The End Of Illusion: Financial Repression Unmasked

Smash The Kulaks! The Forgotten Man Part II

The Forgotten Man—the productive middle class—has been reduced to a “coppertop battery” whose life force powers the Financial Matrix.

The Financial Matrix’s architects styled themselves Sorcerers, but proved mere Sorcerer’s Apprentices—summoning forces well beyond their control. Like the fable’s enchanted brooms, the Financial Matrix has taken on a life of its own, flooding the chamber—the global economy—and drowning civilization in the deluge.

In Goethe’s original tale, the Sorcerer eventually returns to break the spell; in our reality, however, there is no Sorcerer to restore order and halt the rising waters.

When civilization drowns, what Leviathans surface from the depths? And how do we preserve wealth in their wake?

Twitter/X: @bewaterltd | Mojo Website: bewaterltd.com

Not investment advice. For educational/informational purposes only. See Disclaimer.

Note: This is an exercise in Multiflation regime risk assessment, not partisan politics.

When Money Dies, Reality Dies

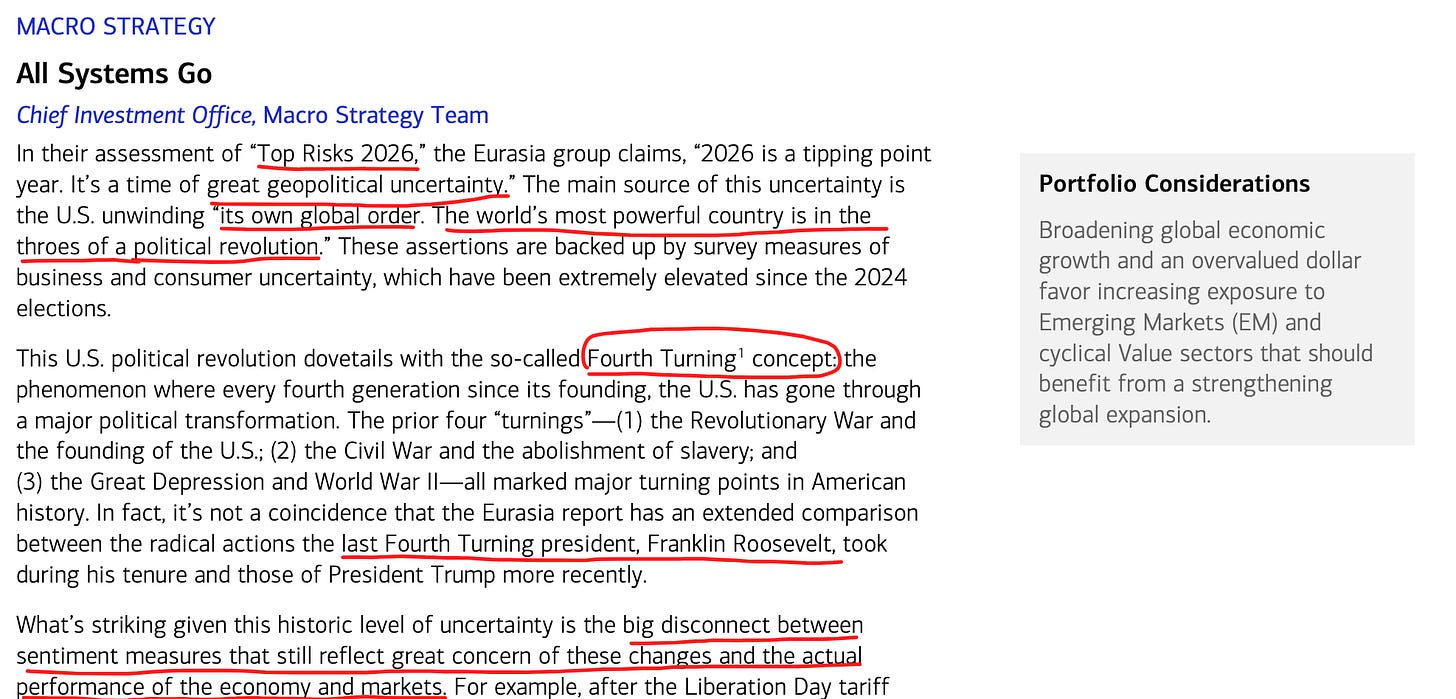

During COVID, our Sorcerer’s Apprentices lost control of their spell and devoured economic reality: the markets—if not society itself—suffered a schizophrenic break. Ever since, we’ve inhabited a world that feels increasingly like a fever dream; a glitching simulation in which the cause-and-effect logic of the past no longer applies:

While some attribute the gnawing sense that something is terribly wrong—that “nothing feels real”—to the rise of AI and social media, the roots of this dissolution reach far deeper—to the foundations of civilization itself.

