

Part II thrust us into the unsettling reality of HyperPrices in our own world—from a $24 million Amazon book to a chaotic penny-pricing debacle.

Part III revealed that Skynet is already online in the financial markets, and humans are in retreat: our semi-autonomous digital decision-makers increasingly sideline human judgment.

Part IV reveals how the 2010 Flash Crash was just the beginning—a glimpse into the world of HyperPrices, Flash Crashes, Meltups—where $1 trillion can vanish and reappear in minutes based on nothing but code.

Read the full Part IV Black Box Bedlam on our website (link here):

Seems likely it'll just end up with over-fitted models which fail in the real world.