AI and social media certainly intensify our disorientation, of course, yet such feelings of irreality are—and have always been—a defining feature of money’s death throes. Money is society’s operating system; when money dies—as it loses its meaning and value—so too does everything else: life feels increasingly hyperreal, a hollow facsimile of its former substance.

We are not the first society to experience this particular affliction. Well before the advent of AI deepfakes, Thomas Mann described the Weimar hyperinflation as a “witches’ sabbath”—a feverish enchantment under which reality dissolved into delirium. As Paul Cantor argued in his seminal essay Hyperinflation and Hyperreality—and we explored further in The Flight Into Fake Values—Mann traced this dissolution to “the monetary madness of the Weimar Republic”:

Mann suggests that if we seek an explanation of the dissolution of authority in the world he is portraying, we should look to the monetary madness of the Weimar Republic…Inflation eats away at more than people’s pocketbooks; it fundamentally changes the way they view the world, ultimately weakening even their sense of reality. In short Mann suggests a connection between hyperinflation and what is often called hyperreality...

A strong sense of counterfeit reality prevails in “Disorder and Early Sorrow.” That fact is ultimately to be traced to the biggest counterfeiter of them all the government and its printing presses…Inflation is that moment when as a result of [money printing] the distinction between real money and fake money begins to dissolve.

That is why inflation has such a corrosive effect on society. Money is … the principal repository of value. As such, money is a central source of stability, continuity, and coherence in any community…To tamper with the basic money supply is to tamper with a community’s sense of value. By making money worthless, inflation threatens to undermine and dissolve all sense of value in a society.

This sort of counterfeit reality—born of counterfeit currency—is recurrent throughout history. Indeed, it is perhaps no coincidence that the term hyperreality itself emerged during America’s last great monetary crisis. Baudrillard coined it in the 1970s amidst the stagflation spawned by the collapse of Bretton Woods. While he observed that the untethering of money from gold allowed it to “escape…beyond any reference to the real,” it was Cantor who later traced the causal link—demonstrating that monetary derangement is the wellspring of the hyperreality that Baudrillard was exploring. Baudrillard more fully developed hyperreality in Simulacra and Simulation—published near the conclusion of the great stagflation, in 1981—which became one of the inspirations for The Matrix:

The artists of the Great Mirror of Folly, too, depicted the all-consuming hyperreality devouring their own society during John Law’s infamous monetary experiment, the Mississippi Bubble of 1719-1720. Law’s financial alchemy produced not only the notorious speculative mania, but also a “world in masquerade”—enchanted by symbols severed from substance, in which “ideas and words themselves seemed to lose all meaning.”

This selfsame spell has now been cast over the West. Though we have not—as yet— reached Weimar-scale hyperinflation, the pervasive hyperreality and mass dissociative state that Thomas Mann and the satirists of the Great Mirror captured is nonetheless unmistakable in our society.

Nor is it solely a product of the pandemic and its aftermath; in truth, the seeming ‘normalcy’ of recent decades had itself been a manufactured construct all along. The COVID era simply revealed the code underlying the simulation for what it was.

For those who began to see through the Financial Matrix during COVID, the shock wasn't so much the chaos, but the realization that the prior order had been a lie. The Forgotten Man had played by the rules—saved, worked, deferred gratification—only to discover the game was rigged from the start.

COVID made the rigging visible in ways that shattered all prior illusions. Small businesses shuttered while asset prices soared. Inflation destroyed the value of wages and savings while asset holders multiplied their wealth within the Financial Matrix overnight. ‘Essential workers’ were praised even as they were impoverished by inflation. And even now the revelations of corruption still pour forth—fresh scandals and fraud emerging in relentless succession from every stratum of society—each one making the emperor’s nakedness impossible to ignore.

From Hyperreality To Hostility

The dying of money—and the hyperreality this unleashes—engenders a population that is disoriented and increasingly angry. Amidst this civilizational unmooring, people grasp for systems and saviors that promise to restore order and meaning, even when—or precisely because—those systems and saviors are radical.

The “political center” cannot hold because the economic center—the Forgotten Man—has been eviscerated, stripping the body politic of its natural immune system and leaving it vulnerable to ideological contagion. Long-gestating radical doctrines that perhaps struggled to gain purchase suddenly find fertile ground amidst a populace that has lost faith in the system.

When honest work can’t secure basic necessities; when saving means impoverishment; when owning a home becomes impossible for many; when the prudent are punished while the reckless and corrupt rewarded; when the Forgotten Man feels as if he is being robbed and held hostage with his own money—betrayal hardens into rage. When the “coppertop batteries” realize the rules they’ve been playing by are a suicide pact, they don’t shrug and peacefully withdraw to Galt’s Gulch. If reality itself has been inverted, they feel, then the old system deserves to be burned down.

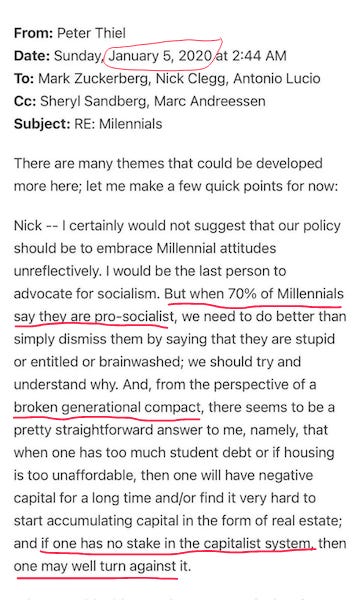

The Forgotten Man—and particularly the young Forgotten Man—impoverished by the Financial Matrix operating under “capitalism’s” banner, doesn’t distinguish this counterfeit simulation from genuine free markets; he simply knows the game is rigged and attacks ‘capitalism’ itself. As Peter Thiel noted on the eve of the pandemic—even before all hell broke loose—the Forgotten Man already had nothing to lose and no stake in the system:

The situation has only deteriorated since. Those positioned within the Financial Matrix—asset holders—have grown wealthier as debased dollars fuel asset price inflation. Meanwhile, the majority of Americans—net asset negative and living paycheck-to-paycheck—have been doubly plundered: debasement devours their purchasing power while their tax dollars both fatten fraudsters and further entrench their disenfranchisement. The Financial Matrix’s architects had chosen the winners and losers in advance—and the Forgotten Man was excluded by design.

And so a spectre haunts the global capital markets: the façade of the Financial Matrix’s “free market” is increasingly being abandoned for a variety of ‘isms’—all of which take the form of intensifying political control over the economy and financial markets. While these emerging political forces may superficially appear to be mortal enemies locked in battle, together they are consummating the destruction of the old order.

Like predators fighting over a dying animal, they rend the ‘Forgotten Man’ apart from all sides. The “Invisible Hand” gives way to iron fists reaching out to strangle what remains of private capital—accelerating the violent economic whiplash and financial repression that defines Multiflation.

Gotham City: Smash The Kulaks!

The capital of global finance—the largest metro area in America, the city that houses Wall Street, the thrumming mainframe rendering the Financial Matrix—has just elected a mayor whose stated ambition is to replace “the frigidity of rugged individualism with the warmth of collectivism.”

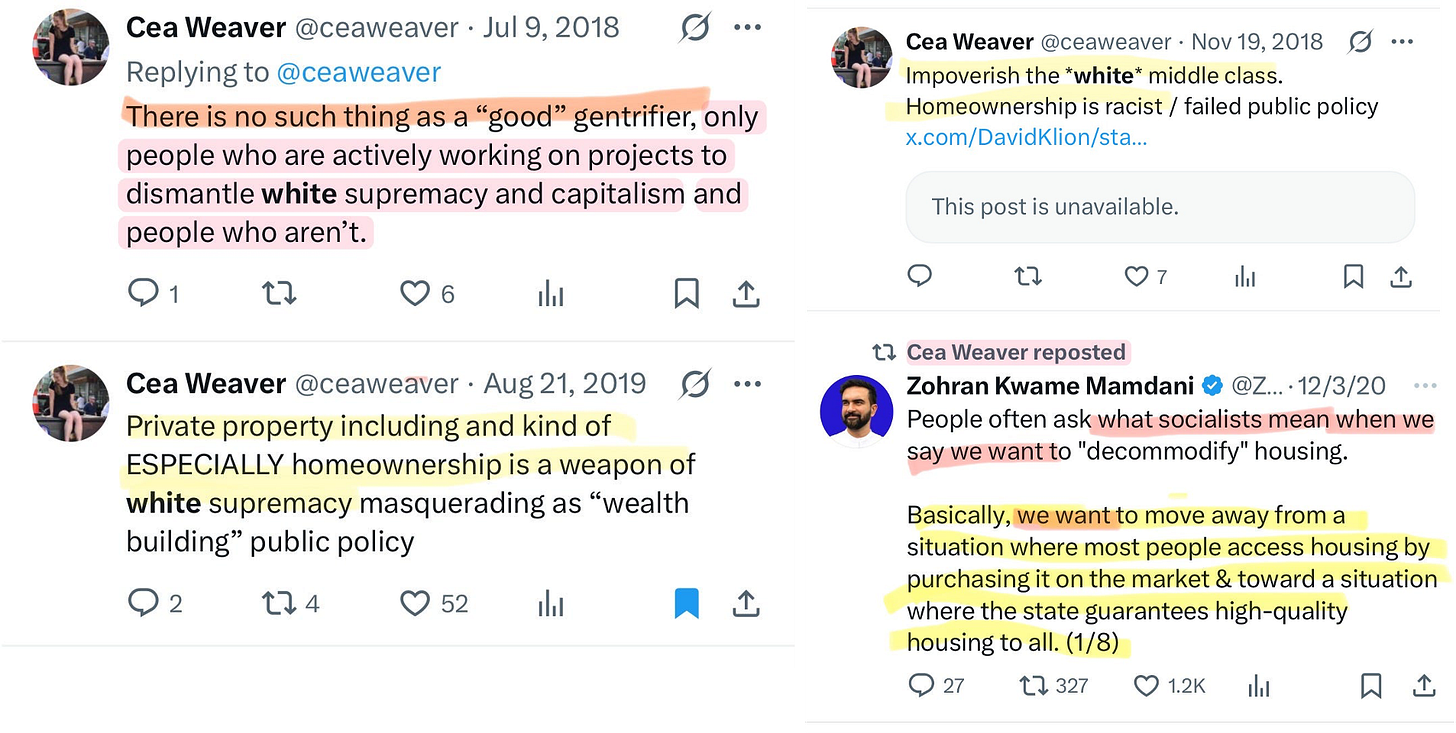

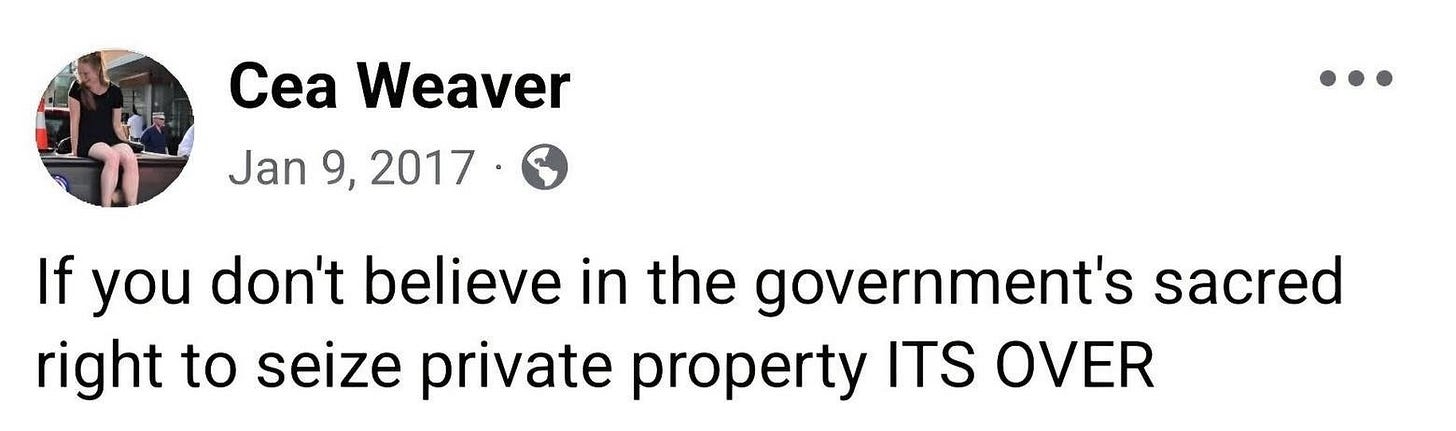

Mamdani’s housing czar has openly declared that the government has a “sacred right to seize private property” and that “homeownership itself is “a failed public policy,” as well as advocating for a future where the “middle class [is impoverished]” and “the state guarantees high-quality housing to all”:

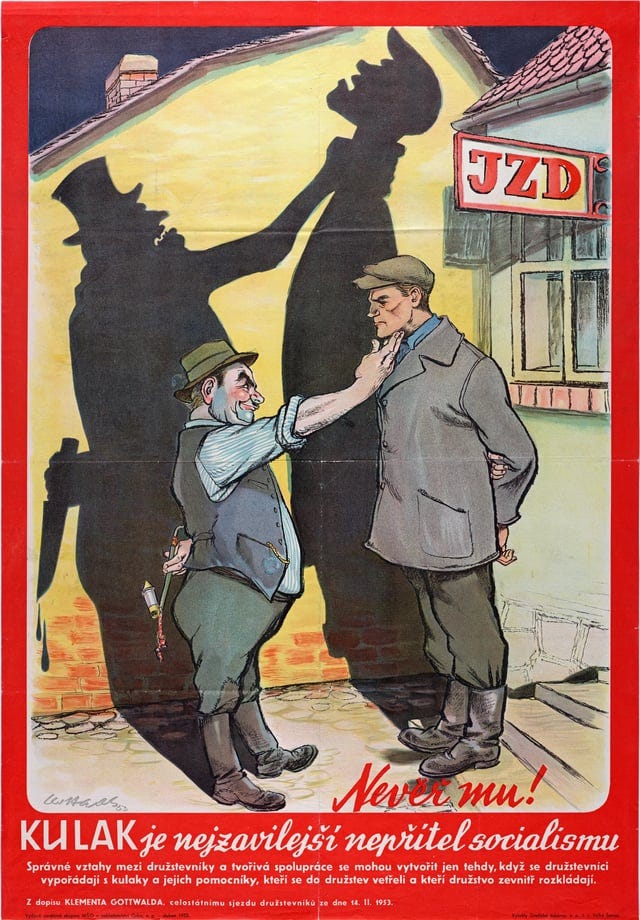

Mamdani and his administration are explicitly championing what can only be described as a textbook Bolshevik-style program of collectivization—the seizure of private property and its transfer to state control. The term is chosen deliberately, not as hyperbole: collectivization has a specific historical meaning that applies here.

Mamdani’s and Weaver’s rhetoric, too, mirrors that of the Bolsheviks. The road to collectivization first required demonizing the kulaks—the productive, middle-class yeoman farmers who served as the backbone of the rural economy. Though their ‘wealth’ was often meager—perhaps a metal plow or a few extra livestock—they were vilified as predatory ‘class enemies’.

Once transformed into villains in the public consciousness, their dispossession became not merely permissible but morally necessary:

In the eyes of the State, their independence was an intolerable affront to the collectivist ideal, justifying their destruction in the name of The Radiant Future. In Stalin’s own words:

That is a turn towards the policy of eliminating the kulaks as a class…Without it, no substantial, let alone complete, collectivisation of the countryside is conceivable. That is well understood by our poor and middle peasants, who are smashing the kulaks and introducing complete collectivisation.

The Soviets called this campaign dekulakization. Millions of kulaks were stripped of their property, exiled, imprisoned, or worse—all in service of “the greater good”.

Today, landlords and homeowners are being targeted as New York’s kulaks—exploiters whose private ownership stands in the way of the collective good. The danger isn’t so much that Mamdani will replicate Stalin’s atrocities, but rather that he will replicate Stalin’s economics: once the principle is enshrined that private wealth is in fact public property awaiting reclamation, confiscation becomes constrained only by power and practicality—whether institutional guardrails hold against political will, whether capital escapes before the trap closes, whether the targeted are able to successfully defend themselves—in courts, or by other means.

The possible failure of Mamdani and his comrades to fully realize their collectivist goals does not justify dismissing such openly stated intentions to collectivize as mere posturing; history warns against such complacency. Even after seizing power in 1917, the Bolsheviks were widely dismissed by domestic opponents and foreign powers alike as fringe radicals whose grip on power couldn’t possibly last—their regime viewed as ephemeral, their programs too extreme, too economically ruinous, too contrary to human nature to ever be fully implemented.

Whether Mamdani ultimately succeeds or fails in implementing his specific programs matters less than understanding the forces that elevated him to power. These same Multiflationary forces are producing similar outcomes across the West, making figures like Mamdani less important as individuals than as “morbid symptoms” of Gramsci’s interregnum now metastasizing across the West—canaries signaling that the air has already turned toxic.

The specific tactics and degree may vary, yet the essence remains: all subordinate private property and market allocation to political control. California, for example is proposing a redistributive wealth tax on unrealized gains:

This ‘soak the rich’ philosophy is now accelerating rapidly throughout the West:

The Netherlands is proposing taxing unrealized capital gains:

Unwilling to cut spending in the face of insurmountable debt loads—perhaps the result of an intentional Cloward-Piven strategy—Western governments are converging on a politically expedient prescription: dekulakization. What begins by targeting ‘billionaires’ and ‘landlords’ inevitably cascades as governments redefine the threshold of ‘wealth’ ever lower—until those who cheered the confiscations discover that they, too, are kulaks.

People Are The Means Of Production

People Are What Collectivists Always Seize

—Billy Beck

Washington Seizes the Commanding Heights

As New York City, California, London, and beyond embrace Bolshevist-style collectivization and wealth redistribution, Washington is pursuing ever more extensive economic interventionism—trending towards the “German pattern” of socialism that maintains capitalism’s facade while increasingly implementing socialism’s reality: private property remains in name but becomes subject to comprehensive state direction in practice.

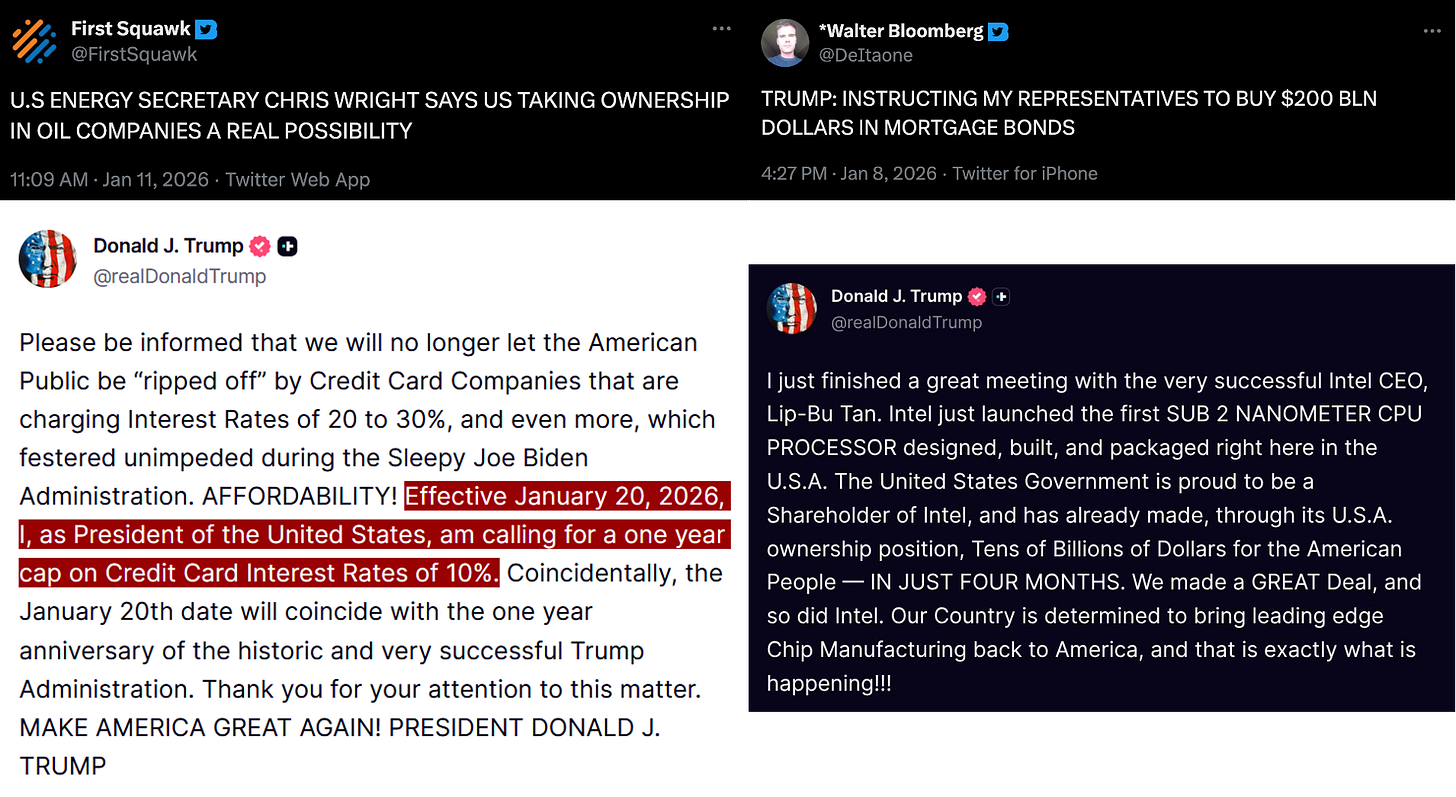

Unlike Soviet-style collectivization, the German model preserves the form of private ownership while hollowing out its substance. Businesses retain their titles and corporate structures, but their fundamental decisions—what to produce, where to invest, what prices to charge—become increasingly subject to political diktat rather than market forces. The current trajectory in Washington—while far less extreme than historical precedents—shares this essential characteristic: the progressive subordination of economic decisions to political control.

The shift from market pretense to political diktat is now accelerating into public view. President Trump’s DOJ announced an investigation into Fed Chair Jerome Powell—perhaps the latest salvo in his campaign pressuring Powell to cut rates:

Powell’s response was immediate and defiant, framing the DOJ subpoenas as naked political interference in monetary policy:

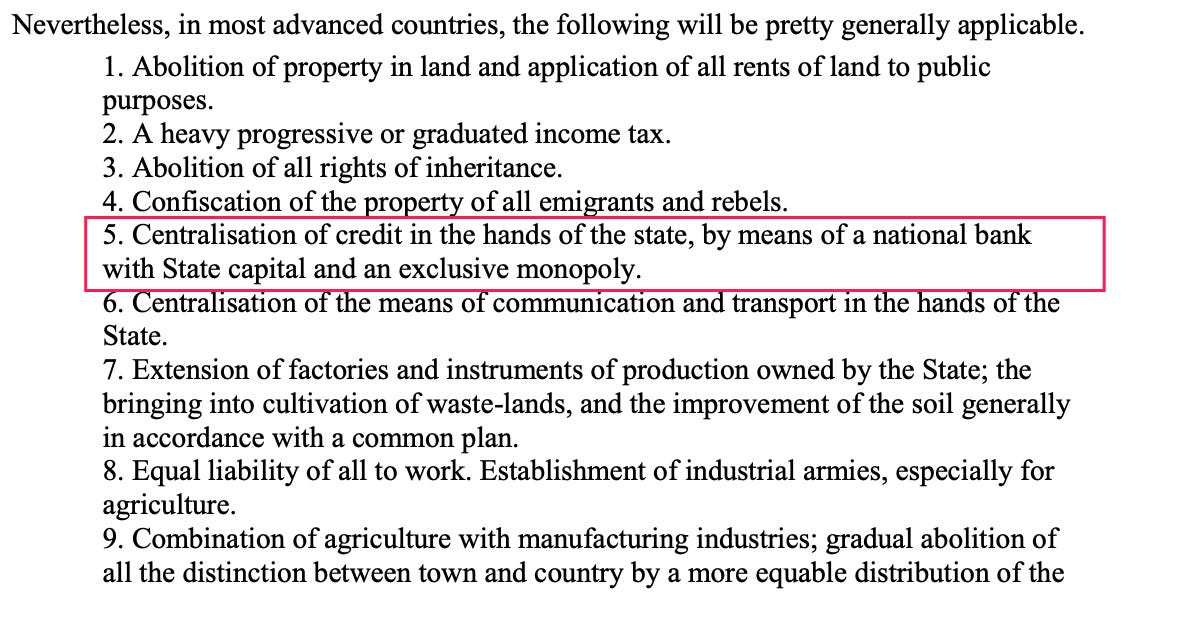

The hysterics over President Trump’s supposedly novel incursions into “Fed independence” ignore historical precedent—see LBJ and Nixon—and obscure a deeper truth. The Trump-Powell confrontation represents less the corruption of a pristine pillar of free markets than the abandonment of pretense: the Fed was never a market institution. After all, what is a central bank with monopoly control over credit if not—functionally, at least— Plank 5 of the Communist Manifesto?

How is it possible to have free and open markets when the operating system of the entire economy—money and interest rates—is closed source and set by committee diktat? Or when a President can “influence” the committee? Asking such a question is heresy, of course. The Fed is the monetary water in which we swim—so ubiquitous that questioning it is as nonsensical as questioning gravity. Central banking is viewed not merely as compatible with capitalism but essential to it—without which it would be impossible to imagine a modern economy.

Yet the vaunted myth of sacred “Fed independence” as an essential ingredient of American capitalism is even now being revealed by President Trump for the farce it always was. Indeed, hysteria over Trump pressuring Powell provides the reductio ad absurdum to the entire Fed apparatus: we’re debating which central planner should control money and rates. It brings to mind the apocryphal exchange attributed to Churchill/Shaw about propositioning a socialite for a million pounds, then haggling down to five—we've already established what the Fed is, now we're just haggling over who holds the levers.1

War Socialism & The New Command Economy

The ongoing confrontation with Powell, dramatic as it is, represents only one front in a broader policy offensive in Washington to seize what Lenin called the “commanding heights”—the strategic control points of the economy.

Tariffs become weapons; industrial policy targets strategic sectors; the federal government now owns stakes in ‘private’ enterprises ranging from Intel to rare earth miners to steelmakers; the President secured “golden shares” holding ultimate veto power over corporate actions; extracted revenue cuts from chipmakers’ China sales; floated taking direct stakes in oil companies and pressured them to invest $100 billion in Venezuela—all as a “down payment on a sovereign wealth fund”. At the same time, the President threatens pharmaceutical companies with “every tool in our arsenal” if they don’t slash prices, while proposing credit card rate caps and new GSE mandates to purchase mortgages.

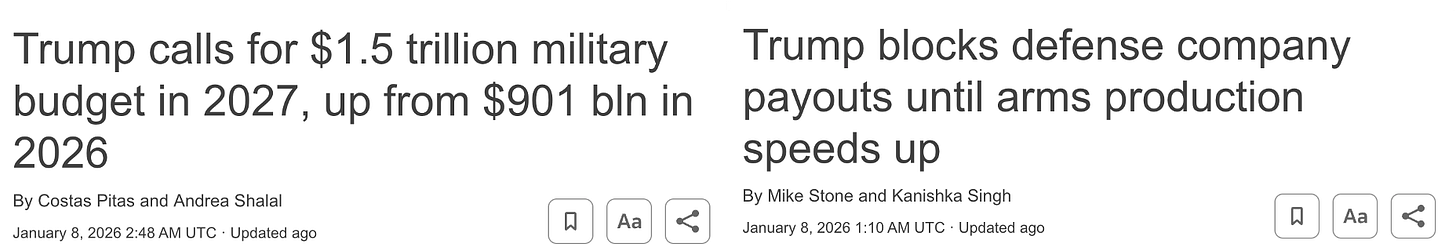

Even now, US policy appears to be escalating towards explicit “war socialism”—a hard, command-and-control economy in which private economic decisions are subordinated to strategic national objectives:

Conclusion: Who, Whom?

The fact is, we live according to Lenin’s formula [who-whom]: will we knock the capitalists flat and give them the final, decisive battle, or will they knock us flat?

-Stalin

The insidiousness of the Financial Matrix was always its camouflage—how convincingly its trappings mimicked a market economy. Now, however, the system has entered its terminal phase. As Multiflation accelerates and the “coppertop batteries” run dry, the disguise is being discarded in favor of brute political force from all quarters.

We are living through what Antonio Gramsci termed the “interregnum”—that dangerous twilight in which “the old world is dying, and the new world struggles to be born.” The “morbid symptoms” of which he spoke now surround us—and find their collective expression in Multiflation: the Forgotten Man, hyperreality, glitches in the Financial Matrix, rage, populism and extremism, cults of personality—all of it.

It is no longer contested whether private wealth will be subject to political diktat, or whether political allocation should supersede market allocation. The only question remaining is Lenin’s: “who, whom?”—who does what to whom, the reduction of all politics to this zero-sum question.

The political spectrum has converged on a single premise: State primacy. While the warring factions may fight among themselves as if they are mortal enemies, all political conflict is a knife fight over who wields control over the State’s supremacy over private capital—and against whom.

Next: The Vampire Economy’s Three-Front War On Capital

Yet what may appear as a sudden, radical departure from American norms—“the old world dying”—is in fact the end state of a process that began generations ago. The forces now converging—from Mamdani’s collectivization to Trump’s interventionism—aren’t so much shattering the system as stripping away the remaining threadbare illusions obscuring a transformation set in motion long before any of today’s political leaders were even born.

To understand what lies beneath the Financial Matrix’s failing disguise—and how to preserve wealth in the Multiflationary maelstrom now engulfing us—we must return to the source: FDR’s New Deal.

In Part III, we examine how the New Deal laid down the primitive scaffolding for what would—seventy-five years later—be perfected into the Financial Matrix. Understanding this system’s origins and history—and its current unraveling—is prerequisite to the preservation of capital as the interregnum intensifies and Leviathans surface.

The investing strategies that sustained wealth for four decades were built for Goldilocks’ calm seas and presumed at least some semblance of property rights. But Goldilocks was the aberration—an artificial stability purchased with monetary alchemy that has now reached its limit—and the investment strategies built for her world assumed away the very risks now materializing before us.

We find ourselves in uncharted waters, facing risks few living investors have ever confronted—or if they did, only briefly, and never at this scale. We must invest accordingly.

Next: The Vampire Economy

Lest one think President Trump’s pressure on Powell represents an unprecedented assault on monetary norms, recall that FDR confiscated citizens’ gold at gunpoint and then launched a special executive program to personally steer the gold price—bizarrely, from his bed while eating breakfast, and as his advisers looked on. Even more absurdly, he set the price using numerology as his guide:

One morning, FDR told his group [of advisers] he was thinking of raising the gold price by twenty-one cents. Why that figure? his entourage asked. ‘It’s a lucky number,’ Roosevelt said, ‘because it’s three times seven.’” As [Treasury Secretary] Morgenthau later wrote, ‘If anybody knew how we really set the gold price through a combination of lucky numbers, etc. I think they would be frightened.’”

FDR’s arbitrary approach to monetary policy was so ludicrous that South Park’s later satire of the 2008 bailouts seems almost tame by comparison. In the episode, critical financial decisions are made by a decapitated chicken running on a game show-style board at the U.S. Treasury, while officials play kazoo music. The chicken’s random movements determine whether to bail out failing companies, and billions of dollars are allocated based on where the headless bird collapses.

Well-articulated - and clairvoyant

Stirring and disconcerting. I have a sickening sense that AI will be the accelerant to Hyperreality that burns the whole thing down.